How the right payment methods can boost customer retention

- Types of payment methods for online payments

- Why payment methods matter for customer retention

- Convenience is a King

- Trust and security build loyalty

- Faster transaction – increased satisfaction

- Personalised payment options drive engagement

- Localisation – a must for global businesses

- Strategies to enhance retention through payment methods

Not all business owners think about it, but how your customers pay for what they buy – the payment methods you offer – can make or break their loyalty. A smooth and convenient payment experience builds trust and satisfaction, while a frustrating one can drive customers straight to your competitors. Let’s dive into why payment methods matter and how they boost customer retention.

Types of payment methods for online payments

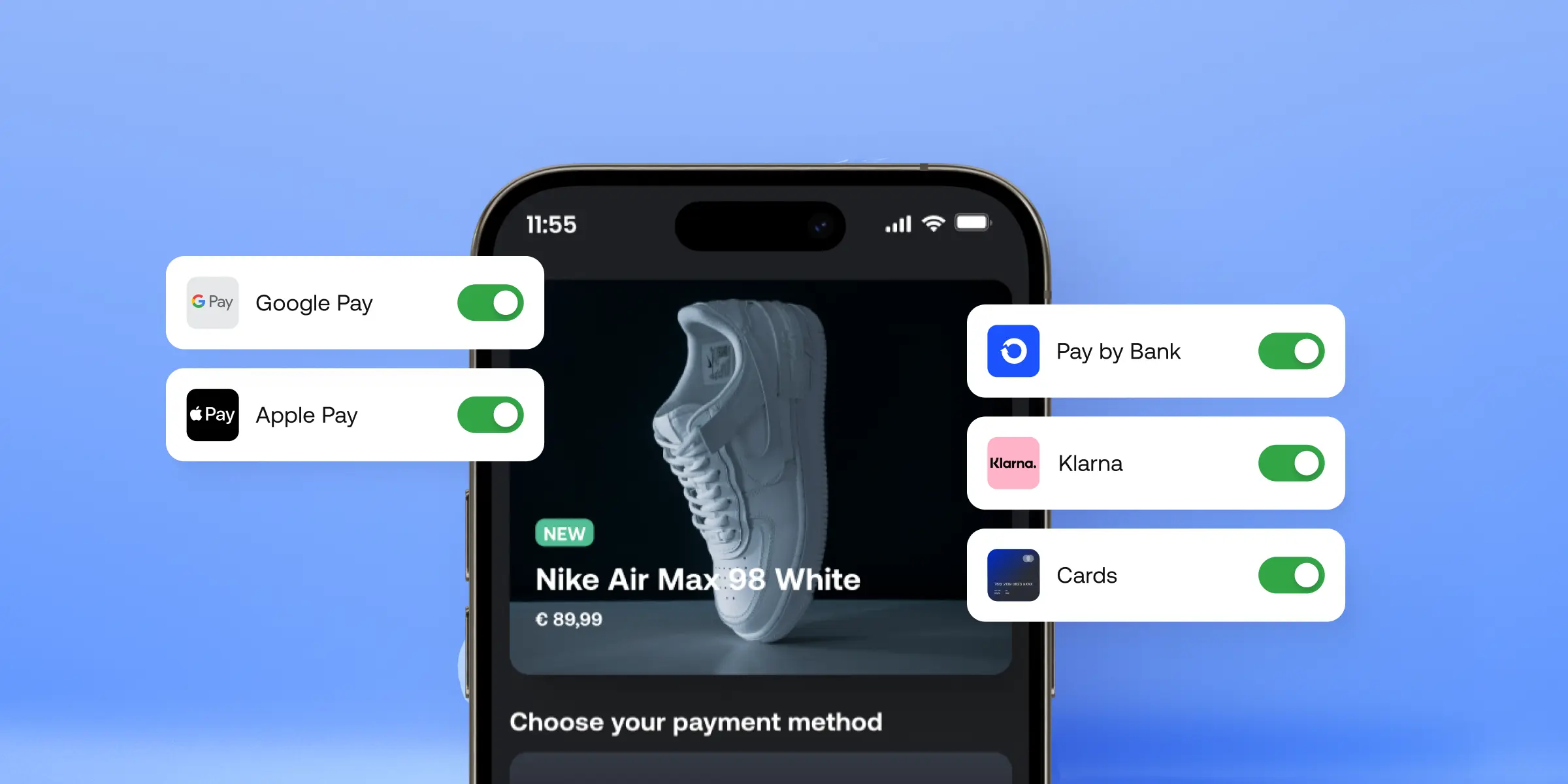

Offering various payment options isn’t just a nice-to-have; it’s a must-have for meeting diverse customer preferences. Here are some of the most popular online payment methods:

- Credit and debit cards

- Universally accepted and convenient for most shoppers.

- Features like 3D Secure provide extra security.

- Digital wallets

- Think Apple Pay, Google Pay, and PayPal.

- Loved for their speed and one-click convenience, especially on mobile.

- Bank transfers

- Instant bank transfers or real-time payment systems (like SEPA in Europe) are secure and reliable.

- Often preferred for pricier purchases.

- Buy Now, Pay Later (BNPL)

- Services like Klarna and Afterpay let customers pay in installments.

- A hit with younger shoppers and for expensive items.

- Cryptocurrency

- A growing option for tech-savvy customers.

- Offers fast, decentralised transactions, though it’s still niche.

- Mobile carrier billing

- Allows customers to pay via their phone bill.

- Perfect for digital goods and microtransactions, especially in gaming.

- Localised payment methods

- Regional favourites like Alipay and WeChat Pay in China or Boleto in Brazil cater to local audiences.

Why payment methods matter for customer retention

Payment methods aren’t just about completing a transaction; they’re a critical touchpoint that shapes how customers feel about your brand. A smooth, secure, and versatile payment experience shows customers you value their time and trust. So, here’s a closer look at how payment methods influence loyalty.

Convenience is a King

Imagine this: You’re ready to check out, but your preferred payment method isn’t available. Frustrating, right? That’s exactly what you don’t want your customers to experience. Offering fast, user-friendly, and widely accessible payment options removes barriers to purchase.

Tips:

- Mobile wallets let customers check out in seconds.

- Localized options ensure global customers aren’t left out.

When customers know they can always pay their way, they’ll keep coming back.

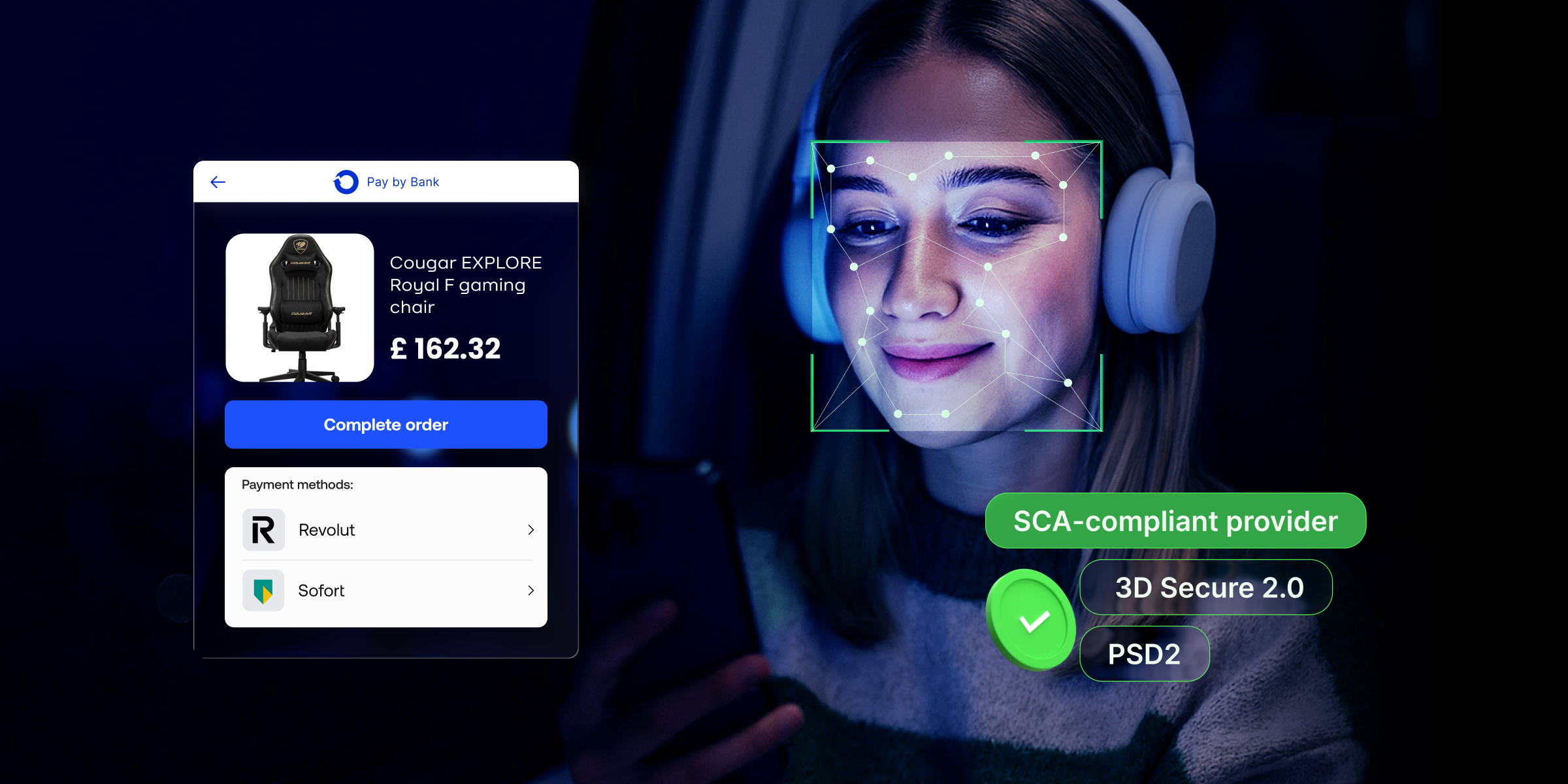

Trust and security build loyalty

Security matters a lot. Nobody wants to worry about their personal or financial information being compromised. Offering payment methods known for robust security reassures customers, helping them feel safe whenever they buy.

Tips:

- Two-factor authentication (2FA) for card payments adds an extra layer of protection.

- Trusted payment service providers show customers you’re serious about safeguarding their data.

When customers trust you with their money, they’re more likely to stick around.

Learn more about how to protect your customers from fraud.

Faster transaction – increased satisfaction

Time is precious. A slow or buggy payment process can turn an excited customer into a frustrated one. On the other hand, fast payment options like BNPL or instant bank transfers show you value their time.

Think about it: The quicker they can complete their purchase, the happier they’ll be.

Learn about instant payments in Europe.

Personalised payment options drive engagement

People love feeling understood. Offering payment methods that suit your audience’s unique needs makes them feel valued.

Tips:

- Subscription services thrive with recurring billing solutions.

- Gamers appreciate in-app purchases or mobile carrier billing.

By tailoring payment options to your customers, you create a sense of connection that keeps them coming back. With Payop’s checkout, your customers get a personalised selection of methods based on their purchase history, location and language.

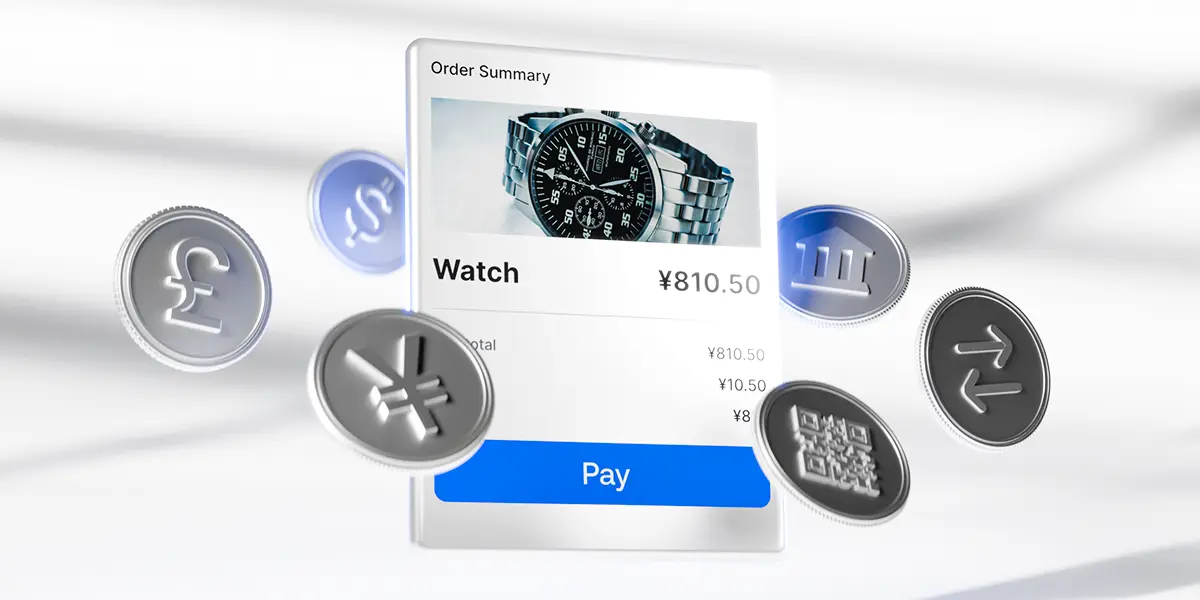

Localisation – a must for global businesses

Going global? Then, you need to think local. Customers in different regions often have unique payment preferences. Catering to these preferences signals respect for their needs.

Tips:

- In Europe, SEPA Direct Debit is a top choice.

- In Asia, Alipay and WeChat Pay dominate.

If you meet buyers’ preferences, you’re more likely to earn their loyalty. Payop’s team can help you with that. With over five years of experience, we know your industry and your customers.

Strategies to enhance retention through payment methods

Providing the right payment methods is a simple way to improve customers’ checkout experience and boost your conversion. Here’s what you can do:

- Diversify payment options: Regularly update your offerings to match evolving customer needs.

- Optimise mobile payments: With mobile shopping on the rise, ensure your payment methods are mobile-friendly.

- Regularly update security measures: Stay ahead of threats by enhancing fraud detection and tokenization.

- Offer transparent policies: Clear refund and chargeback policies build trust.

- Gather customer feedback: Listen to your customers and adapt based on their preferences.

Final thoughts

Payment methods aren’t just a step in the checkout process; they’re a powerful tool to build loyalty and trust. With Payop, businesses can provide a seamless, secure, and diverse payment experience tailored to customer needs. From localised options to cutting-edge solutions like Pay by Bank, Payop helps you keep your customers happy and coming back for more.

Contact us at sales@payop.com for individual consultation.