SWIFT, SEPA and Faster Payments – what’s the difference?

With the variety of payment schemes used for international transactions, it is easy to lose track of what is what. To keep things simple, today we will focus on three schemes – SWIFT, SEPA and Faster Payments – their differences and where Payop’s Pay-by-Bank falls among these three acronyms.

SWIFT payments

Let’s start with SWIFT (Society for Worldwide Interbank Financial Telecommunication), as it is the most popular payment system in the world. Perhaps it’s better to explain it as a messaging network that banks use for secure and standardised communication in international transactions.

Picture this: You are a multinational corporation doing business with partners in different countries. SWIFT provides a standardised language for your financial messages, allowing your funds to move securely around the world. The unique SWIFT codes assigned to each bank ensure that the right messages reach the right recipients.

Although SWIFT is a reliable and widespread system, it has a trade-off – speed. Due to the difficult network of banks, transactions through SWIFT can take time. Therefore, there is a need for faster alternatives.

SEPA payments

SEPA, or the Single Euro Payments Area, is a scheme that allows easy and quick bank-to-bank payments in EUR within European borders. It involves credit and direct debit transactions, card and cashless payments. So, if you have a business in Germany and a client/partner in France, you can easily transfer funds to your French counterparty using SEPA.

As a Payop customer, you can make SEPA and SEPA Instant payments using our Pay-by-Bank solution. It supports all industries and has high conversion and no chargeback risks, which makes this method a reliable way to transfer funds across Germany, Austria, Netherlands, United Kingdom, Italy, France, Finland, Portugal, Spain, Lithuania, and Estonia.

Learn more about Pay-by-Bank solution → Pay-by-Bank payments explained: Step-by-step guide

Faster Payments

Faster Payments is a local payment method in the UK that offers near-instant transfers between bank accounts. This option is widespread and used by businesses and individuals alike due to its speed and value for money.

However, it has a serious limitation for businesses – its coverage. If you’re dealing with international transfers, you will still have to opt for other options, like SEPA or SWIFT.

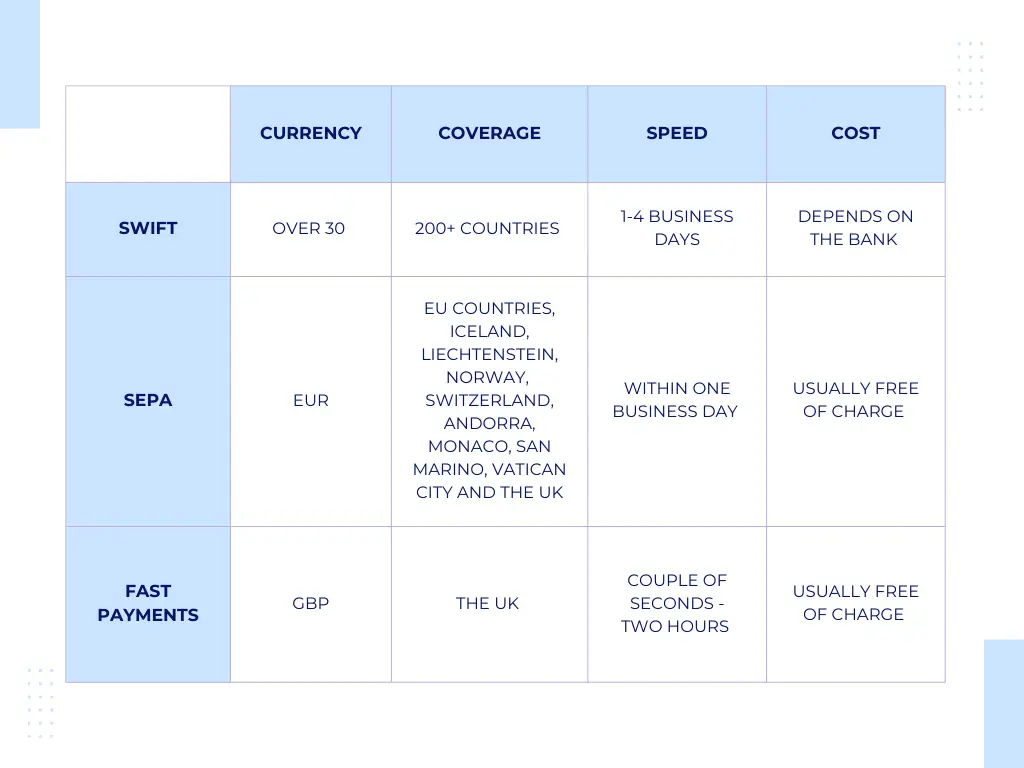

SWIFT, SEPA and Faster Payments compared

Now that we have outlined the basic facts about each payment scheme, let’s look at their key features and differences.

Conclusion

Each of these three systems has its distinct strengths and limitations that cater to diverse business needs. By understanding their characteristics and the needs of your business, you can optimally choose payment schemes and conduct transactions with the greatest benefit and convenience. To learn more about Payop’s Pay-by-Bank and other options Payop offers, contact our team at sales@payop.com.