Top payment options for video gaming in 2025

Payment service provider vs. payment gateway: Which do you need?

Pay by Bank vs. Credit cards: Which is better for business?

Your guide for Payop’s WooCommerce plugin integration

Unlocking growth in Africa: Local payment trends and methods

How payment UX can make or break your e-commerce store

How to accept international payments: Guide for your business

Expanding your business to global markets is a huge step forward—but to succeed internationally, you need a smooth, secure, and accessible way to accept payments worldwide. Customers expect to pay in their preferred currency and method. If they can’t, they might abandon the purchase entirely.

This guide explains how to accept international payments and what to consider when choosing the right payment solutions for your business.

Difference between international and domestic payments

At first glance, international and domestic payments may seem similar – they both involve customers sending money for goods or services. However, under the surface, international payments come with additional layers of complexity that businesses must understand and plan for.

Here’s how they differ:

1. Currency and conversion

- Domestic: Payments are made in the same currency, so no conversion is required.

- International: Involves different currencies, which means you’ll need to deal with exchange rates. This also introduces currency conversion fees and the need for real-time FX handling or settlement in multiple currencies.

2. Banking infrastructure

- Domestic: Transactions typically go through local clearing systems, which are fast and low-cost.

- International: Payments often go through global networks, which are slower, more expensive, and may involve intermediary banks that take a cut of the transaction.

3. Regulatory compliance

- Domestic: Compliance focuses on national financial and data protection laws.

- International: You must comply with multiple sets of regulations, such as GDPR for European customers, tax collection rules like VAT or GST, and local financial licensing or consumer protection laws.

4. Fees and settlement times

- Domestic: Typically low fees and quick settlements – often same-day or next-day.

- International: Higher transaction costs, especially for cross-border card payments, and longer settlement times (sometimes 2–5 business days, depending on the method and region).

How to prepare your business to accept international payments

Let’s go through everything you need to know to start accepting international payments – and do it correctly.

Understand your target markets

Starting with the basics. Take time to understand where your customers are and how they prefer to pay.

- Research preferred payment methods: Credit cards might dominate in North America, but many prefer SEPA or SOFORT in Germany. In Brazil, PIX is a top choice, while Alipay and WeChat Pay are essential in China.

- Understand local currencies: Customers want to see prices in their native currency. Displaying costs in EUR to a shopper in India or Japan can lead to cart abandonment.

- Know cultural preferences: Some markets prioritise trust and may be more comfortable with cash-on-delivery or bank transfers, while others expect instant, mobile-friendly options.

Taking time to localise your offering ensures higher conversion rates and happier customers.

Choose the right payment service provider

Your payment service provider (PSP) is the backbone of your cross-border payment strategy. Keep in mind that not all PSPs are equipped to handle global needs.

Look for a provider that offers:

- Broad geographical coverage: The more countries and regions supported, the better your expansion potential.

- Multiple currencies: Ensure the PSP can process and settle payments in the currencies relevant to your market.

- Local payment methods: Choose a PSP that supports various local and international options, like bank transfers, QR payments, and mobile wallets.

- Risk and fraud management: International transactions are more prone to fraud. A good PSP should offer robust fraud detection and chargeback protection.

- Seamless integrations: Whether you use Shopify, WooCommerce, or a custom site, your provider should integrate easily with your system.

Choosing the right PSP ensures your business can scale efficiently, stay compliant across regions, and deliver a seamless payment experience to customers worldwide.

Offer a variety of payment methods

Customers trust what they know. A European shopper might reach for SEPA, while someone in Southeast Asia might prefer GrabPay or GCash. Offering limited options means turning away potential buyers.

You should aim to support not just basic cards but also:

- Digital wallets allow users to store payment details securely and pay with a single tap, offering speed, convenience, and built-in authentication.

- Bank transfers include traditional and instant payment methods such as SEPA in Europe, SWIFT globally, or local instant schemes like PIX in Brazil or UPI in India.

- QR code payments: Popular in Asia, these allow customers to scan a code using their mobile wallet to pay instantly – ideal for mobile-first markets with high smartphone penetration.

- Buy Now, Pay Later (BNPL): Services like Klarna let customers split purchases into instalments, making them appealing to younger payers and boosting average order value.

- Cryptocurrencies: Adoption varies but is growing, especially in regions with currency volatility or limited banking access.

By offering multiple ways to pay, you reduce friction and make it easier for anyone to complete a transaction.

Enable multi-currency checkout

Imagine seeing a product priced in a foreign currency, unsure of how much you’ll be charged once exchange rates and fees are added. That confusion leads to distrust – and often, lost sales.

Offering a multi-currency checkout helps:

- Boost conversion: Customers feel more comfortable seeing prices in their currency.

- Minimise currency conversion fees: If your PSP offers competitive exchange rates and settles in local currencies, you can reduce unnecessary costs for your business and customers.

Many PSPs offer dynamic currency conversion or the ability to settle in multiple currencies – choose what works best for your business model.

Optimise your checkout page

A localised and user-friendly checkout page can make or break your international sales.

Here’s what to focus on:

- Language and localisation: Your checkout should automatically adapt to the customer’s language and region.

- Mobile optimisation: In many markets, mobile commerce dominates. Make sure your checkout works flawlessly on phones and tablets.

- Minimal steps: Don’t overload your customers with forms. Keep it simple – name, shipping info, payment method.

- Clear fees and delivery details: Be transparent about added costs, like shipping, VAT, or exchange fees.

An easy checkout leads to fewer abandoned carts and happier international customers.

Know the fees involved

Processing international payments comes with additional costs. Understanding these helps you price your products appropriately and protect your profit.

Watch out for:

- Cross-border fees: Charged when the buyer’s card is issued in a different country than your merchant account.

- Currency conversion fees: These can be hidden or inflated if not managed transparently.

- Processing fees can differ depending on the method; for example, a Pay by Bank transaction will cost you less than a card payment.

- Settlement fees: Some providers charge extra to settle payments in certain currencies.

Be sure to double-check for any hidden charges which providers may not advertise very clearly.

Ensure compliance and security

International payments come with various legal, financial, and data protection regulations. These are essential to avoid penalties and build trust with your customers.

You should comply with:

- PCI DSS: If you handle card payments, compliance is non-negotiable.

- GDPR or other data laws: If you’re targeting European customers, you must meet strict data privacy standards.

- Local tax regulations: Many countries require you to register for VAT/GST and collect tax at checkout.

Don’t forget about fraud prevention. International transactions carry higher risk, so work with a PSP that offers tools like 3D Secure, anti-fraud scoring, and tokenization.

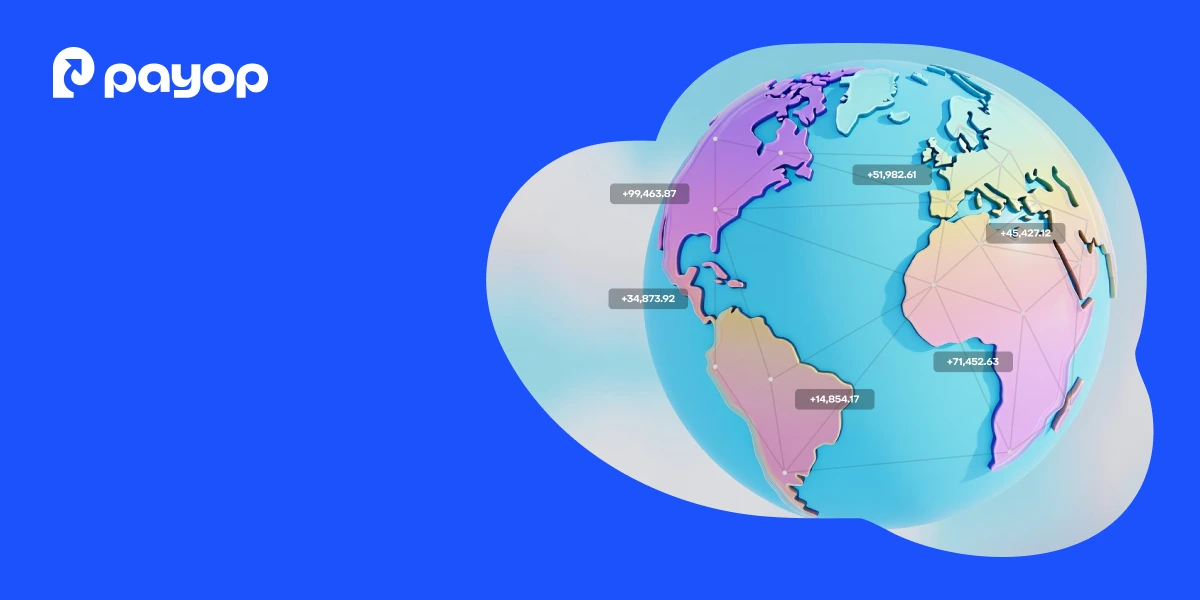

Set up international payments with Payop

Working with Payop, you get over 500 payment methods and 100 currencies that grant you access to 170 countries.

Whether you’re targeting established markets or emerging ones, Payop helps you localise the payment experience for every customer. With a single integration, you can offer local cards, digital wallets, bank transfers, QR payments, and more – backed by secure infrastructure, fast onboarding, and real-time analytics.

We offer a complete solution built for businesses ready to scale globally.