How a payment gateway can help optimise conversion rates

Every online business owner dreams of higher conversion rates, but many overlook a crucial piece of the puzzle: the payment gateway. The right payment gateway is not just a tool for processing payments, it can make or break a sale.

A smooth, secure, and flexible payment process can be the difference between a customer completing their purchase or abandoning their cart. Let’s dive into how payment gateways can boost your conversion.

What is a payment gateway?

A payment gateway is a technology that securely transfers payment information between customers, merchants, and financial institutions. While its core job is to facilitate payments, its real impact lies in shaping the customer’s experience. A smooth and trusted checkout journey builds confidence, reduces frustration, and encourages customers to complete their transactions – all of which directly impact your profits.

How payment gateways boost conversion rates

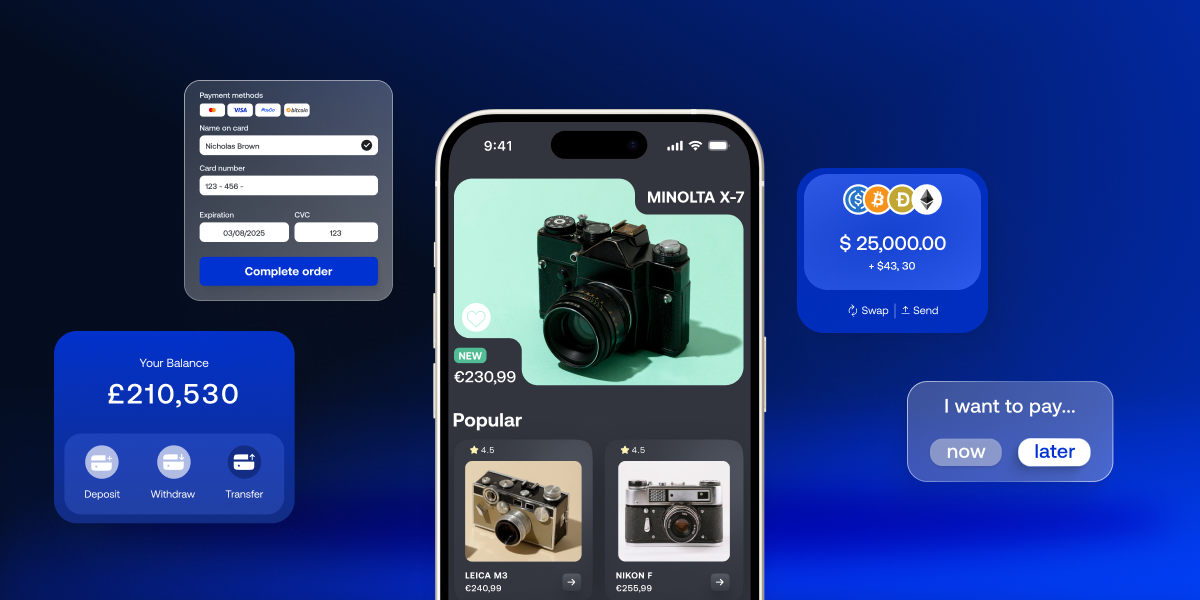

Optimised user experience

A smooth checkout process ensures that customers don’t lose patience halfway through their transaction. Payment gateways simplify the experience with:

- Autofill features that pre-enter saved payment and shipping details, making checkout faster.

- Mobile optimisation for customers shopping on their phones, ensuring the interface works flawlessly on smaller screens.

- One-click payments that allow returning customers to skip the hassle of entering their details repeatedly.

The easier it’s for customers to pay, the more likely they are to stick around and complete the purchase.

Support for diverse payment methods

Customers today have varying preferences for how they pay. A robust payment gateway offers flexibility by supporting:

- Traditional methods like credit and debit cards, which remain popular, particularly among older customers.

- Digital wallets that not only grant convenience and speed, but also give underbanked users access to financial services.

- Buy Now, Pay Later (BNPL) options, appealing to younger shoppers who prefer to spread out payments.

- Cryptocurrencies for tech-savvy customers who want more modern payment options.

Offering a variety of payment methods ensures that no customer leaves because their preferred method isn’t available.

Learn how to choose payment methods that fit your industry.

Global payment options for international customers

Expanding into international markets? A payment gateway helps bridge the gap by offering:

- Local payment methods such as OXXO in Mexico or Alipay in China.

- Multi-currency support, allowing customers to see prices in their own currency without surprise conversion fees.

- Localised checkout experiences, including region-specific languages and payment preferences.

These features make your business feel more approachable and trustworthy to global shoppers, increasing their likelihood of completing a purchase.

Enhanced security and trust

One of the biggest reasons for cart abandonment is fear of fraud or data breaches. Payment gateways reassure customers with:

- Adherence to the highest security standards like PCI DSS.

- Tokenization, replacing sensitive card details with encrypted tokens to protect data.

- Fraud detection systems, powered by AI, to identify suspicious activity and prevent fraudulent transactions.

- Two-factor authentication (2FA) for an added layer of security.

Displaying secure payment badges during checkout further builds trust, making customers feel safe as they complete their purchases.

Quick payment processing

No one likes to wait – especially when making an online payment. The reliable payment gateway optimises speed by:

- Ensuring transactions are completed in seconds with minimal latency.

- Providing retry logic for failed transactions, so customers can attempt payment again without restarting the process.

- Reducing downtime, even during high-traffic periods like sales events or holidays.

Fast, reliable payment processing keeps customers happy and reduces the risk of them abandoning their cart out of frustration.

Effective analytics insights

Many payment gateways offer built-in reporting tools, providing valuable data to improve your checkout process. For example:

- Success vs. failure rates can highlight technical issues that need fixing.

- Customer payment preferences show which methods are most popular, so you can prioritise them.

- Refund and chargeback statistics can help identify and correct internal issues.

These insights give you the power to continuously refine and optimise your payment experience for better results.

How to choose the right payment gateway

Choosing the perfect payment gateway can make a significant impact on your conversion rates. Here’s what to consider:

- Payment options: Ensure your gateway of choice supports a wide range of methods, including credit cards, digital wallets, and local payment methods.

- Security features: Look for PCI DSS compliance, fraud prevention, and tokenisation.

- Ease of integration: A gateway should integrate seamlessly with your e-commerce platform or marketplace.

- Global support: If you serve international customers, ensure the gateway handles multiple currencies and local payment methods.

- Scalability: Pick a solution that can grow with your business.

Evaluating these factors will help you find a gateway that aligns with your business goals and customer needs.

Learn about the difference between payment gateways and payment orchestration.

Final thoughts

Optimising your checkout process starts with choosing a payment gateway that aligns with your business needs. Payop goes beyond basic payment processing to offer a tailored solution for businesses of all sizes. With over 500 payment methods, support for global and local payments, and advanced security features, Payop empowers businesses to reduce cart abandonment and boost conversions.

Additionally, Payop’s personalised checkout pages and real-time analytics tools provide merchants with everything they need to create a smooth, secure, and efficient payment experience.

Discover how Payop can drive your success – contact us at sales@payop.com.