Top payment options for video gaming in 2025

Payment service provider vs. payment gateway: Which do you need?

Pay by Bank vs. Credit cards: Which is better for business?

Your guide for Payop’s WooCommerce plugin integration

Unlocking growth in Africa: Local payment trends and methods

How payment UX can make or break your e-commerce store

How payment UX can make or break your e-commerce store

Your e-commerce store’s checkout experience is the final step before converting a visitor into a paying customer. But here’s the catch – if that payment process is frustrating, slow, or confusing, many customers will simply walk away.

A poor payment user experience (UX) can lead to abandoned carts, lost revenue, and a damaged brand reputation. On the other hand, a seamless, intuitive payment flow builds trust, increases conversions, and enhances customer satisfaction.

So, how do you ensure your payment UX works for you, not against you? Let’s dive into the key factors that can make or break your e-commerce store’s checkout experience.

Why does payment UX matter in e-commerce?

Imagine a customer who’s excited about their purchase. They’ve added items to their cart, proceeded to checkout, and then…

- They’re forced to create an account before paying.

- The checkout page loads slowly or isn’t mobile-friendly.

- Their preferred payment method isn’t available.

- They get an error message with no clear fix.

What do they do? Leave.

In fact, 22% of online shoppers abandon their carts, because of the complicated checkout process.

A well-optimized payment UX minimises these frustrations, making the payment process effortless and encouraging customers to complete their purchase.

7 key factors that impact payment UX

Let’s explore the key elements of a great payment UX and what you can do to improve yours.

Speed and simplicity

Customers want to check out quickly and effortlessly. If they have to take too many actions, they’ll likely abandon their carts.

???? How to optimize speed and simplicity:

- Offer guest checkout – forcing account creation drives away 26% of customers, especially first-time buyers.

- Use auto-fill and stored payment details – save customers the hassle of typing in details repeatedly.

- Keep forms short and sweet – only ask for essential information.

- Provide a progress indicator – so users know how many steps remain.

Pro tip: One-click payments (like Amazon’s one-click purchase) significantly improve conversion rates.

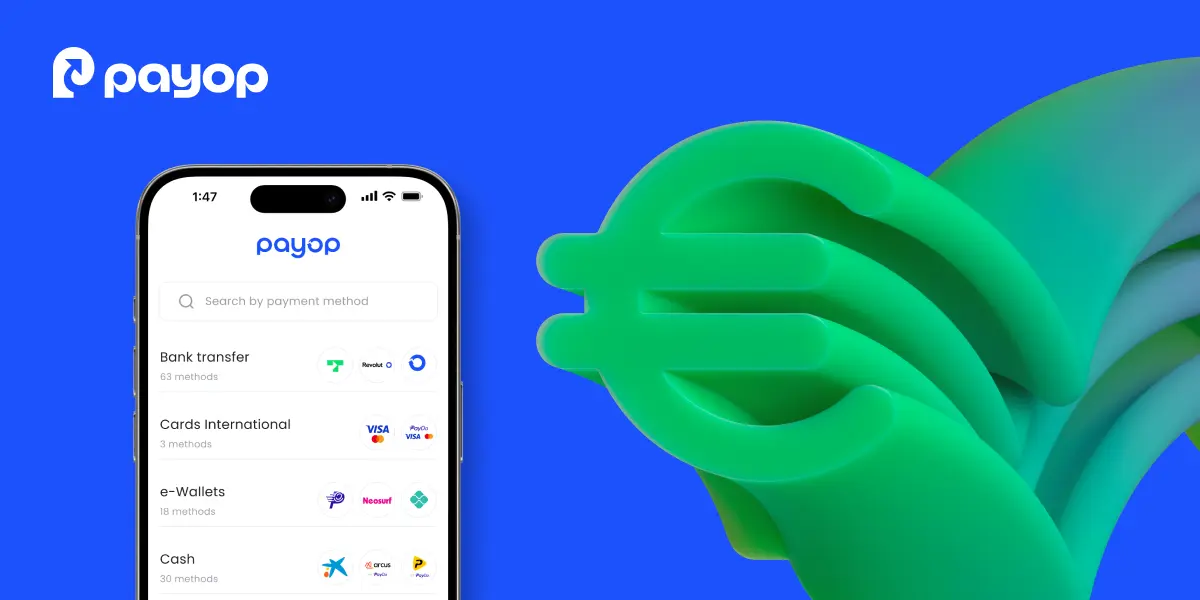

Offer multiple payment options

Not every customer prefers the same payment method. Some love digital wallets, others prefer cash-based methods, and in some countries, super apps dominate the market.

???? Consider adding the following payment options:

- Digital wallets – Convenient and mobile-friendly, perfect for younger audience.

- Pay by Bank – Allows the customer to pay directly from their banking app. Ticks all the boxes: convenient, secure and fast.

- Buy Now, Pay Later (BNPL) – Popular among younger shoppers for flexible spending. Allows you to increase the average order value.

- Cryptocurrency payments – Growing in popularity for certain niches, especially among tech-savvy buyers.

- Local payment methods – A must-have for international expansion. Customers want to pay with OXXO in Mexico and with EPS in Austria.

Learn how payment flexibility drives customer loyalty in e-commerce.

Mobile optimisation

With over 56% of online transactions happening on mobile devices, your checkout must be seamless on smartphones. If your payment process isn’t mobile-friendly, you’re losing sales.

???? How to optimise for mobile:

- Make forms easy to tap and fill – larger buttons, autofill, and fewer fields.

- Ensure your checkout loads fast – slow pages kill conversions.

- Use responsive design – buttons and text should adjust smoothly on any screen.

- Implement mobile wallets and Pay by Bank for easy payments.

- Make forms easy to tap and fill – larger buttons, autofill, and fewer fields.

Trust and security

No one wants to risk their personal data on an untrustworthy website. If customers don’t feel safe, they won’t complete the payment.

???? How to build trust:

- Display SSL certificates and security badges.

- Offer secure payment gateways that customers recognise.

- Clearly state refund and return policies – transparent policies reassure buyers.

- Send instant payment confirmation emails – so customers know their transaction was successful.

Error handling and instant feedback

Few things are more annoying than vague error messages at checkout. Customers need clear, helpful guidance on what to do next if a payment fails.

???? How to optimise error handling:

- Show errors in real-time, for example, “Invalid card number” before submission.

- Provide clear explanations, such as “Card expired – please enter a new one”.

- Don’t reset fields after errors – let users correct the mistake without starting over.

- Offer alternative payment options if one method fails.

Localised checkout experience

If you sell internationally, your payment UX should adapt to different regions. What works in one country might not work in another.

???? How to localise your checkout:

- Show prices in local currency – no one likes surprise currency conversions.

- Provide local payment methods – for example, Latin America prefers digital wallets and cash-based methods over cards.

- Offer translated checkout pages for non-English speakers.

Post payment experience

A smooth payment process doesn’t stop after checkout. The post-payment experience keeps customers happy and builds loyalty.

???? How to enhance post-payment UX:

- Send instant order confirmation via email or SMS.

- Offer an easy order tracking system.

- Provide fast and accessible customer support for payment-related issues.

The cost of lousy payment UX

So what happens if you ignore the payment user experience?

- Lost sales – Confusing checkout = higher cart abandonment rates.

- Negative brand perception – Customers won’t return to a frustrating store.

- Lower conversion rates – Even minor UX issues can cause significant revenue losses.

On the other side, a well-optimised payment experience can increase conversions by 35% or more.

How Payop can help improve your payment UX?

Selecting the right payment service provider that meets your needs can be tricky. At Payop, we achieve just that.

- Personalised, user-friendly payment experience

- Support for 500+ payment methods worldwide

- Secure, localised, and mobile-optimised payments

- Advanced anti-fraud tools to protect transactions

By prioritising payment UX, you create a smooth and secure checkout process that reduces friction, builds trust, and drives sales.

Final thought: A great product is not enough if customers struggle to pay for it. Make your payment UX flawless, and watch your business grow.