Choosing payment methods for your business: A guide by industry

Choosing payment methods for your business is crucial for enhancing customer experience and ensuring smooth transactions. However, different industries come with different requirements.

Whether you operate in e-commerce, iGaming, video game items or boosing sectors, here are essential tips to guide your decision-making process.

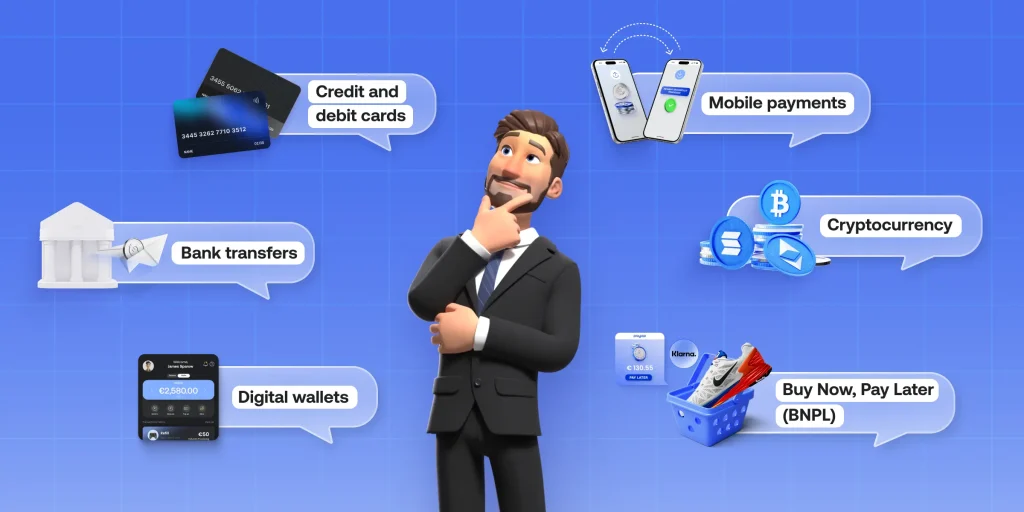

Types of payment methods

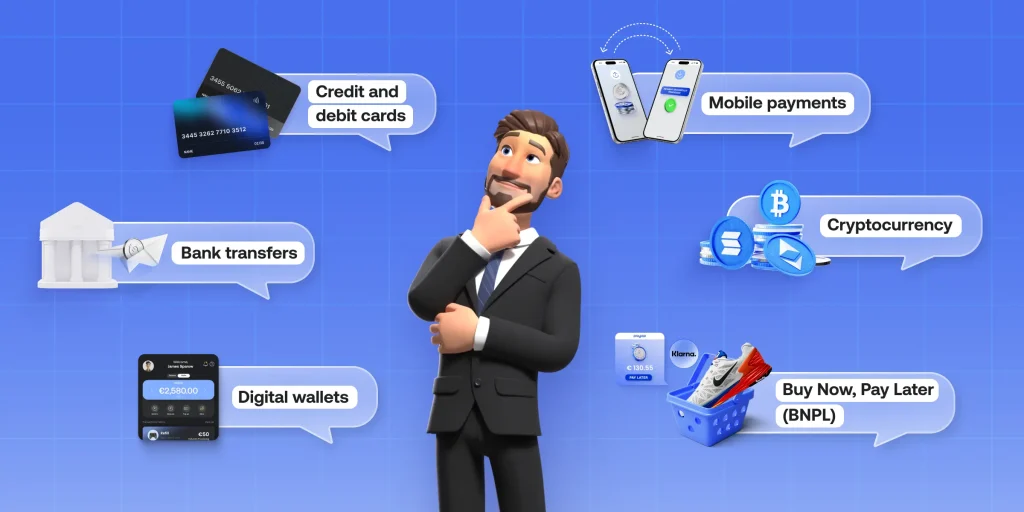

Before you begin choosing the correct payment method, it’s important to familiarise yourself with the common types of payment solutions available. Businesses today have access to a wide range of payment methods, each designed to meet different needs and preferences:

- Credit and debit cards: Still one of the most widely accepted payment methods, cards offer convenience for both online and in-store transactions.

- Bank transfers: A direct and secure way for customers to send payments, especially popular in B2B transactions.

- Digital wallets: Services like PayPal, Apple Pay, and Google Wallet have gained popularity due to their convenience and enhanced security features.

- Mobile payments: Many customers now prefer paying via mobile apps like Venmo or through QR code payments, especially for in-person transactions.

- Cryptocurrency: Although niche, cryptocurrencies like Bitcoin and Ethereum are becoming more accepted as alternative payment methods for tech-savvy customers.

- Buy Now, Pay Later (BNPL): Services like Klarna, which allows customers to split their payments into instalments, are rapidly gaining popularity among younger generations.

General tips for all industries

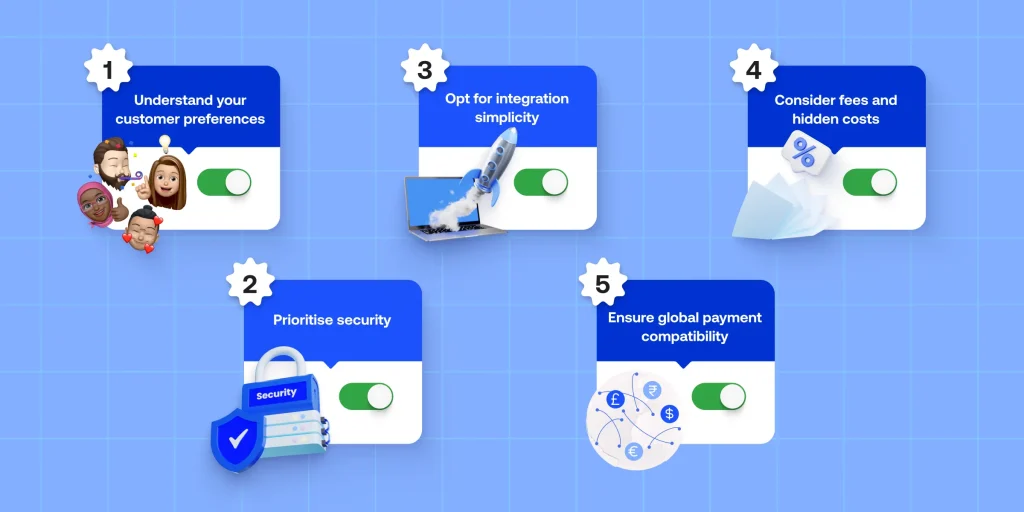

Regardless of your business industry and its specifics, it’s worth keeping this basic checklist in mind when choosing methods:

- Understand your customer preferences: Analyse your customer base to determine their payment habits and favourite methods.

- Prioritise security: Ensure your payment provider offers robust fraud prevention and data protection tools.

- Opt for integration simplicity: Make sure your payment methods integrate smoothly across all channels.

- Consider fees and hidden costs: Look for cost-effective solutions that will save your business from unnecessary expenses and ensure consistent profits.

- Ensure global payment compatibility: Make sure your payment solutions work across borders if you serve international customers.

Choosing payment methods for e-commerce

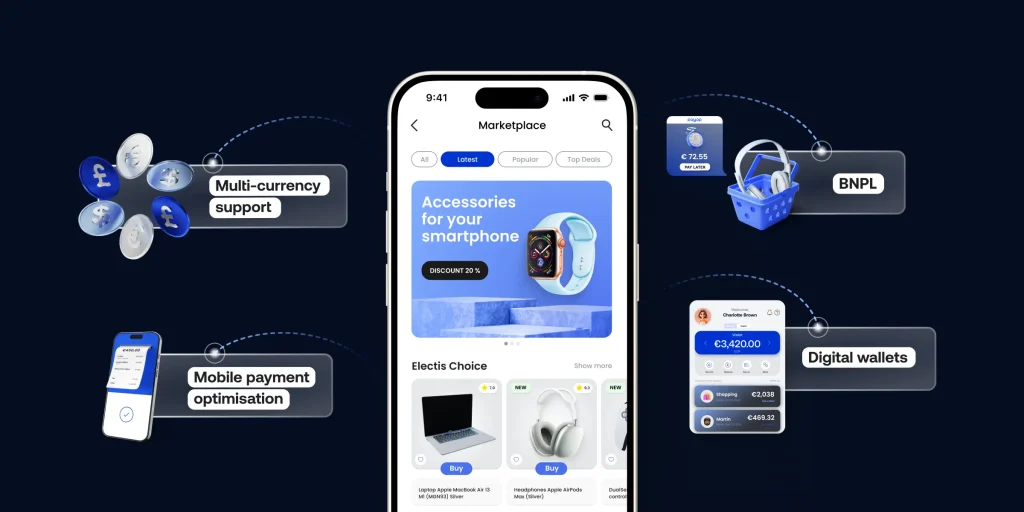

The e-commerce sector relies heavily on customer convenience and experience. Choosing the correct payment methods for your online store can make or break the checkout experience. Consider the following:

- Multi-currency support: E-commerce businesses often serve global customers. Multi-currency payment options will help reduce cart abandonment and improve the shopping experience.

- Digital wallets: Services like Apple Pay provide an easy checkout experience, encouraging faster payments and higher conversion rates.

- Mobile payment optimisation: Ensure your payment gateway is optimised for mobile devices, as more customers prefer shopping on smartphones.

- BNPL: Allowing customers to pay for goods in instalments will make larger purchases more accessible and reduce cart abandonment.

Bonus tip: Offer multiple payment methods to accommodate customers across different groups and regions. Consider popular regional solutions like Sofort in Germany or Pix in Brazil. Learn the top payment methods across different markets:

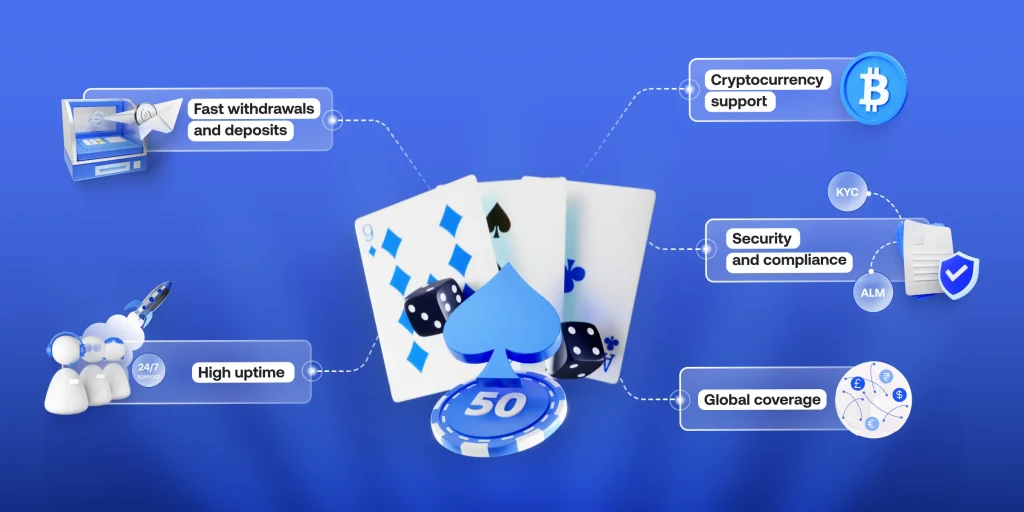

Choosing payment methods for iGaming

The iGaming industry requires payment solutions supporting quick transactions while maintaining regulatory compliance and security. When choosing payment methods for iGaming, keep in mind:

- Fast withdrawals and deposits: iGaming customers expect quick and smooth transactions. To maintain player satisfaction, choose payment methods that support instant deposits and quick withdrawals.

- High uptime: Select payment providers with robust integration features and reliable customer service available around the clock to handle any transaction issues swiftly.

- Security and compliance: Ensure your payment options comply with the strict iGaming regulations in different jurisdictions. Payments should include anti-money laundering (AML) and Know Your Customer (KYC) processes.

- Cryptocurrency support: Many iGaming platforms are adopting cryptocurrencies to offer anonymous, fast, and secure transactions.

- Global coverage: Offer methods that support multiple currencies and regional payment preferences. This helps ensure accessibility for players from different countries.

Bonus tip: Partner with payment gateways that specialise in handling high-risk industries like iGaming, ensuring compliance and security.

Read about iGaming payment trends in Latin America.

Choosing payment methods for the video game items industry

You should offer smooth in-game purchases and subscription payments in the video game industry. These aspects are crucial for enhancing the gaming experience and driving revenue. Pay attention to:

- In-app and microtransactions: In-game purchases are a huge part of revenue for many video game companies. Support payment methods that allow for easy microtransactions, like digital wallets and mobile payments.

- Subscription payment options: Many online games are subscription-based. Ensure your payment method allows for seamless recurring payments.

- Global payment support: Video games have a broad, international audience. Offering a wide variety of regional payment methods is key to reaching players worldwide.

Bonus tip: In-game item sales can be prone to chargebacks. Work with payment providers that offer chargeback protection features, such as dispute management tools, transaction monitoring, and fraud prevention services, to minimize financial losses.

Choosing payment methods for the boosting services

Boosting services require specific payment solutions to manage high transaction volumes, mitigate risks, and offer privacy. As the industry often faces challenges in risk management and fraud prevention, when selecting payment solutions, consider the following:

- Instant transaction processing: Players expect an immediate and transparent payment process when using boosting services. Choose payment methods that facilitate real-time transactions and send confirmation notifications.

- Security and fraud prevention: Boosting services are often considered high-risk, so robust fraud prevention is essential to protecting both your business and your customers.

- Cryptocurrency support: Cryptocurrencies are increasingly popular in the boosting industry as they provide anonymity and fast transaction processing, which many users prefer.

Bonus tip: Opt for payment providers specialising in high-risk sectors and offering secure and flexible payment options to support your business needs.

Conclusion

Choosing the correct payment methods is essential to providing a desired customer experience, increasing sales, and building trust. With the right payment partner, you can simplify these processes and focus on growing your business.

Payop provides over 500 payment solutions tailored to various industries’ unique needs. With our support for multi-currency transactions, robust security features, and different integration options, you can accept payments globally, securely, and efficiently. Contact us at sales@Payop.com to get started.