Why your business should accept PagoEfectivo in Peru

How is Pay by Bank revolutionising e-commerce payments?

Payment landscape in Mexico: a complete guide

The future of mobile payments: Trends and innovations to watch

The role of open banking in enabling faster payments and real-time settlement

In today’s fast-moving digital economy, speed is everything. Customers expect instant checkouts, merchants need faster cash flow, and no one wants to wait days for payments to clear. While traditional banking systems struggle to keep up, a major shift is already happening, driven by open banking.

In this article, we examine how open banking is transforming the global financial landscape, enabling faster payments and real-time settlements to become not just possible, but increasingly the norm.

What is open banking?

At its core, open banking is about reshaping the financial world. It allows banks to securely share customer data and payment services with licensed third-party providers through APIs (Application Programming Interfaces). This opens the door for fintech companies, payment service providers, and merchants to create smarter, faster, and more secure financial experiences – all while giving users more control over their money.

How do open banking payments work?

As we discuss open banking-powered payments here, let’s break down how they work. Open banking payments eliminate the middlemen and go directly to the source: the customer’s bank account. The process then usually looks like this:

- At checkout, the customer selects “Pay by Bank.”

Instead of typing in card details, they choose their bank from a list. - They authenticate securely through their bank.

Using biometrics, app verification, or two-factor authentication, they approve the payment without leaving the bank environment. - The payment is initiated instantly.

Funds move directly from the customer’s bank account to the merchant’s account via a secure, real-time transfer. - Both sides get instant confirmation.

The customer knows the payment succeeded, and the merchant can immediately process the order.

Because payments move directly from bank to bank through APIs, it’s faster, more secure, and typically cheaper than traditional card-based systems.

Open banking equals faster payments and real-time settlement

Before we dive deeper, let’s quickly define what we mean by “faster payments.”

Faster payments refer to systems that enable near-instant money transfers between bank accounts, operating 24/7, including weekends and holidays. Well-known examples include the UK’s Faster Payments Service (FPS) and the EU’s SEPA Instant Credit Transfer.

Open banking takes these faster payment systems and supercharges them. Instead of requiring complex card processing or manual bank transfers, open banking initiates these instant payments directly through secure bank APIs.

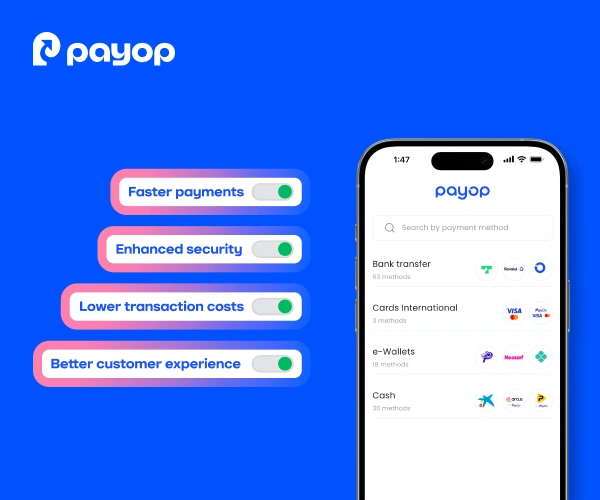

Here’s how open banking enhances faster payments:

- Streamlined process: Directly connects bank accounts, cutting out card networks and third-party processors.

- Real-time confirmation: Merchants get immediate payment status updates, reducing uncertainty.

- Always-on access: Payments can be made at any time, even outside traditional banking hours.

And it doesn’t stop at just faster initiation. Open banking also enables real-time settlement – the actual movement of money from payer to payee – which used to take hours or even days in traditional banking systems.

The business impact of real-time settlement

Real-time settlement means better cash flow and smoother operations for businesses. Instead of waiting days for funds to clear, merchants can:

- Receive payments instantly into their accounts.

- Fulfil orders faster.

- Minimise risks linked to payment delays.

- Plan financial operations more accurately.

In short, your money is where it needs to be, when you need it.

Real-world examples of faster payments driven by open banking

The impact of open banking on faster payments isn’t theoretical – it’s happening around the world right now:

United Kingdom: Open banking APIs + Faster Payments

In the UK, open banking regulation requires banks to give licensed providers access to customer accounts through APIs. When a customer pays using an open banking method, the merchant’s system securely connects to the customer’s bank, triggers the payment, and uses the Faster Payments network to move the money — all within seconds. No cards, no manual transfers, no waiting.

European Union: PSD2 + SEPA Instant

In Europe, banks must comply with PSD2 rules, which allow third-party providers to initiate payments from customers’ bank accounts. When combined with SEPA Instant – which clears euro payments across Europe in less than 10 seconds – open banking enables real-time, cross-border payments. Customers authenticate through their banking app, and the money reaches the merchant almost immediately.

Learn about payment regulations in Europe.

Brazil: Open Banking + Pix APIs

Brazil’s open banking initiative allows licensed providers to initiate payments directly from customer accounts. When paired with Pix – the country’s instant payment system – this means businesses can request payments automatically through APIs. Customers just approve the payment, and the money is transferred instantly, speeding up the checkout experience and ensuring real-time settlement.

Unlocking faster payments with Payop

You might be thinking that this all sounds amazing, but it is complicated to set up.

Fortunately, it’s not. With Payop, merchants can unlock the power of open banking easily through our Pay by Bank solution.

With Pay by Bank, your customers can pay directly from their bank accounts, ensuring instant transfers, lower costs, and real-time confirmation — even on weekends and holidays. No cards, no waiting, no unnecessary fees.

Whether you’re running an e-commerce store, a marketplace platform, or an online gaming platform, integrating Pay by Bank through Payop can dramatically upgrade your payment experience.