Why your business should accept PagoEfectivo in Peru

How is Pay by Bank revolutionising e-commerce payments?

Payment landscape in Mexico: a complete guide

The future of mobile payments: Trends and innovations to watch

How is Pay by Bank revolutionising e-commerce payments?

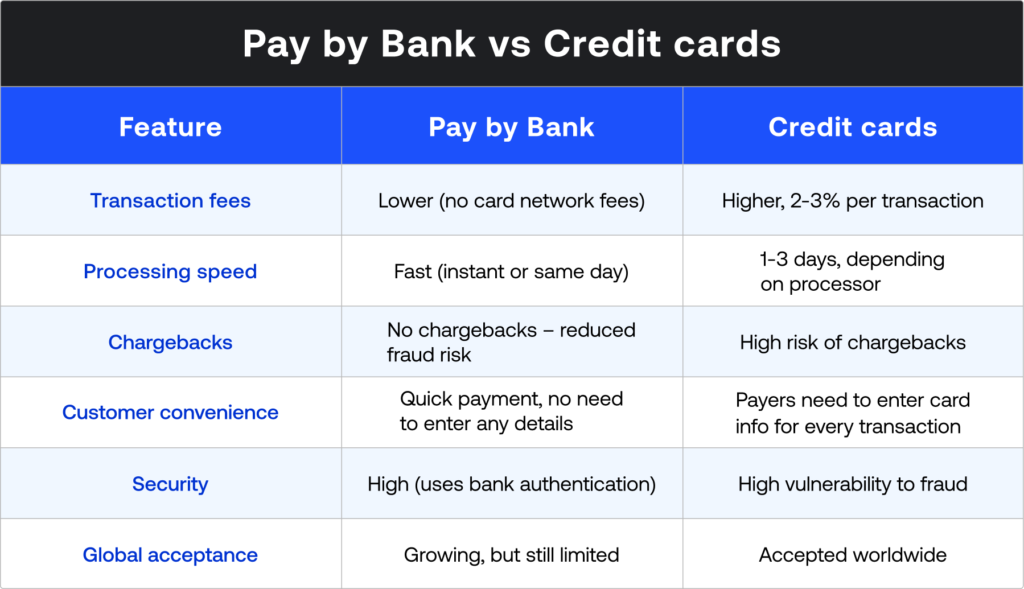

In an era where speed, security, and simplicity are key to winning customers, Pay by Bank is quickly becoming a game changer for e-commerce businesses. By bypassing traditional card payments and using direct bank transfers, this method is cutting down on transaction costs and providing a smoother checkout experience.

However, it’s not just about convenience – Pay by Bank is redefining how payments work, helping merchants stay ahead of the curve in a competitive landscape. Let’s dive into how this innovative payment method is shaking up the world of online shopping.

What is Pay by Bank?

Pay by Bank is an open banking-based payment solution that allows consumers to make payments directly from their bank account without needing credit or debit cards. Instead of using card networks, Pay by Bank connects a customer’s bank account to the merchant’s payment gateway via a secure API. This enables real-time bank transfers for transactions, making the whole process faster, easier, and more secure for everyone involved.

What role does open banking play in enabling Pay by Bank?

At its core, open banking refers to the practice of allowing third-party financial service providers to access customer bank account data through secure APIS with the customer’s consent.

This data-sharing model is built on the principles of transparency and customer control. It enables consumers to access a range of financial services directly from their bank accounts. In the case of Pay by Bank, it allows making payments directly from banking apps.

How does Pay by Bank work?

So, how does Pay by Bank actually work? Let’s break it down:

- Payment method selection: A customer chooses Pay by Bank as their payment option at checkout.

- Banking app login: The customer is then securely redirected to their online banking app or website, where they log in using their usual banking credentials.

- Payment authentication: The customer verifies the payment using strong customer authentication (SCA). This might involve a biometric scan or a PIN for extra security.

- Payment authorisation: Once the customer confirms, the payment is processed directly from their bank account to the merchant’s account in real-time.

- Transaction complete: The customer and merchant receive instant transaction confirmation.

This whole process eliminates the need for credit or debit card details and reduces the reliance on multiple intermediaries. It’s a more direct and efficient way to pay, offering greater transparency and fewer customer barriers.

Key features of Pay by Bank

Pay by Bank offers a range of features that directly address the arising customer needs. Let’s explore how this payment method can transform the way your business handles transactions.

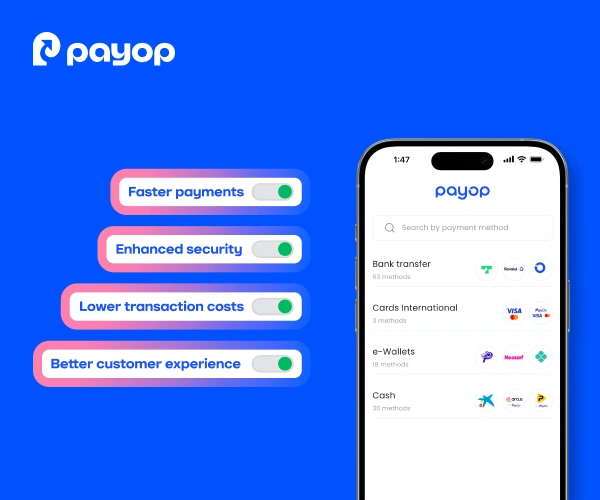

Faster payments

One of the most attractive features of Pay by Bank is the speed at which payments are processed. Traditional card payments can take several days to clear, especially for cross-border transactions. On the other hand, Pay by Bank settles payments in real-time so merchants can receive their funds near-instantly. This is a massive boost for businesses that rely on quick access to cash flow, helping them stay agile and efficient.

Enhanced security

Pay by Bank leverages the robust security features of open banking, including strong customer authentication (SCA) and encryption. Since payments are authorised directly by the account holder in the banking environment, the risk of fraud or data theft is minimised.

Unlike card payments, Pay by Bank is also much more resistant to chargebacks, which can be a costly and time-consuming issue for merchants.

Lower transaction costs

Payment processing fees can add up quickly, especially when using card payment systems. Pay by Bank reduces these fees by cutting out card networks and other intermediaries. For merchants, this means lower transaction costs, resulting in higher margins and more competitive pricing. It’s a win-win for businesses looking to save on payment processing.

Better customer experience

As more consumers seek to avoid using credit cards online, Pay by Bank is stepping up to meet the demand for faster, simpler, and more secure payment methods. Now, customers can make payments with just a few clicks, reducing the risk of data theft and friction at checkout.

This means fewer abandoned carts and higher conversion rates, as customers appreciate the convenience and security of direct bank transfers.

Learn about payment trends in 2025.

How Pay by Bank benefits e-commerce merchants

Merchants gain a lot from integrating Pay by Bank into their payment ecosystem. Here’s how:

- No chargebacks: Since the payment is authorised directly by the customer, Pay by Bank reduces the risk of chargebacks.

- Seamless integration: Pay by Bank can be easily integrated into existing payment gateways through robust APIs, so merchants don’t have to worry about overhauling their systems.

- Stronger customer trust: By offering Pay by Bank, merchants show that they care about security, providing customers with a reliable, safe, and straightforward payment option.

- Optimised operations: Thanks to sped up processing and improved cash flow, Pay by Bank allows businesses to handle orders more efficiently. This leads to faster order fulfilment, improved inventory management, and better overall operational optimisation.

Choose a fitting payment provider with this simple guide.

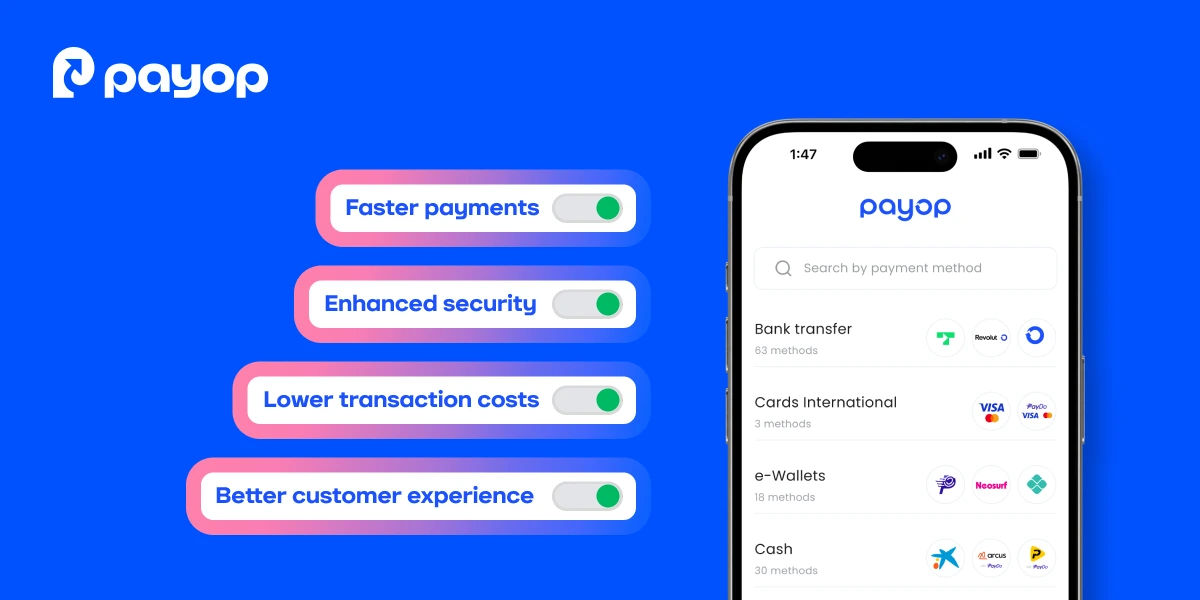

Integrating Pay by Bank with Payop

With Payop’s Pay by Bank, you can easily start accepting direct bank payments without complex setup or technical hurdles. It’s fast, secure, and built to support real-time processing across a wide network of European banks.

If you want to lower costs, speed up processing, and offer your customers a smoother way to pay, Payop’s Pay by Bank is the solution.

Contact us at sales@payop.com to learn more.