How AI and machine learning are transforming fraud detection

Global overview of alternative payment methods in 2025

Key payment challenges in Latin America and how to overcome them

Payment trends in Asia in 2025

Why gaming platforms need localised payment methods

How AI and machine learning are transforming fraud detection

Fraud detection is more crucial than ever, especially in finance, e-commerce, and digital payments. Traditional fraud detection methods rely on manual intervention and predefined rules and are no longer enough to combat fraudsters’ modern tactics. But thanks to artificial intelligence (AI) and machine learning (ML), we now have smarter, faster, and more efficient tools to stop fraud.

What are AI and machine learning?

AI is the simulation of human intelligence in machines designed to think and act like humans. These machines can interpret data, recognise patterns, and make decisions based on those patterns, much like humans.

Machine learning, a subset of AI, refers specifically to systems’ ability to learn from data, improve over time, and make predictions or decisions without explicit programming.

How AI and machine learning tackle fraud

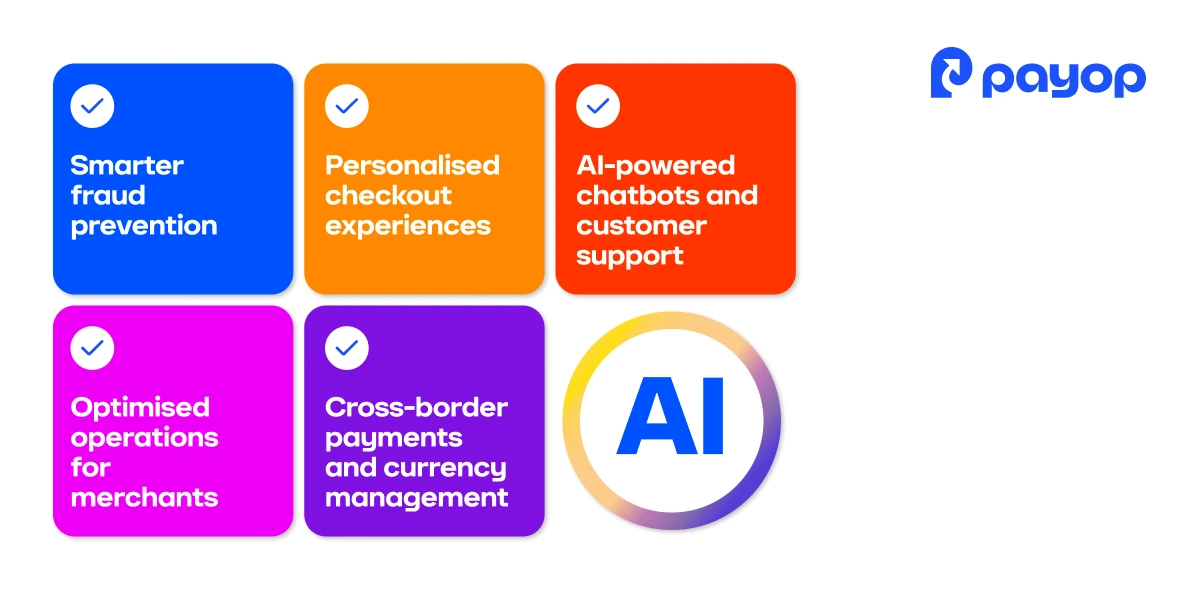

AI and ML are changing the game in fraud detection by allowing systems to detect suspicious activity in real time and adapt to emerging threats. Here’s how they’re making a difference:

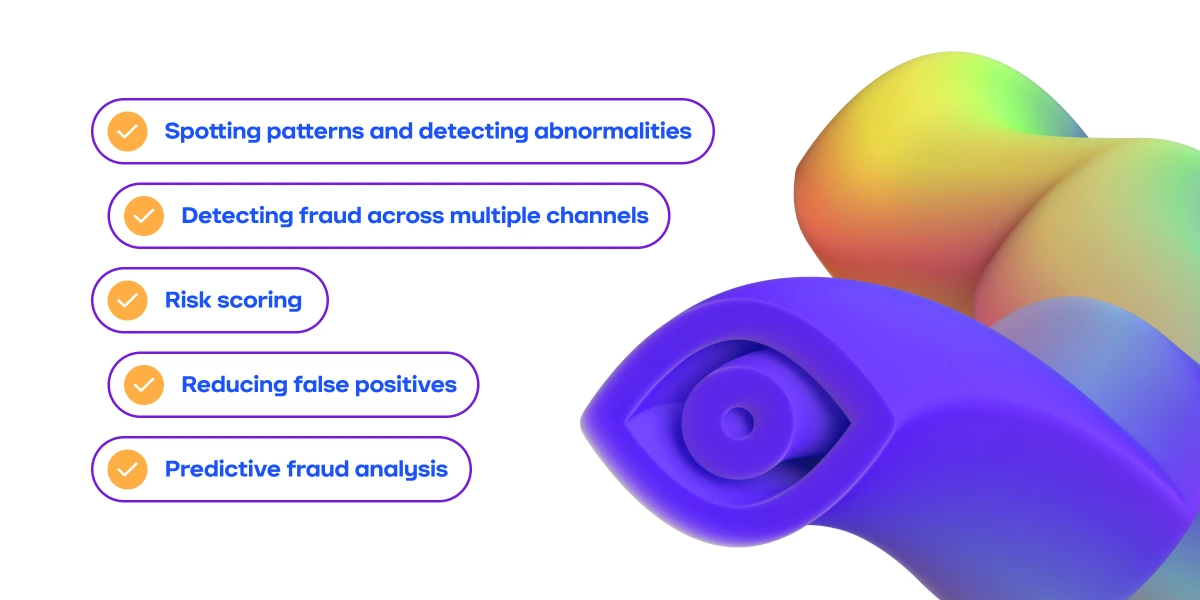

Spotting patterns and detecting abnormalities

AI and ML excel at recognising patterns in huge amounts of data. By analysing past transactions, these systems learn what “normal” behaviour looks like for individual users. When something unusual happens – a sudden large purchase or a login from an unfamiliar location – the system instantly flags it as potentially fraudulent. This means AI can detect suspicious activity before it even becomes a problem.

What’s even better? These systems don’t stop learning. With every new transaction, they get smarter, recognising subtle fraud patterns that might have gone unnoticed by traditional methods.

Detecting fraud across multiple channels

Fraudsters don’t limit themselves to one channel; they might target multiple touchpoints, such as mobile payments, online shopping, and social media. AI and ML can detect fraud across all these channels, providing a comprehensive solution that works wherever transactions occur.

For example, a fraudster might try to impersonate someone through both a fraudulent online transaction and fake social media activity. AI can connect the dots, identifying these cross-channel fraud attempts and flagging them for review.

Risk scoring

Risk scoring is another powerful tool where AI and ML are really successful. This process involves assessing the likelihood that a transaction is fraudulent based on a combination of factors, such as transaction history, location, amount, and even user behaviour.

AI systems assign a risk score to each transaction, which helps businesses make informed decisions about whether to approve, deny, or flag a transaction for further review.

Reducing false positives

One of the most frustrating parts of traditional fraud detection is dealing with false positives. When a legitimate transaction is flagged as suspicious, it leads to unnecessary customer frustration and lost sales. However, AI and ML help reduce this problem by improving fraud detection accuracy.

By analysing a wider range of data points – such as purchase history, location, and browsing habits – AI can better distinguish between fraudulent and legitimate transactions. This means better customer experience and a more streamlined process for businesses.

Predictive fraud analysis

Predictive analytics powered by AI and machine learning can forecast potential fraud attempts before they even occur. They analyse past fraud attempts and spot emerging patterns that hint at new types of fraud. By recognising these early warning signs, businesses can proactively adjust their security measures to stay ahead.

For instance, financial institutions can predict trends in card-not-present fraud (when a stolen card is used for online purchases) and adjust their security protocols accordingly.

Learn about the advantages of payment tokenisation for the security of your payments.

Advantages of AI and machine learning in fraud detection

AI and machine learning bring several key advantages to fraud detection, transforming how businesses safeguard their transactions. Here are some of the main benefits:

- Faster detection and response: AI and ML analyse data in real time, enabling immediate action to stop fraud and prevent losses.

- Continuous learning and adaptation: These systems improve over time, adapting to new fraud tactics and evolving patterns.

- Reduced human intervention: Automates detection and decision-making, allowing businesses to focus on higher-priority tasks.

- Improved accuracy: AI and ML reduce false positives by analysing a broader range of variables and detecting subtle fraud patterns.

- Scalability: Handles large transaction volumes efficiently, ensuring strong performance as businesses grow.

- Cost efficiency: Reduces the need for manual reviews, saves time, and prevents financial losses, making fraud detection more cost-effective.

Conclusion

AI and machine learning are revolutionising fraud detection by offering faster, more accurate, and scalable solutions to protect businesses and customers.

At Payop, we partner with advanced anti-fraud tools to provide our clients with the best protection against fraudulent activities. Integrating these state-of-the-art solutions into our payment processing system ensures that transactions remain secure, efficient, and trustworthy in the face of the growing fraud threat.