The future of payments: How AI is transforming the industry

Pay by Bank vs. e-wallets: What should merchants promote at checkout?

How Gen Z shops: Insights on online payments

Why cash-based digital vouchers still matter in 2025

Can open finance deliver what open banking promised?

Can open finance deliver what open banking promised?

When open banking first launched, it came with big promises: more control for consumers, more competition in the market, and smarter, more personalised financial services. Years later, the results are mixed. While open banking built a solid foundation, it hasn’t quite delivered the transformation many hoped for.

Now, open finance is stepping in with a broader vision and a bold question: can it finally achieve what open banking set out to do?

What open banking promised

Open banking allowed third-party providers to access consumers’ bank data, only with their permission and using secure APIs. The idea was to:

- Give users more control over their financial information

- Encourage innovation and competition

- Improve access to better, more personalised financial services

This led to tools like budgeting apps, account aggregators, and new payment options like Pay by Bank. But adoption was slow. While Pay by Bank is gaining traction in Europe, particularly in the UK, the Nordics, and the Netherlands, other benefits that open banking set out to deliver have been harder to realise. In many regions, lack of regulation, limited consumer awareness, and weak commercial incentives have held the ecosystem back.

What makes open finance different?

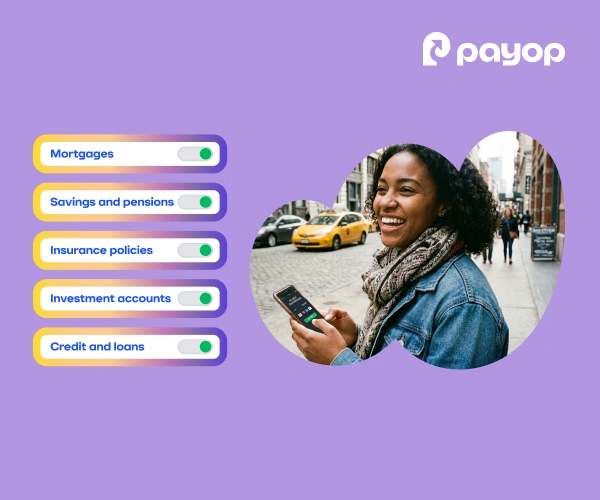

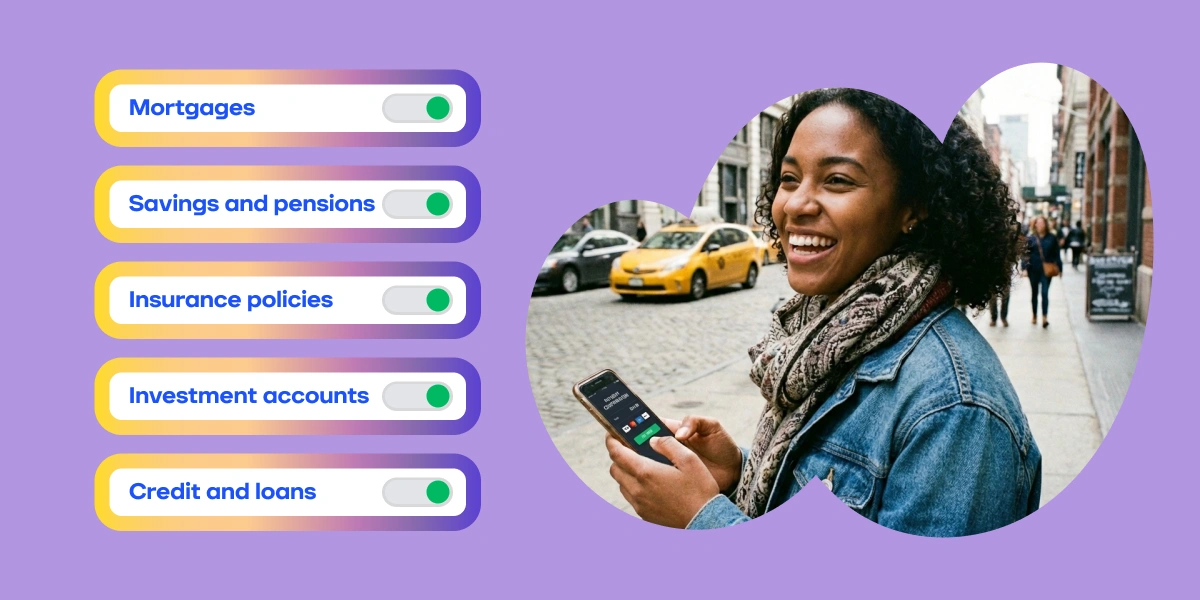

Open finance takes the same core idea of secure, consent-based data sharing, but expands it beyond just current accounts. It opens access to:

- Mortgages

- Savings and pensions

- Insurance policies

- Investment accounts

- Credit and loans

This broader scope gives businesses and fintechs a complete view of a customer’s financial life. The result? More advanced services like:

- All-in-one finance dashboards

- Smarter credit scoring

- Tailored insurance offers

- Real-time lending decisions

Open finance isn’t just bigger. It’s more useful and more aligned with what consumers need.

Why open finance might succeed where open banking fell short

Open banking laid the groundwork, but it didn’t quite spark the revolution many expected. Open finance builds on those foundations but with a broader scope, stronger momentum, and a better chance of delivering real value to both consumers and businesses. Here’s why it might succeed where open banking struggled.

1. More data, more possibilities

Open banking was limited to a narrow set of financial products. Open finance unlocks much more, creating space for better products, deeper insights, and more personalised services.

2. Stronger regulatory momentum

Governments and regulators are now pushing open finance forward. For example:

- The EU’s FIDA framework

- The UK’s Smart Data initiative

- Brazil’s open finance rollout

- Australia’s CDR, which already covers sectors beyond banking

This broader support helps create clearer rules and faster adoption.

3. Consumer expectations are changing

People expect convenience, personalisation, and control. They want their apps to sync and services to talk to each other. Open finance fits perfectly with these expectations.

Learn about key fintech trends in 2025.

Key challenges ahead

Open finance has a lot of potential, but a few things are still getting in the way of real progress:

- Lack of regulation: In many places, there’s still no official framework to support open finance, so progress is slow and inconsistent.

- Banks are slow to engage: Without clear rules or strong reasons to act, many banks are taking a wait-and-see approach to open finance.

- Technical fragmentation: Without standard APIs and formats, it’s hard for fintech companies to build solutions that work across different markets.

- Low consumer awareness: Most consumers aren’t familiar with open banking, let alone open finance, so adoption is naturally low.

Until these challenges are addressed, open finance may struggle to move from concept to mainstream reality.

Start benefiting from open data today

Open finance is still in development in most parts of the world. But that doesn’t mean your business has to wait to experience the benefits of open data access and bank connectivity.

With Payop’s Pay by Bank solution, you can already tap into one of the most practical and powerful use cases born from open banking: instant account-to-account payments.

Here’s what you get:

- Secure, real-time transfers without cards or intermediaries

- Frictionless payments authorised directly from customers’ banking apps

- Built-in security with strong customer authentication and no need to share card details

- Availability outside banking hours, including nights, weekends, and holidays

- Lower transaction fees than traditional card processing

Pay by Bank is a future-ready solution built for today’s market, giving businesses a competitive edge while the rest of the open finance infrastructure catches up.