How AI and machine learning are transforming fraud detection

Global overview of alternative payment methods in 2025

Key payment challenges in Latin America and how to overcome them

Payment trends in Asia in 2025

Why gaming platforms need localised payment methods

Global overview of alternative payment methods in 2025

Alternative payment methods (APMs) are taking over traditional systems, offering more flexibility, security, and convenience. A recent report predicts mobile payment transactions will reach an impressive $17 trillion globally by 2025, highlighting the increasing demand for APMs.

In this article, we’ll explore the major trends shaping payments today and how they’re revolutionising the way we pay for goods and services.

What are alternative payment methods?

Alternative payment methods are any payment options that fall outside traditional methods like cash, debit cards, and credit cards. These are typically cashless and cardless solutions that leverage technology to help consumers send, receive, and spend money without relying on physical currency or cards.

Alternative methods are gaining popularity due to their convenience, security, and speed, allowing consumers to pay in a way that suits their modern, digital lifestyles.

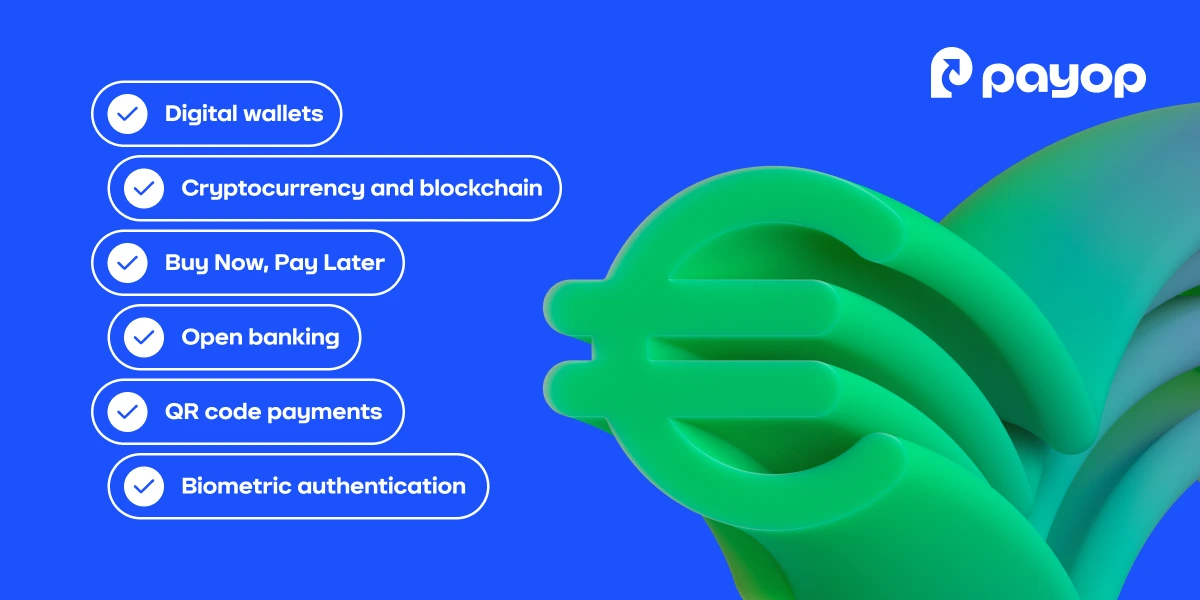

Digital wallets

Digital wallets like Apple Pay, Alipay, and WeChat Pay have become central to mobile payments. By 2026, over 5.2 billion people are expected to use digital wallets globally, a sharp increase from just over 3 billion in 2022.

The appeal lies in their simplicity and security. These apps offer more than just storage for payment methods – they integrate loyalty cards, bank accounts, and even ID documents. With mobile phones as the primary tool for payments, digital wallets are set to dominate the payments world.

Cryptocurrency and blockchain

Cryptocurrency is now mainstream, with Bitcoin and Ethereum leading the charge. Around the world, more businesses are beginning to accept cryptocurrency payments, especially in regions with limited access to traditional banking services.

What makes cryptocurrency so appealing? Lower transaction fees, faster cross-border payments, and the ability to bypass traditional banking infrastructure make it an attractive option.

The rise of stablecoins – cryptocurrencies pegged to traditional currencies – is making digital currencies a more reliable option for daily use, offering the benefits of cryptocurrency without the usual volatility.

Buy Now, Pay Later (BNPL)

BNPL services like Klarna, Afterpay, and Affirm have exploded in popularity, particularly among millennials and Gen Z. These services allow consumers to purchase items and pay later in instalments, often with no interest.

This growing trend is also making its way into retail, with more and more businesses offering BNPL as a payment option. The BNPL market is expected to exceed $500 billion in transaction value by 2026.

For consumers, BNPL provides a way to spread out payments without the burden of high-interest rates, while businesses enjoy increased conversion rates and higher order values.

Open banking

Open banking is reshaping how we make payments. By 2025, over 60% of EU consumers are expected to use open banking services, which allow third-party providers to access customer data with consent. This enables faster and more secure transactions, creating a more seamless experience for consumers and businesses alike.

With Payop’s Pay by Bank you can start enjoying all the benefits of this technology right now. This service allows merchants to accept direct payments from consumers’ bank accounts, bypassing card networks and offering faster, more secure transactions. It also enables you to receive payments during unbanked hours, including weekends and holidays.

This solution enhances payment reliability and ensures that businesses can keep running smoothly around the clock.

QR code payments

QR code payments are booming, especially in Asia. In China alone, QR code-based payments surpassed $35 trillion in 2024. This method allows consumers to make payments by simply scanning a code using their smartphone, making it incredibly user-friendly and fast.

For merchants, QR code payments also offer flexibility. They can be integrated into websites, mobile apps, and even social media platforms, allowing businesses to reach customers wherever they shop.

With the rise of mobile commerce and the push for frictionless, contactless payment methods, QR codes will become even more popular. For online businesses, they present a quick, secure, and low-cost way to accept payments globally, especially in regions where smartphone usage is high and traditional banking infrastructure is limited.

Biometric authentication

Biometric authentication, including fingerprint scanning, facial recognition, and voice recognition, is becoming a key security feature for digital payments. It offers a fast, secure way to verify users, eliminating the need for passwords or PINs. With smartphones and devices incorporating these features, consumers can make payments quickly and safely with just a fingerprint or face scan.

This method significantly reduces the risk of fraud, as only the authorised user can approve transactions. As biometric technology continues to improve, it becomes more accurate and reliable, ensuring even higher levels of security.

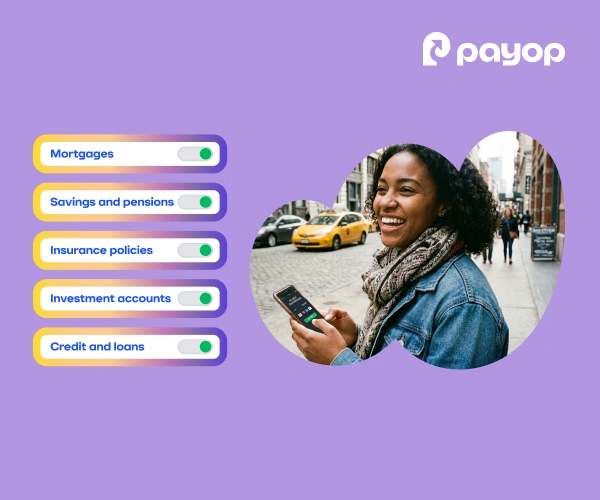

Alternative vs. traditional payment methods

As digital payments evolve, alternative payment methods are gaining popularity for their speed, flexibility, and enhanced security. While traditional methods like credit and debit cards have been widely used for years, APMs offer consumers and businesses a more modern, seamless payment experience. Here’s a comparison based on five key factors:

Traditional payment methods:

- Popularity: Credit and debit cards are still dominant methods, especially for older payers.

- Security: Exposed to fraud and identity theft.

- Transaction fees: Higher fees for merchants, especially for international payments.

- Payment speed: Can involve delays and take up to 3 days, especially for cross-border transactions.

- Accessibility: Requires physical cards or card details, limiting access for some users in the unbanked areas.

Alternative payment methods:

- Popularity: APMs are rapidly growing, with digital wallets expected to reach 5.2 billion users by 2026, and cryptocurrency adoption increasing worldwide.

- Security: Enhanced security with features like biometrics and tokenization.

- Transaction fees: Lower fees, especially with methods like cryptocurrency or Pay by Bank.

- Payment speed: Faster transactions, including instant payments via open banking and real-time systems.

- Accessibility: Easy access through mobile phones, allow to reach unbanked customers in emerging markets.

Check out our industry-specific guide to choose payment methods that fit your business.

Final thoughts

As alternative payment methods like digital wallets, cryptocurrency, and Pay by Bank grow in popularity, businesses must adapt to stay competitive. Payop’s payment solutions offer reliable, secure, and cost-effective ways for online businesses to accept a wide range of payment options, including real-time bank transfers.

With lower transaction fees and enhanced security, Payop ensures businesses can meet the demands of today’s consumers and stay ahead in the evolving payments landscape.

Contact us at sales@payop.com to learn more.