How open banking APIs are transforming the payment landscape

The financial world is undergoing a profound transformation, and at the heart of this change lie open banking APIs. These digital tools are not just reshaping how payments are made but also redefining how businesses and consumers interact with money. From faster transactions to personalised financial solutions, open banking APIs are paving the way for a more inclusive and competitive financial landscape. Let’s see how they do it and what it can give to your business.

What is open banking?

Open banking is a system where financial institutions share customer data with third-party providers through APIs, provided the customer consents. This allows for the development of innovative financial services, such as direct account-to-account payments, advanced budgeting tools, and personalised lending options.

What is an API?

API stands for Application Programming Interface. Think of it as a digital bridge that allows two different software systems to communicate with each other. Just as a waiter takes your order at a restaurant and conveys it to the kitchen, APIs relay requests between applications and deliver the responses back to you.

In the context of open banking, APIs are the tools that enable secure data sharing between banks, fintech companies, and other authorised third parties. For instance:

- When a fintech app helps you manage your finances by accessing your bank account details, it’s using an API.

- When you pay directly from your bank account through an e-commerce checkout, it’s an API doing the heavy lifting.

By leveraging APIs, open banking ensures that data sharing is not only seamless but also secure and efficient. This API-driven ecosystem is the foundation for the sweeping changes we see in the payment landscape.

The influence of open banking APIs on payments

The way we pay for goods and services is evolving rapidly, and open banking APIs are driving much of this change. So, let’s explore the specific ways and see how your business can use it.

1. Making payments faster and simpler

Gone are the days when payments took hours—or even days—to process. Open banking APIs enable direct account-to-account payments, which are processed almost instantly.

Imagine paying for an online order directly from your bank account without using a card or wallet. No intermediaries, no extra fees, and no waiting for funds to clear. APIs make this possible.

For businesses, this means faster cash flow. For consumers, it means a checkout process so smooth it feels almost invisible.

2. Cutting costs for everyone

Traditional payment systems often rely on card networks, which charge hefty fees for each transaction. Open banking bypasses these middlemen, enabling direct payments that are significantly cheaper.

For example:

- A small e-commerce business can save thousands annually in transaction fees by adopting open banking solutions.

- Subscription services can use APIs to handle recurring payments without the cost overhead of card-based transactions.

3. Promoting financial inclusion

According to the World Bank, over 1.4 billion adults globally are unbanked – but many of them own smartphones. Open banking APIs turn these devices into financial systems.

How?

- APIs power fintech apps that offer alternative credit assessments, helping people access loans without traditional credit scores.

- Digital wallets, integrated with open banking, allow users to manage finances without needing a bank account.

This is especially transformative in regions like Southeast Asia, Africa, and Latin America, where traditional banking infrastructure may be limited.

4. Boosting payment security

Contrary to what some may think, open banking isn’t a security risk – it’s an upgrade. APIs adhere to strict regulatory frameworks like PSD2 (in the EU) and Open Banking Standards (in the UK), which mandate strong customer authentication (SCA) and robust encryption protocols.

Moreover, direct account-to-account payments reduce the need for businesses to store sensitive customer data, lowering the risk of breaches and payment fraud.

Industries that benefit from open banking APIs

E-Commerce

Open banking APIs are revolutionizing online shopping by offering faster, cheaper, and more secure payment options. Imagine a customer completing a purchase with just a tap, directly from their bank account—no cards or third-party apps needed.

Marketplaces

Online marketplaces often handle complex transactions involving multiple parties – buyers, sellers, and sometimes third-party service providers. Open banking APIs streamline these payments by enabling direct account-to-account transfers, reducing delays and transaction fees. They also support automated payout systems, ensuring that sellers receive their earnings promptly, enhancing trust and satisfaction.

Gaming and Forex

In industries where speed is critical, like gaming or forex trading, open banking ensures instant deposits and withdrawals. Players and traders get real-time access to their funds, keeping the game/work going.

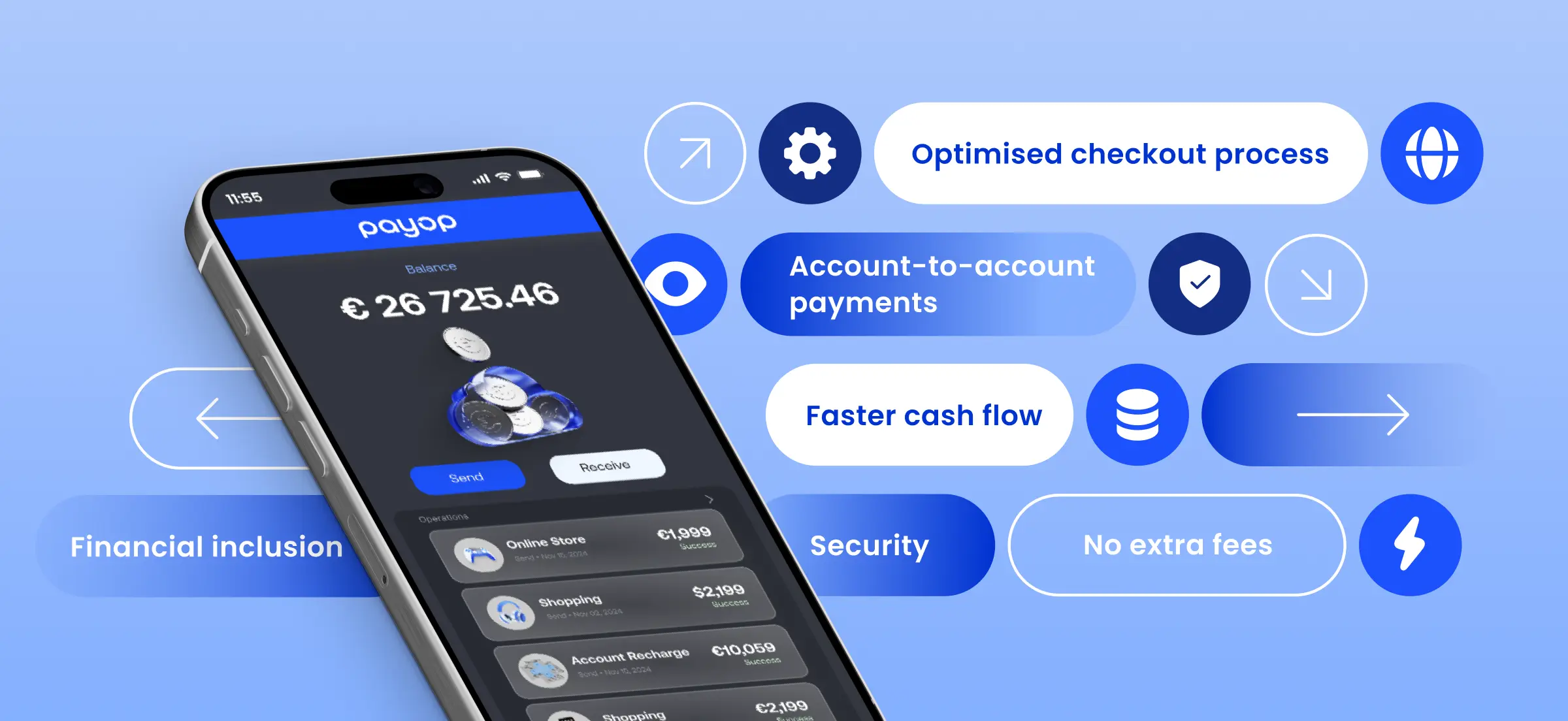

How Payop uses open banking APIs

With Payop’s Pay by Bank, your business can unlock the full potential of open banking APIs. This payment solution lets your customers pay directly from their bank accounts, offering a modern, efficient, and user-friendly payment experience that benefits both you and your customers.

Enjoy lower transaction fees, faster payment processing, and enhanced security, all while reducing chargeback risks. Upgrade to smarter payments today with Pay by Bank.

Contact our team at sales@payop.com to learn more.