Gaming without cards: A look at Pay by Bank for in-game purchases

Are e-wallets enough? Building a diverse payment mix in emerging markets

Secure by design: How open banking mitigates data breach impact

How to build a local payment strategy for global growth

Latin America’s digital wallet boom: What’s driving adoption in 2025

Latin America’s digital wallet boom: What’s driving adoption in 2025

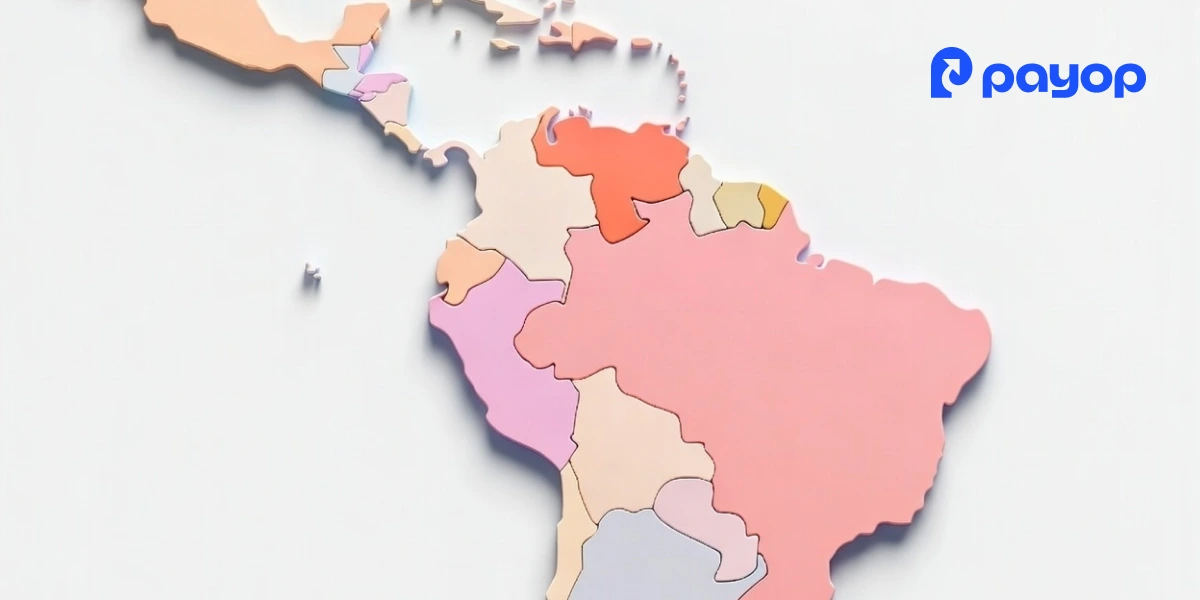

In recent years, Latin America (LATAM) has become one of the world’s fastest-growing regions for digital payments. In 2025, digital wallets are at the heart of this transformation. As cash use declines and financial inclusion efforts expand, wallets like Mercado Pago, PicPay, and Nubank are reshaping how people and businesses transact across the region.

But what exactly is behind this spike in adoption? And what should businesses know to stay ahead in the region’s rapidly evolving payment landscape?

Digital wallets on the rise: The market landscape

Digital wallet penetration in Latin America has skyrocketed. According to EBANX, digital wallets now account for over 20% of all e-commerce payments in countries like Brazil and Mexico, and nearly 30% in Argentina. More than 250 million people in the region actively use at least one e-wallet, and this number is expected to keep climbing.

Popular players include:

- Mercado Pago (Argentina, Brazil, Mexico)

- PicPay (Brazil)

- Nubank (Brazil, Mexico, Colombia)

- RappiPay (Colombia, Mexico)

- DaviPlata (Colombia)

- Nequi (Colombia)

- Cuenta DNI (Argentina)

- Yape & Plin (Peru)

In some countries, these wallets have become daily essentials used for grocery shopping, bill payments, public transport, and even peer-to-peer transfers.

What’s fueling the digital wallet boom?

Several key factors are contributing to the rapid adoption of digital wallets across Latin America in 2025:

1. Financial inclusion and mobile penetration

35 and 42% of Latin America’s population remain un- or underbanked, but smartphone access is widespread. Digital wallets provide a convenient alternative to traditional banking, enabling users to make payments, receive transfers, and even apply for microloans. All with just a smartphone connected to the internet, no physical bank account needed.

2. Government and Central Bank support

Regulators across the region are encouraging financial digitisation. For instance:

- Brazil’s Pix, the instant payment system backed by the Central Bank, seamlessly integrates with digital wallets and has become a game-changer for low-cost, instant transactions.

- Argentina’s interoperable QR system, driven by the country’s Central Bank, enables users of different wallets to transact easily.

- Mexico’s CoDi, developed by the Committee on Payments and Financial Infrastructures (CPFI) and the Bank of Mexico (Banxico), enables wallet payments via QR or NFC, thereby pushing mobile adoption.

These initiatives make digital payments more accessible and interoperable, which is essential for scaling.

3. Shift to e-commerce and contactless payments

Post-pandemic shopping habits have persisted. Consumers are increasingly opting for digital-first experiences, particularly when buying online or ordering delivery. E-wallets offer fast and secure checkouts, eliminating the need for card details, making them ideal for mobile-driven e-commerce.

4. Rewards, cashback & loyalty programs

Wallets aren’t just convenient, they’re rewarding. Cashback offers, in-app promotions, and gamified saving tools help attract and retain users. In markets like Brazil, PicPay and Mercado Pago offer higher returns on wallet balances than traditional savings accounts.

Learn about key payment challenges in Latin America.

Use cases: More than just e-commerce

While e-commerce is a major driver, digital wallets are now embedded in everyday life across LATAM:

- Paying bills and utilities

- Receiving remittances

- Managing the gig economy or freelance earnings

- Paying at physical stores using QR codes

- Buying transport tickets or paying for tolls

This versatility is one reason wallets are growing not just in urban centres but also in semi-rural and remote areas.

Read about the payment trends in the LATAM iGaming industry.

What does this mean for businesses?

For local and international merchants, the rise of digital wallets in Latin America presents a massive opportunity, but only if they offer the right payment mix.

Integrating regionally popular wallets directly or via a payment partner can:

- Boost conversion rates

- Increase checkout speed

- Reach unbanked or underbanked customers

- Offer local credibility and trust

Challenges ahead

Despite the momentum, a few challenges remain:

- Security and fraud prevention are top concerns as adoption rises.

- Connectivity and digital literacy gaps in rural areas still limit full penetration.

- Fragmentation of wallet options and a lack of standardisation may confuse consumers or slow merchant adoption.

Nevertheless, most indicators suggest that the current rise of digital wallets is likely to continue.

Get the right payment mix with Payop

For merchants looking to expand in the region, integrating the right payment methods is critical. With Payop, you can easily accept a wide range of popular digital wallets across Latin America, including Mercado Pago, Pix, Nequi, Yape, and many more. Our platform helps you localise payments, increase conversion rates, and reach customers who may not use traditional banking services.

Latin America is going wallet-first. Is your business ready?

With Payop, you can go live with top local wallets all in one integration.