The future of payments: How AI is transforming the industry

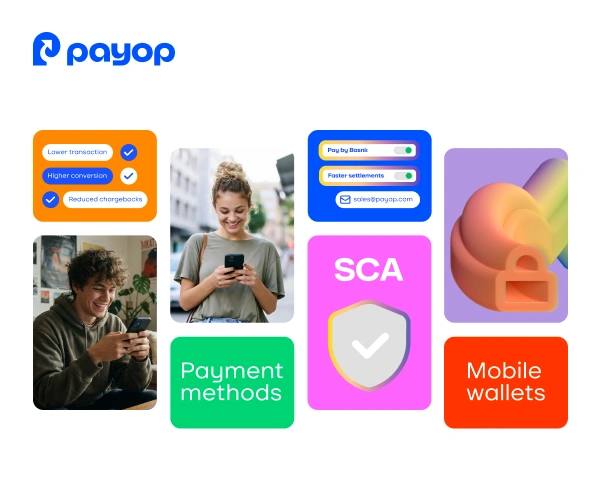

Pay by Bank vs. e-wallets: What should merchants promote at checkout?

How Gen Z shops: Insights on online payments

Why cash-based digital vouchers still matter in 2025

Can open finance deliver what open banking promised?

The future of payments: How AI is transforming the industry

Artificial intelligence (AI) has moved from theory to practice in financial services. It’s already changing the way people and businesses send, receive, and manage money. Payments are now faster, safer, and more personalised, but with these advances come new challenges. Companies that understand how AI shapes payments today will be better prepared to improve efficiency, protect revenue, and keep up with customer expectations.

Why do we need AI in payments?

The payment industry is changing fast, faster than ever. Digital wallets, open banking, real-time transfers, and BNPL have already changed how people pay. At the same time, rising transaction volumes and increasingly sophisticated fraud attempts put new pressure on businesses and payment providers. Consumers expect instant, seamless checkouts, while regulators demand stricter compliance and transparency.

Put simply: expectations are higher, risks are bigger, and oversight is tougher. Old systems based on fixed rules can’t keep up. Al brings the adaptability needed to manage this complexity, making it essential for the future of the payments industry.

How AI is transforming payments

From stopping fraud before it happens to predicting which checkout option a shopper will pick, Al is already working behind the scenes to make payments smarter, faster, and safer. Here’s where the technology is making the biggest impact.

Smarter fraud prevention

Fraudsters are constantly testing new tactics, from account takeovers to synthetic identities. Al models learn from huge datasets of past transactions, spotting patterns humans would miss, for example, an unusual device fingerprint or a mismatch in geolocation. Unlike traditional systems that need manual rule updates, AI adapts in real time. This cuts fraud losses, lowers chargeback rates, and protects both merchants and customers.

Personalised checkout experiences

Customers abandon their carts if the checkout process feels complicated. Al helps reduce that friction by tailoring payment pages. For example, it can highlight the method a customer is most likely to choose based on past behaviour or even the device they’re using. Someone on mobile might see digital wallets first, while a desktop shopper may get bank transfer or card options. This not only speeds up the process but also boosts conversion rates.

AI-powered chatbots and customer support

Support requests often spike during peak seasons. AI-powered chatbots handle common payment queries instantly, such as failed transaction explanations, refund status, or 3DS verification steps. Advanced systems even detect when frustration rises in a customer’s tone and escalate the issue to a human agent. The result: customers feel heard without waiting, and businesses save on support costs.

Optimised operations for merchants

Behind the scenes, Al helps merchants manage complex transaction flows. It can automatically route payments through the cheapest or most reliable provider, saving on processing fees and reducing the number of failed payments. Predictive models also forecast settlement times and cash flow, which is crucial for businesses operating on thin margins. Plus, by detecting anomalies in reports early, Al reduces costly accounting errors.

Cross-border payments and currency management

Expanding globally often means juggling multiple currencies and compliance rules. Al tools analyse exchange rates in real time and choose the most cost-effective paths for cross-border transactions. Some systems even predict currency fluctuations, allowing merchants to optimise when to settle funds. This reduces hidden costs and ensures that international customers enjoy the same smooth payment experience as local buyers.

Final thoughts: Al as the next payment standard

Al is no longer an experiment in payments – it’s becoming the standard. From security and personalisation to global expansion, the technology is quietly shaping every part of the payment journey.

For merchants, this isn’t just about keeping up with innovation; it’s about staying competitive in a market where customers expect speed, convenience, and trust.

The businesses that embrace AI today will be the ones setting the pace tomorrow. Those who wait risk finding themselves in a world where “traditional” payments no longer meet modern demands.