Gaming without cards: A look at Pay by Bank for in-game purchases

Are e-wallets enough? Building a diverse payment mix in emerging markets

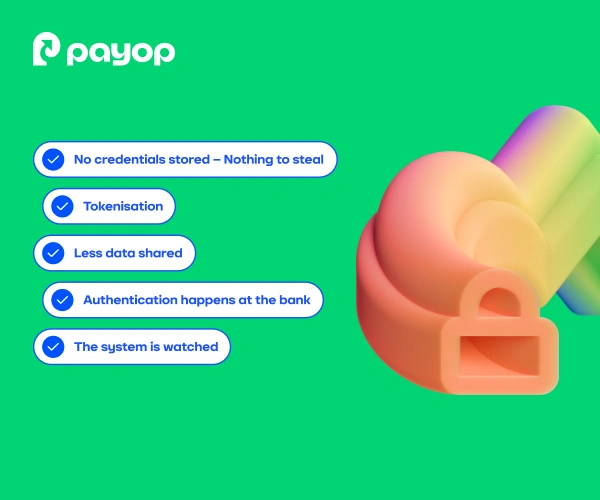

Secure by design: How open banking mitigates data breach impact

How to build a local payment strategy for global growth

Latin America’s digital wallet boom: What’s driving adoption in 2025

How to build a local payment strategy for global growth

Expanding your business globally isn’t just about translating your website or offering international shipping. It also means understanding how people pay in different countries and making it easy for them to do so. Without the right local payment strategy, you risk losing customers at the final, most crucial step – checkout.

In this article, we’ll explore how to build a local payment strategy that drives global growth and conversion.

Why local payment strategy matters

Consumers are 10% more likely to complete a purchase if they can use a payment method they know and trust.

If that’s not enough, consider the fact that in many emerging markets, millions of people lack access to traditional banking services, including credit cards and checking accounts. But they do have mobile phones and use alternative methods like digital wallets, QR codes, or cash-to-digital payment networks. By offering local payment options, you’re not just increasing your revenue; you’re giving more people the ability to participate in the digital economy.

So, a strong local payment strategy helps you:

- Increase conversion rates

- Build customer trust

- Reduce cart abandonment

- Stay compliant with local regulations

- Compete more effectively with local players

- Promote inclusion by reaching unbanked or underbanked customers

Keep reading to learn how to achieve all of it.

Step 1: Research payment preferences by market

Start by identifying the most popular payment methods in each region. While Visa and Mastercard may dominate in North America, you’ll see very different preferences elsewhere:

- Germany: Bank transfers like Sofort or Giropay

- Brazil: Boleto Bancário and Pix

- India: UPI and mobile wallets

- Netherlands: iDEAL

- Mexico: OXXO

That’s just a couple of examples that say: don’t just look at what’s available, look at what’s trusted. Cultural familiarity is key.

Step 2: Localise the checkout experience

Even if your website is translated into a local language, a generic checkout can break the flow. Make sure your checkout:

- Displays local currencies

- Offers familiar payment methods based on the shopper’s IP or language

- Minimises form fields (no unnecessary postal codes or phone formats)

- Clearly communicates fees, taxes, or exchange rates

The payment process should be swift and intuitive, allowing the payer to complete it without a second thought.

Step 3: Partner with the right payment service provider (PSP)

You need a PSP that supports the payment methods your target regions rely on. A global PSP with strong local coverage can help you:

- Offer a wide choice of local payment methods

- Navigate local regulatory requirements

- Settle funds in your preferred currency

- Reduce cross-border transaction fees

What to look for:

- Transparent pricing

- High acceptance rates

- Fast onboarding

- Advanced reporting and analytics

- Real human support

Step 4: Optimise for mobile payments

In many emerging markets, mobile payments are the default way to shop and pay. In Africa, Latin America, and Southeast Asia, mobile wallets and QR code payments are growing at a faster rate than any other method.

Make sure your local payment strategy includes:

- Mobile-optimised checkout

- Support for local mobile wallets, like M-Pesa, GCash

- Fast loading times even on slow connections

The payment UX should be just as smooth on an old smartphone as on the latest iPhone.

Step 5: Understand local compliance and tax rules

Payment regulations vary significantly across regions, and getting them wrong can result in fines, payment rejections, or even being blocked from a market.

What to consider:

- KYC/AML rules: Know Your Customer and Anti-Money Laundering regulations vary by country

- Tax obligations: Understand VAT, GST, or other digital service taxes

- Data privacy laws: Ensure compliance with rules like GDPR, LGPD, or India’s DPDP Act

To save yourself some trouble, work with a PSP that stays on top of these requirements and shields you from risk.

Step 6: Monitor performance and iterate

Once you’re live with local payment options, keep a close eye on:

- Conversion rates by payment method

- Drop-offs during checkout

- Fraud rates per region

- Customer feedback on payment issues

Use this data to adjust your strategy, drop underperforming methods, and prioritise high-converting ones.

Real-time analytics can help you act quickly and keep revenue on track.

How Payop helps you go local, globally

At Payop, we make it easy to go local in any market. Our platform provides access to over 500 payment methods, including local cards, e-wallets, bank transfers, and instant payments, through a single integration.

Whether you’re targeting customers in Southeast Asia, Latin America, Africa, or Europe, Payop ensures your checkout supports their preferred payment methods. We also offer:

- Fast onboarding and no setup fees

- Real-time dashboard for managing payments

- Transparent pricing

- Support of a dedicated manager

- Payout solutions for global partners

Want to build a truly local strategy that scales? With Payop, you’re ready for global growth.