Why your business should accept PagoEfectivo in Peru

How is Pay by Bank revolutionising e-commerce payments?

Payment landscape in Mexico: a complete guide

The future of mobile payments: Trends and innovations to watch

The future of mobile payments: Trends and innovations to watch

Mobile payments are undergoing a significant evolution in 2025. Fueled by rapid advances in technology, shifting consumer expectations, and new regulations, how we pay is becoming faster, safer, and smarter.

With AI-powered fraud detection, real-time transfers and contactless options, mobile payments are on track to become the go-to method for both everyday and cross-border transactions.

What are mobile payments?

Mobile payments refer to transactions made using a mobile device, like a smartphone, tablet, or smartwatch. Instead of reaching for your wallet or entering card details, you can simply tap your phone, scan a QR code, or use a mobile app to send or receive money.

These payments can happen in stores, online, or between individuals. Whether customers are paying for groceries with Apple Pay, splitting a bill using a digital wallet, or shopping on an app, mobile payments offer a faster and more convenient way to handle money, without the need for cash or cards.

Key trends shaping the future of mobile payments

The mobile payment landscape is changing rapidly, driven by innovation and shifting user expectations. Below are the key trends that will shape mobile transactions in the near future.

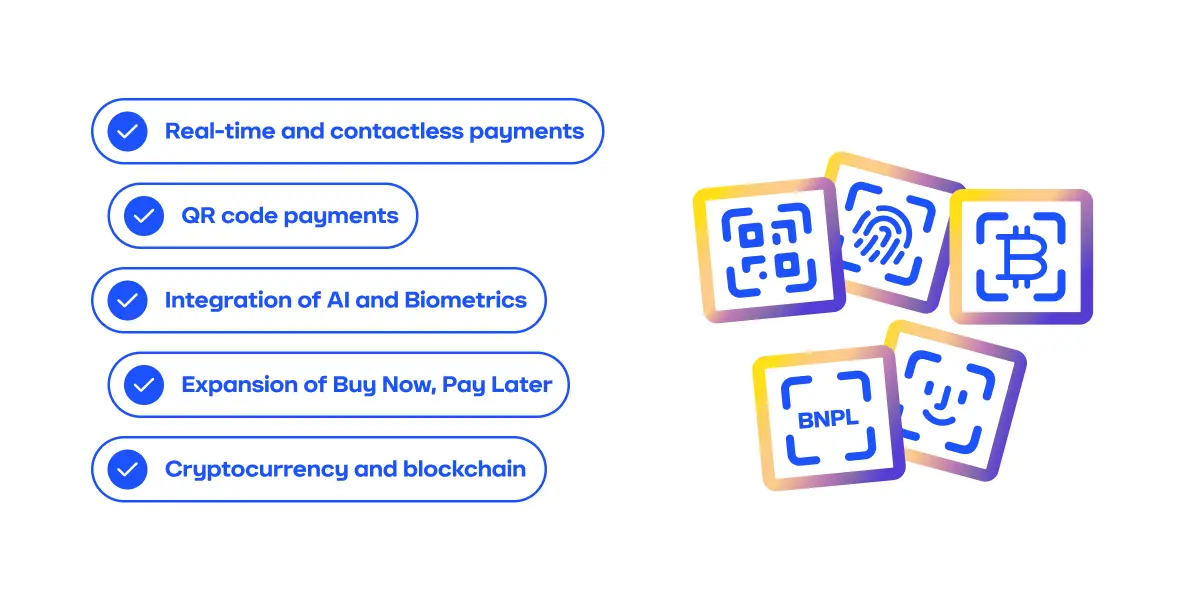

Real-time and contactless payments

We’re moving toward a world where waiting for payments to “go through” is a thing of the past. Real-time payment networks like SEPA Instant in Europe, UPI in India, and M-Pesa in Africa are speeding things up, delivering instant transfers and 24/7 availability. This is a game-changer for both businesses and consumers who want immediate results.

QR code payments

QR code payments are also on the rise, especially in regions where mobile-first adoption outpaces traditional banking. These payments are fast, cost-effective, and easy to use, which makes them ideal for both online and offline transactions. In China, Alipay has made QR codes the default payment method for everything from groceries to taxis, helping to digitise even the most informal aspects of the economy. Its success has set the standard across Asia, where QR code infrastructure is now expanding rapidly.

Integration of AI and Biometrics

AI is reshaping mobile payments behind the scenes – helping prevent fraud, personalise spending insights, and optimise customer support. It analyses patterns in real time, flagging suspicious activity before it becomes a problem.

Biometrics, meanwhile, are making authentication smoother and safer. Fingerprints, facial recognition, and even voice IDs are replacing PIN codes and passwords. You can now confirm a payment with a glance, keeping things secure while reducing friction.

Expansion of Buy Now, Pay Later (BNPL)

BNPL services are becoming a natural extension of mobile payments, allowing users to split purchases into instalments directly from their smartphones. Integrated directly into checkouts on mobile apps and digital wallets, BNPL options offer a smooth, flexible experience for consumers who want more control over their spending.

This trend is growing beyond retail, with mobile platforms now enabling instalment payments for travel, subscriptions, and even utility bills. As adoption rises, regulators are stepping in to ensure transparency and prevent misuse, helping BNPL evolve into a more responsible feature within the mobile payment ecosystem.

Cryptocurrency and blockchain

Blockchain technology is playing an increasingly important role in mobile payments by offering a faster, cheaper, and more transparent way to move money, especially across borders.

Mobile apps that support cryptocurrencies now allow users to send and receive funds instantly, often with lower fees than traditional banks or remittance services. In regions with limited access to financial infrastructure, crypto-enabled wallets on smartphones provide an alternative way to store funds, pay for goods, or transfer money internationally.

Innovations to watch

Beyond the major trends, there are several emerging innovations set to redefine mobile payments even further. These new technologies are making transactions smarter, more accessible, and deeply integrated into everyday life.

- Tap-to-pay: Smartphones are no longer just for making payments – they’re becoming tools to receive them too. With tap-to-phone solutions, even small businesses can accept payments instantly without a traditional terminal.

- Voice-activated payments: Paying by voice might sound futuristic, but it’s already happening. With the help of voice assistants like Alexa or Siri, users can authorise payments hands-free, which offers greater accessibility and convenience.

- Embedded finance: Financial services are built into non-financial platforms. Think of shopping platforms that offer loans or ticket apps with built-in insurance. This trend makes it easier for users to access financial products exactly when and where they need them.

Learn about other alternative payment methods to watch for in 2025.

Mobile payments with Payop

At Payop, we help businesses navigate the evolving world of mobile payments by providing access to over 500 payment methods, from mobile wallets and QR code payments to region-specific real-time systems. We also offer our Pay by Bank solution which allows customers to pay directly from their banking apps, enhancing both speed and security.

With seamless integration, global reach, and a focus on mobile-first experiences, Payop enables you to stay competitive, connect with customers worldwide, and simplify transactions – no matter where your business expands.