The future of payments: How AI is transforming the industry

Pay by Bank vs. e-wallets: What should merchants promote at checkout?

How Gen Z shops: Insights on online payments

Why cash-based digital vouchers still matter in 2025

Can open finance deliver what open banking promised?

How Gen Z shops: Insights on online payments

If your business isn’t paying attention to Gen Z, you could be missing out on one of the most digitally powerful consumer groups today. Born between 1997 and 2012, Gen Z grew up with smartphones, social media, and instant access to information. This shaped their expectations for speed, convenience, and seamless digital experiences.

For merchants, understanding how this generation shops and makes online payments is no longer optional. It’s essential for staying competitive, reducing cart abandonment, and driving loyalty across devices.

Gen Z’s shopping habits

Gen Z values efficiency, personalisation, and mobile-first experiences. They often browse, research, and buy directly from smartphones, and social media heavily influences their choices. Platforms like Instagram, TikTok, and Snapchat are more than just entertainment – they’re active shopping channels where influencer recommendations and in-app purchases drive decisions.

While they still use traditional payment methods like credit cards and PayPal, Gen Z is increasingly open to alternative payment options, ranging from Buy Now, Pay Later (BNPL) to mobile wallets and even cryptocurrency.

So, let’s see what payment preferences dominate among this generation.

Mobile payments

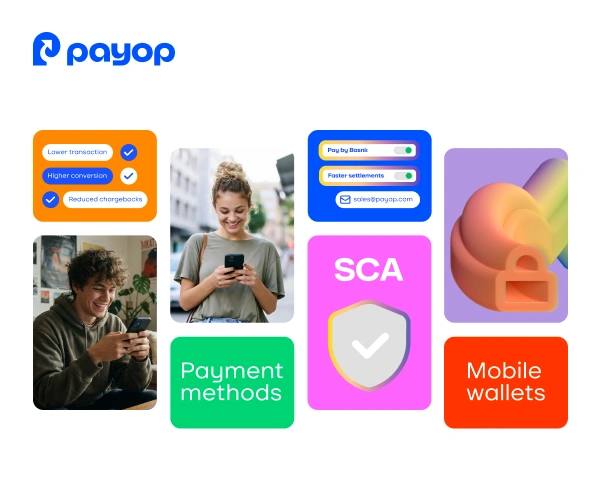

Digital wallets are central to Gen Z’s shopping behaviour. About 79% regularly use mobile payment solutions such as Apple Pay or Google Wallet. Convenience and speed matter more than ever: long checkout forms or mandatory account creation can quickly lead to abandoned carts.

Merchants who streamline mobile payments with one-tap options can capture more sales from this impatient, digitally savvy generation.

Buy Now, Pay Later (BNPL)

Flexibility is a key driver for BNPL adoption. Nearly 46% of Gen Z shoppers use services like Klarna, allowing them to pay over time without delaying gratification. BNPL appeals because it balances instant purchases with responsible money management, making it a particularly attractive option for younger consumers.

Cryptocurrency

Cryptocurrency is still an emerging payment method, but it is gaining attention among Gen Z. For them, crypto represents not just an investment opportunity but also an alternative to conventional banking in online payments.

While not yet mainstream, the growing online acceptance of digital currencies indicates that more Gen Z consumers may use them for purchases in the near future. Businesses prepared to support crypto may gain an early advantage with this forward-thinking audience.

Social commerce

Gen Z often shops where they scroll. Social media platforms are more than just discovery tools – they are active sales channels. Influencer reviews and personalised recommendations heavily affect purchasing decisions, and many Gen Z consumers complete transactions directly within the apps.

Businesses that embrace social commerce can effectively reach Gen Z, where they spend the majority of their online time.

Cross-device consistency

Gen Z expects a seamless experience across devices. They might research a product on a smartphone, compare it on a tablet, and complete the purchase on a desktop. Carts, payment methods, and checkout flows must remain consistent to prevent friction and lost sales.

How businesses can adapt

To effectively engage Gen Z, you need to rethink both payment options and the overall shopping experience. Key strategies include:

- Offer alternative payment methods: From wallets to cryptocurrencies, give customers the choice to pay with their preferred and trusted methods, and watch your conversion rates rise.

- Optimise mobile checkout: Make online payments fast and simple with digital wallets and one-tap checkout options. Avoid long forms or unnecessary steps that can frustrate mobile-first shoppers.

- Integrate social commerce: Enable shopping directly on social platforms. Utilise influencer partnerships, shoppable posts, and personalised recommendations to create a seamless and engaging buying experience.

- Personalise the experience: Use data to tailor recommendations and offers, such as reminding customers of previously viewed items or suggesting complementary products. Personalisation increases engagement and drives conversions.

- Communicate transparency and security: While Gen Z prioritises convenience, they also care about trust and security. Display clear information about secure payments, privacy policies, and trusted payment partners to build confidence.

By combining these strategies, you can create a fast, flexible, and frictionless checkout experience that meets Gen Z’s expectations while maximising conversions.

Final thoughts

Gen Z expects fast, flexible, and frictionless payments. Merchants who adapt by offering mobile wallets, BNPL, social commerce, and crypto-friendly options can increase conversions and build lasting loyalty. Payop helps businesses meet these expectations, providing multiple payment methods and currencies, cross-device consistency, and secure, seamless checkout experiences.

Get an individual consultation from our team at sales@payop.com.