A guide to payment processing: what it is and how it works

Automated payments and how your business can benefit from them

Pay by Bank payments explained: Step-by-step guide

10 Questions to ask before choosing a payment service provider

Why do some markets still prefer cash, and how can your business adapt?

How global payment habits are shifting and what it means for businesses

Automated payments and how your business can benefit from them

To stay competitive in today’s digital economy, businesses need to move fast – and that includes how payments are handled. Automated payments streamline routine transactions, reducing manual effort and freeing up valuable resources.

Let’s explore what payment automation is, how it works, and how it can improve your business operations.

What is an automated payment system?

Payment automation is a technology that lets merchants process transactions without manual intervention. When you partner with a payment provider that supports this technology, your transactions happen on schedule and with minimal effort from your team. It can be used for recurring billing, payroll disbursements, supplier payouts, and customer transactions.

Once integrated, payment automation keeps transactions timely, accurate and smooth. It supports multiple payment methods, including bank transfers, cards, digital wallets, and electronic funds transfers (EFTs).

How do automated payouts work?

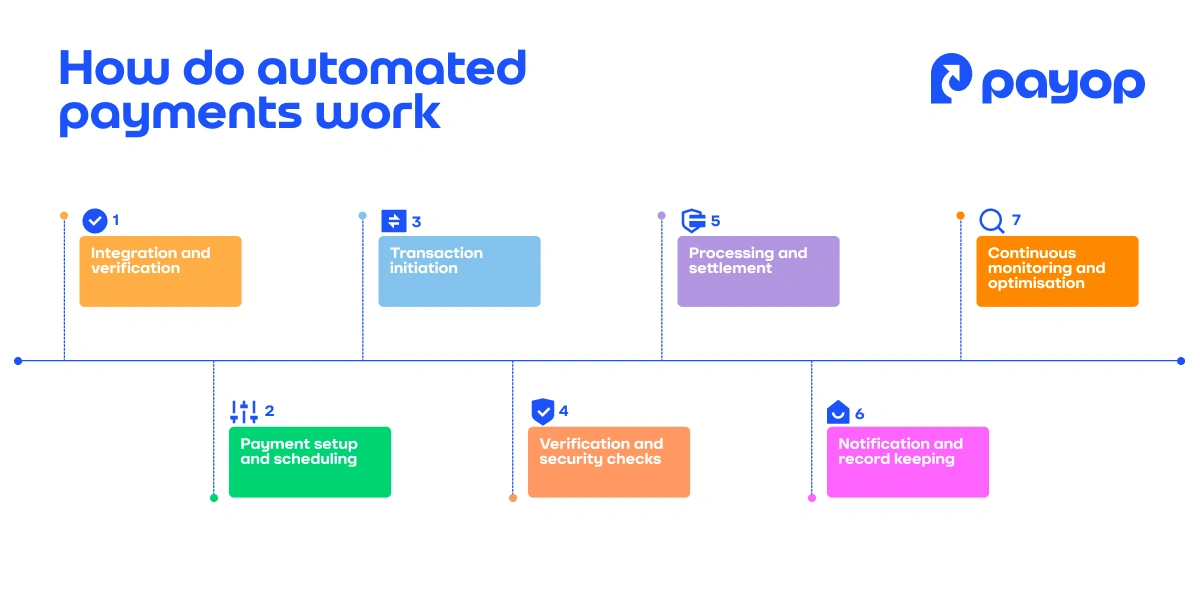

This is how automated payouts are processed within Payop’s system:

1. Integration and verification

After the Payop’s platform is connected to your website or app, you can start setting up automatic withdrawals to your verified accounts. The first step is sending your recipients’ data for verification. This includes: bank details, business address, and proof of account ownership.

2. Payment setup and scheduling

Once the accounts are verified, you can set up our system to make automated payouts. Set the amount, frequency, and payment method, and select a verified recipient to schedule payments.

3. Transaction initiation

When a payment is due, the automated system initiates the transaction based on your rules and schedules. It sends the payment request to the bank or processor, which moves the money from your business account to the recipient’s.

You can control payouts by temporarily switching them off or deleting them completely.

4. Verification and security checks

Before completing the transaction, the system performs some security checks. It makes sure the payment details are correct and that the transaction complies with security protocols and compliance requirements.

5. Processing and settlement

After verification, our system processes the payment and moves the funds from your account to the recipient’s. Depending on the payment method, this can take from a few seconds to a few days.

6. Notification and record keeping

When the payment is completed, you receive a notification. The system updates your transaction records and provides real-time reports with details of all withdrawals.

7. Continuous monitoring and optimisation

Payop’s automation feature allows you to monitor transaction statuses in real time. This helps spot any issues, such as failed transactions or mismatches, and fix them without delays.

Benefits of automated payments

Automated payments aren’t just about efficiency. They come with a range of advantages that allow you to focus on growing your business, such as:

- Optimised workflow: Manual payment processing is time-consuming and error-prone. It involves multiple steps, from data entry to authorisation, and requires a lot of human supervision. With automated payments, these tasks are handled automatically, freeing up your team.

- Improved cash flow management: Automation gives you better control over your funds because payouts are always on time. Plus, with Payop’s real-time monitoring and reporting, you get up-to-date financial data to plan and make smarter business decisions.

- Reduced errors: Human mistakes in manual payouts can be costly. But with automation, you don’t need to worry about it anymore: the system processes transactions correctly every time.

- Improved security: Payop’s automated payment system offers advanced security measures, such as encryption, tokenisation, and multi-factor authentication. It protects sensitive data and lowers fraud risks.

- Scalability: As your business grows, so does the volume of transactions. In this case, manual payment processing could start getting in the way. Automated payments resolve this problem by letting you handle more transactions without extra resources.

Contact our team at sales@payop.com to learn how Payop can help optimise your business operations.