Cross-border payments: Key challenges and solutions for 2025

Interview with Finance Team Lead Olena Polishchuk

Tips for improving the payment success rate for online businesses

Understanding chargeback fraud: How to protect your business

How payment flexibility drives customer loyalty in e-commerce

Customer loyalty is a prized asset that brands work hard to cultivate. With increasing competition and evolving consumer expectations, offering payment flexibility is one of the most effective strategies to drive loyalty. Whether you’re an established retailer or a smaller business, this article will show why offering diverse payment options isn’t just good for your customers – it’s great for your revenue.

Why payment flexibility matters in e-commerce

A recent study by Baymard Institute revealed that nearly 9 out of 10 online shoppers abandon their carts due to issues during checkout, with 9% specifically citing limited payment methods as the reason. That’s why it’s important to prioritise flexibility at your checkout.

Payment flexibility means allowing customers to choose how and when they pay. This can range from accepting diverse payment methods to offering instalment plans or region-specific solutions. It’s all about making shopping easy and accessible, which leads to one key result: happy, loyal customers.

How payment flexibility builds customer loyalty

- A better shopping experience: A seamless checkout process leaves a lasting impression. When payments are hassle-free, customers are more likely to return.

- Wider accessibility: Not everyone has a credit card. Some prefer digital wallets, while others opt for Buy Now, Pay Later (BNPL) services. Offering multiple options shows you care about their needs.

- Lower cart abandonment: Limited payment options often cause abandoned carts. Flexible choices ensure customers can complete purchases with ease.

- Stronger customer bonds: Offering instalment plans or subscriptions makes purchases manageable, creating trust and fostering loyalty.

- Appeal to global shoppers: Payment flexibility is essential for international customers. Supporting local payment methods and currencies shows you value them.

How to make payment flexibility a reality

To truly harness the power of payment flexibility, businesses need a clear plan of action. Implementing the right solutions can transform your checkout process into a loyalty-building machine. Here’s how you can make it happen:

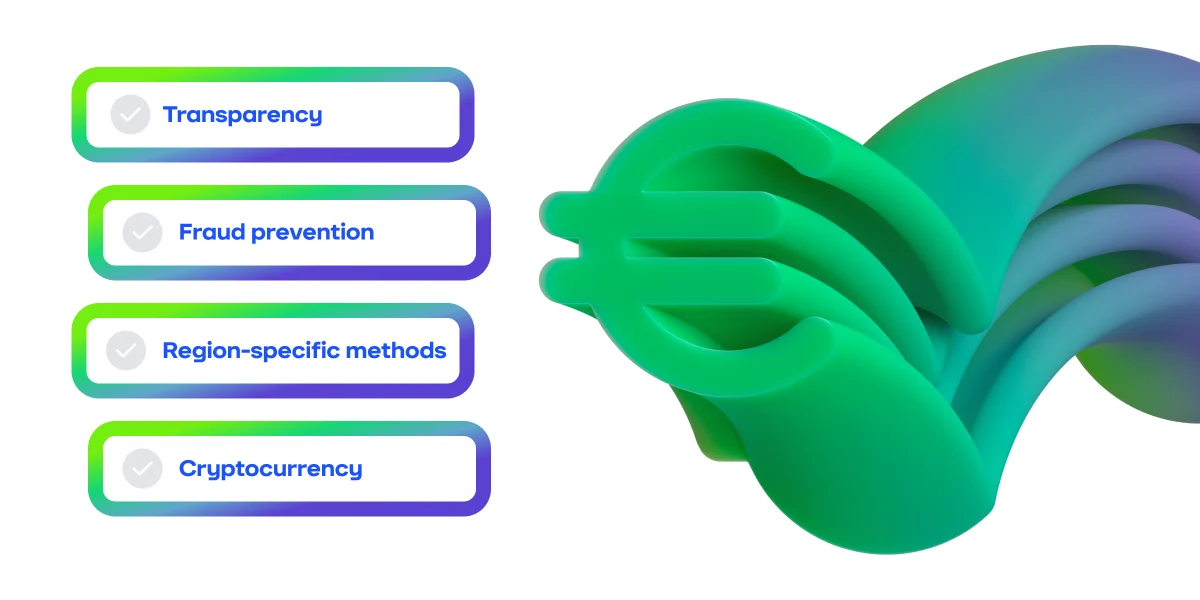

- Expand payment options: Accept popular methods like credit/debit cards, digital wallets, and other alternative solutions. If your audience is ready, consider emerging trends like cryptocurrency.

- Go local: Research the markets you serve and offer region-specific methods, such as iDEAL in the Netherlands or Boleto Bancário in Brazil.

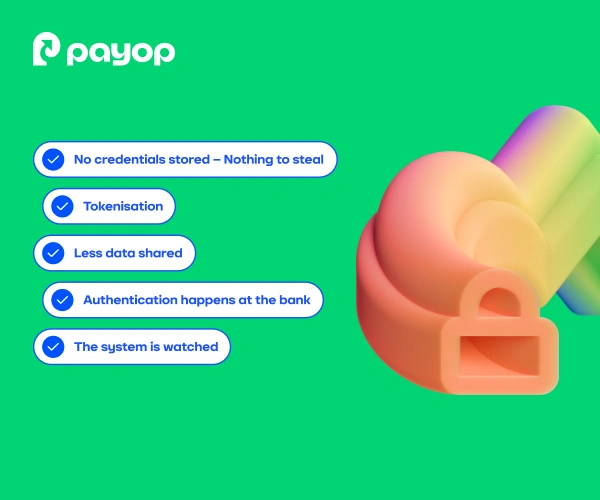

- Emphasise security: Use trusted payment gateways and highlight security features like encryption and fraud prevention to build customer confidence.

- Showcase your options: Clearly display payment methods throughout the customer journey. Transparency builds trust and reduces confusion.

Emerging trends in payment methods

To make smart decisions for your checkout, it’s worth keeping an eye on the latest developments in the industry. Here are some of the trends, that’ve been gaining traction lately:

- BNPL boom: More shoppers are embracing flexible payment terms to manage their budgets.

- Digital wallet domination: This payment option is gaining popularity, especially among younger customers, due to its convenience and accessibility.

- Cross-border expansion: The global e-commerce market is expected to reach approximately USD 6.72 trillion by 2034. Offering local payment options and currencies helps your business take its place in it.

Final thoughts

In today’s e-commerce world, offering payment flexibility is no longer optional – it’s essential for success. Customers expect seamless and personalised payment experiences, and businesses that can deliver on these expectations will stand out in a crowded market. Payop is here to help your business thrive by offering over 500 payment methods and 100 currencies at checkout.

Whether you’re expanding globally or aiming to simplify checkout for your local customers, Payop’s secure and diverse solutions ensure everyone can pay their way.

Contact us at sales@payop.com to learn more.