How payment flexibility drives customer loyalty in e-commerce

Cross-border payments: Key challenges and solutions for 2025

Interview with Finance Team Lead Olena Polishchuk

Tips for improving the payment success rate for online businesses

Understanding chargeback fraud: How to protect your business

Understanding chargeback fraud: How to protect your business

Running a business online is exciting but comes with its fair share of challenges – one of the trickiest being chargeback fraud. In 2023 alone, the number of chargebacks exceeded 238 million, highlighting just how widespread this issue has become.

This sneaky problem can eat into your revenue, drain your resources, and even harm your reputation. But don’t worry! With a solid understanding of chargeback fraud and the right strategies, you can protect your business effectively.

What is chargeback fraud?

Chargeback fraud, sometimes called friendly fraud, happens when a customer disputes a legitimate transaction and asks their bank and not the merchant for a refund. They might claim they didn’t authorise the purchase or never got the product or service. While some claims are honest mistakes, others are deliberate attempts to get something for free.

Types of chargeback fraud

There might be several types of chargeback fraud:

- True fraud: This happens when a fraudster steals someone’s payment details and uses them to make unauthorised purchases. These disputes are genuine, but the victim isn’t the merchant – it’s the cardholder.

- Friendly fraud: In this case, a legitimate customer disputes a charge they actually authorised. Sometimes, it’s accidental – maybe they forgot about the purchase – but other times, it’s intentional, aiming to get a refund while keeping the product or service.

- Return fraud: Some customers exploit return policies to dispute charges, even after receiving or using the product. They falsely claim that the product arrived defective or didn’t match the description.

- Subscription fraud: This involves customers signing up for subscription-based services and then disputing recurring charges, claiming they didn’t authorise them. Fraudsters may also abuse free trials that require payment details.

How chargeback fraud impacts businesses

Chargeback fraud can hit hard. Here’s how:

- Lost revenue: You lose the money from the sale, plus you have to refund the transaction and pay chargeback fees.

- Slows down operations: Disputing chargebacks takes time and resources that can be used to develop the business.

- Damaged reputation: Too many chargebacks can make payment processors wary, leading to higher fees or even shutting down your account.

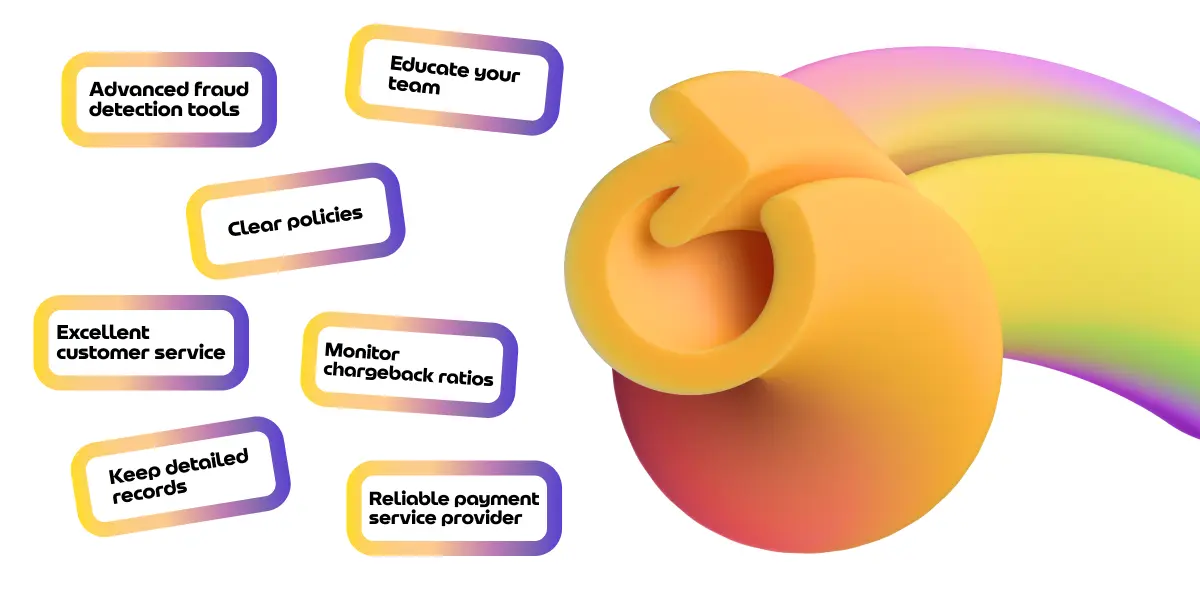

Strategies to protect your business from chargeback fraud

Protecting your business from chargeback fraud requires a proactive approach. By combining technology, clear communication, and robust internal processes, you can significantly reduce the risk of disputes and safeguard your revenue. Here are some key strategies to help you stay ahead of the problem.

Implement advanced fraud detection tools

Leverage fraud detection software that uses artificial intelligence to analyse transactions. Look for tools that flag unusual purchase patterns or mismatched customer details, and act quickly when red flags arise.

Set clear policies

Make your return, refund, and shipping policies easy to find and understand. Use plain language to outline procedures and ensure customers are fully aware of your terms before making a purchase.

Provide excellent customer service

Offer multiple ways for customers to contact you, such as live chat, email, or phone. A fast, empathetic response can resolve misunderstandings before they escalate into disputes.

Keep detailed records

Save invoices, transaction receipts, shipping details, and customer communications. These records can be invaluable when providing evidence to dispute chargebacks successfully.

Educate your team

Train your staff to recognise signs of fraudulent activity, such as mismatched billing and shipping addresses or unusually large orders. Equip them to handle disputes professionally and proactively.

Monitor chargeback ratios

Track your chargeback ratio regularly. If it’s trending upward, review your processes and pinpoint areas where you can reduce disputes, such as improving shipping timelines or communication.

Partner with a reliable payment service provider

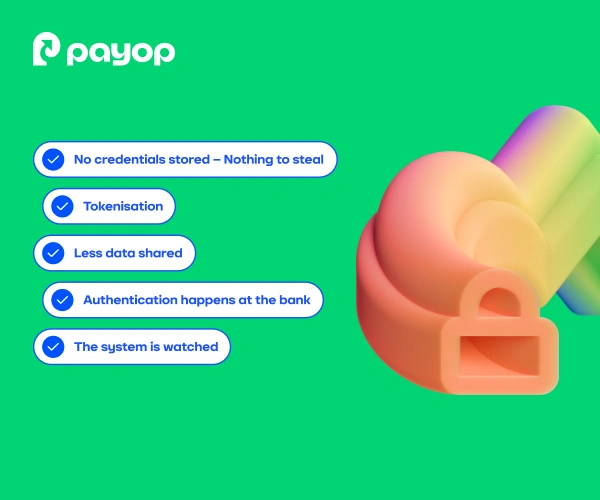

Work with a trusted PSP like Payop. Our solutions include advanced fraud prevention tools, such as tokenization, encryption, and multi-factor authentication, and dedicated support. These will help you navigate disputes and safeguard your business.

Conclusion

Chargeback fraud can be a headache, but you don’t have to let it derail your business. By understanding how it works, taking preventive measures, and working with a reliable payment partner, you can protect your revenue and reputation. Want to learn more about securing your transactions? Contact our team to discuss how Payop’s payment solutions can help safeguard your business.