Payment toolkit built for your digital business

Merchant benefits

Trusted by 10,000+ digital businesses

Get started in just 4 steps

Still have some questions?

You can create and verify a business account for a company or an individual entrepreneur.

Once the pre-check application is approved, your account manager or sales manager will provide you with the required details needed to complete the verification.

Below, you can check the documents required for company and individual entrepreneur registration.

For company:

- Certificate of Incorporation;

- Beneficiary’s passport and proof of residence address;

- Register of Directors;

- Passport and proof of residence for each Director;

- Register of Shareholders;

- Passport and proof of residence for each Shareholder;

- Certificate of Good Standing/Certificate of Incumbency/Extract from register/issued within three months (in case legal entity was registered more than two years ago);

- Memorandum & Articles of Association/Constitution/Statute/other statutory documents;

- If the project is Betting, Gambling, Crypto, Forex:

- Activity License;

- Payment Agent Agreement (if applicable).

For individual entrepreneurs:

- An official document from the state registration that shows you as a sole proprietor;

- Tax registration confirmation of a private entrepreneur;

- Passport (driver’s license/international passport/ID card);

- Proof of residence address.

Please remember that all the mentioned documents must be in English or with a certified translation.

The proof of residence has to be issued within three months.

To receive a merchant account and the ability to accept online payments, each website must meet certain criteria.

This includes the availability of:

1.The logos of the payment systems whose payments you will accept.

2.Contact us page.

3.Information about the company. The website must indicate the official name of the company, its address, and the country in which the merchant’s main business entity is registered. This information helps companies gain consumer confidence and must be indicated on the checkout or payment data entry pages.

4.Terms of delivery. When selling goods online, you must provide detailed information about the delivery time of the goods.

5.A detailed description of goods and services. Make sure the offered product matches the description on the website.

6.Privacy Policy, Return & Cancellation Policy.

7.SSL certificate.

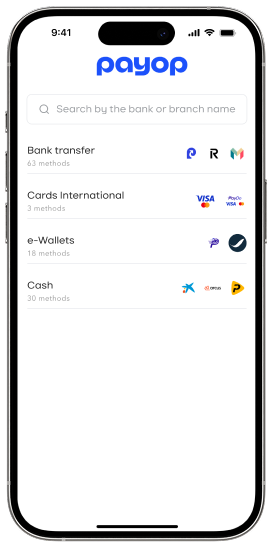

There are two ways you can check the availability of payment methods for your project.

1) Go to the “Payment Methods” section of your admin panel and choose the project for which you want to check the enabled methods with the applied fees.

2) Make an API request for more details like payment method ID, type, and supported countries.

Get Available Payment Methods · Payop/payop-api-doc

Please be advised that there is a wide range of API testing tools (e.x. Postman, REST-assured, JMeter, Curl, etc.) to make API requests and receive information, you need to choose the most convenient for you.

Step-by-step video instruction: How to find available payment methods for application/project | Payop.

There are two main options for integrating our solutions into your website: using API or CMS plugins (Woocommerce WordPress, Opencart, Lineage2).

To check the relevant information for each connection type, please refer to our Documentation.

If you have any questions or need assistance with integration, please contact our technical support via Tickets or at support@payop.com. Our team will help with your issue or guide you where to check the information.

Unfortunately, we currently do not have any sandbox or test environment. We hope these features will be available soon.

To test your integration, you can make a live payment, indicating a minimum amount possible to receive a successful transaction or cancel the transaction when entering the payment details. In this case, you will receive a notification about the payment cancellation.

If a transaction is successful or failed, you should receive an IPN callback to the IPN URL, which has been indicated in the IPN section of the Payop admin panel.

You can test your IPN URL using Postman (or any other API testing environment).

To do so, we recommend you send a POST request indicating your IPN URL as an endpoint.

An empty JSON object or example IPN callback can be indicated in the request body to troubleshoot your IPN URL service.

If you made a live payment, you can contact our support team via Tickets. They will resend an IPN callback and assist with troubleshooting your IPN URL service.