Payment tokenization vs. encryption: Do you need both?

Bank holidays 2026 in Europe

The rise of QR code payments worldwide

Payment preferences in Southeast Asia: From cash to digital wallets

How global payment habits are shifting and what it means for businesses

The checkout experience has changed significantly in recent years. What used to be a long form with a card payment option has transformed into an oftentimes one-click process with a mosaic of local methods, instant bank transfers, digital wallets, and QR-powered flows.

All of this is a response to a shift in customer preferences and growing expectations for the online shopping experience. For businesses, these changes define who converts, who drops off, and which markets are realistically within their reach.

Below, we look at the details of this transformation and how you can respond.

Mobile shopping has become the default

Let’s start with not exactly the payment habit, but something that, in many ways, defined the direction of the shift. The fact that the majority of online purchases – exactly 57% in 2024 – are now made using smartphones.

What’s changing isn’t only the device, but also the behaviour around the purchase. Buyers now:

- expect one-handed checkout, not forms that feel like paperwork

- trust biometric authentication more than passwords

- prefer wallets, QR payments, and instant bank transfers over typing card details

- make decisions faster and abandon checkouts faster if something feels difficult

This is especially visible in regions with younger, mobile-first populations. Southeast Asia, Latin America, the Middle East, and Africa often skip the desktop entirely and go straight to app-based shopping.

Key takeaway is that your checkout and payment mix should be optimised for mobile behaviour, not desktop expectations. The methods that convert best on a laptop don’t always show the same results on a phone.

Instant bank transfers are becoming mainstream

Real-time bank transfers are no longer niche. They’re becoming the preferred option for domestic online payments in multiple regions.

There are several aspects behind it:

- Regulatory impulse: Europe pushes for mandatory SEPA Instant; LATAM regulators boost account-to-account systems; Gulf countries are rolling out instant clearing systems.

- Lower failure rates: Bank transfers don’t suffer issuer declines as cards do.

- Faster settlement: Merchants receive funds almost immediately rather than days later.

- Better user experience: No card numbers, no expiry dates, no CVV codes.

- Lower fraud risk: With no sharing of payment data and bank authentication, the risk of fraud is minimised.

Some examples are:

- PIX in Brazil: over 160 million users, used everywhere from e-commerce to tax payments.

- UPI in India: over 10 billion transactions monthly, powering QR, app-to-app, and recurring flows.

- Pay by Bank in Europe: quickly becoming the preferred method, especially among users in northern Europe.

Key takeaway: Instant bank transfers have higher success rates and often lower costs than cards. They help you avoid chargebacks and quicken the shipping process.

Digital wallets are becoming more than just a payment method

Wallet adoption is no longer driven by novelty. It’s driven by ecosystem design.

People don’t use wallets because they’re modern. They use them because wallets sit at the centre of how they generally move money – paying bills, transferring to friends, paying in stores, receiving salaries, and shopping online.

The biggest examples are Alipay and WeChat Pay in China. They are used for almost everything: paying rent, buying groceries, ordering food, booking taxis, sending money to friends, paying utility bills, investing, taking loans, buying insurance, and accessing mini-apps.

Most people don’t carry physical wallets. QR-based wallet payments replaced cash and even cards. They also integrate with government services, financial products, loyalty programs, and banking functions.

Key takeaway: Biometrics replaced passwords, which removed the biggest friction point in mobile checkout. This shifted millions of users toward tap-to-pay and wallet-based online flows. So, not offering wallets means losing the fastest-growing segment – mobile-first buyers.

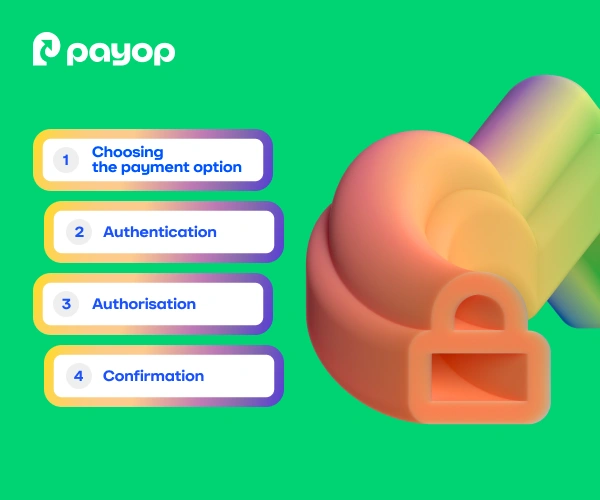

QR codes became a payment infrastructure

QR payments solved problems that cards never could in many regions – cost, accessibility, and infrastructure. The main reasons that made QR payments popular in various regions are:

- They simplify online checkout. No typing payment details – the customer just scans and approves in their banking or wallet app.

- They are often used to initiate real-time bank payments – a format that typically has lower decline rates than cards.

- They suit mobile-first behaviour. Most shoppers browse on their phones, so QR flows feel intuitive and remove friction at the final step.

- They speed up authentication. Biometrics inside the user’s app reduce drop-offs by replacing passwords, confirmation codes, etc.

- They increase the sense of security. Buyers stay within their trusted bank or wallet environment rather than entering sensitive information on a website.

Some well-known and widely used examples include India’s UPI QR network and Brazil’s PIX QR codes. Key takeaway: QR isn’t a trend anymore, it’s infrastructure. If you sell in Asia, LATAM, or the Middle East, QR-based methods often convert better than cards.

Cash-based payment methods are still relevant

Cash hasn’t disappeared. It’s been repackaged into digital-friendly formats.

Some of the examples are:

- OXXO in Mexico – works by generating a barcode and paying in cash at the shop.

- PagoEfectivo in Peru – offers bank deposits or cash payments using a unique code.

- CashToCode in Europe – enables cash payments for online purchases via partner shops.

As mentioned, examples demonstrate that cash-based payments are common not only in emerging markets but also in developed countries. The reasons behind it are:

- Lack of trust in card payments.

- Inaccessibility of traditional banking infrastructure.

- Cultural preferences and the desire to remain anonymous while shopping online.

Key takeaway: Ignoring cash-based methods blocks access to millions of buyers in emerging economies.

Local expectations in cross-border e-commerce

Shoppers actively order internationally, but expect to pay locally. What does it mean?

- familiar payment methods

- pricing in local currency

- smooth authentication

- clear refund flows

- localised checkout

A Brazilian customer isn’t going to get a card just to shop on a UK website. A German customer wants bank-based checkout. A Thai customer wants a wallet. Buyers don’t adapt – merchants have to.

Key takeaway: Localisation directly decides your conversion rate. Not offering the right payment mix is the fastest way to lose international buyers.

What this means for your business

The shifts in how people pay change more than the checkout screen – they change how you plan expansion, handle risk, and optimise revenue. Here are the changes these trends cause in real operations:

- Treat payments as part of the customer experience

A smooth, localised payment flow increases trust and repeat purchases. In competitive markets, payment terms directly influence whether customers return.

- Offer the methods people actually use, not just a long list

Each region has 3-5 must-have payment methods that drive most online purchases. If you miss one of them, conversion drops sharply. Cards alone no longer cover whole regions.

- Expect higher conversion when you add bank-based options

Instant bank transfers typically experience fewer declines than cards, especially in countries with strict issuer filters. Adding a Pay by Bank option often immediately reduces failed payments.

- Design checkout for mobile, not desktop

Mobile shoppers don’t tolerate long forms or multiple redirects. Wallets, QR flows and app-based approvals convert better because they fit how people actually complete purchases on a phone.

- Use a PSP that gives you local methods without the heavy setup

Instead of opening local entities or managing separate integrations for each market, work with a payment service provider like Payop that connects you to all desired methods under a single contract and integration flow. This removes the operational barriers that typically slow expansion into regions such as LATAM or Southeast Asia.

The way people pay will keep evolving, but the direction is obvious: faster, simpler, and more local. Businesses that adapt their checkout to real customer habits will convert more, enter new markets faster, and build trust from the very first transaction.