How to choose the right payment provider for your e-commerce business

Running an e-commerce business means handling transactions seamlessly, securely, and efficiently. This is where a payment service provider (PSP) comes in. But with so many options on the market, how do you pick the right one? Let’s walk through the key steps to help you choose the ideal PSP for your business.

What is a payment service provider?

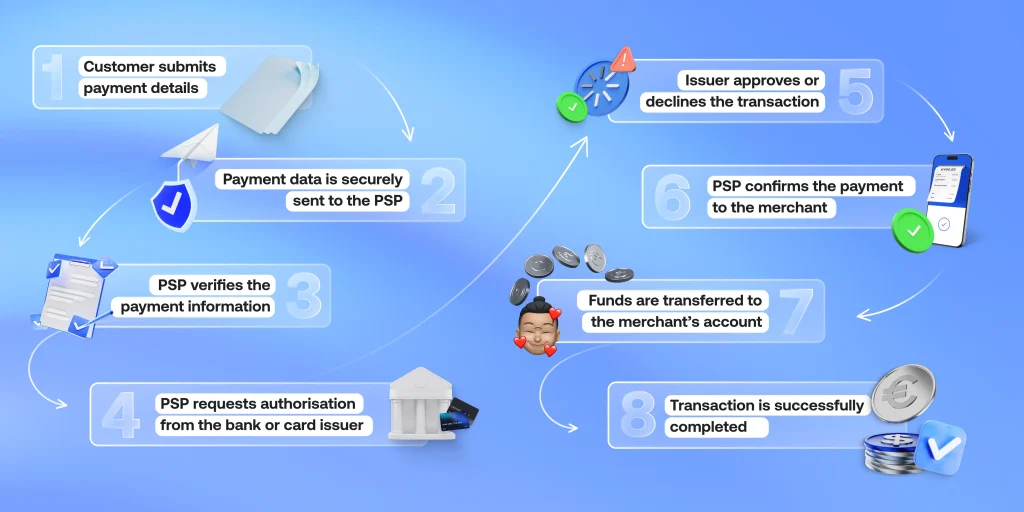

A payment service provider facilitates online payments by allowing your website to accept various payment options, including credit cards, debit cards, bank transfers, digital wallets, and other alternative methods. PSPs provide a unified platform that processes these payments and securely transfers funds to your business account.

Unlike traditional payment processors, PSPs offer value-added services such as multi-currency support, fraud detection, and integration with various e-commerce platforms.

How to choose a PSP for your e-commerce business?

Here’s a list of key aspects to consider before making a decision:

1. Understand your business needs

Before going into the specifics of various PSPs, assess your business’s unique requirements. Ask yourself:

- How many transactions do you handle daily or monthly?

- Do you serve international customers, and if so, in which regions?

- Do you offer one-time purchases, subscriptions, or a mix?

- Are you selling physical goods, digital products, or services?

By understanding these needs, you’ll be better equipped to select a PSP that matches your transaction volume, customer demographics, and e-commerce payment method preferences.

2. Prioritise security and compliance

When it comes to handling payments, security is everything. Make sure the PSP you choose complies with industry security standards, such as PCI DSS (Payment Card Industry Data Security Standard). The safety of customer payment data is essential for avoiding costly breaches and maintaining customer trust.

Look for the following features:

- Encryption and tokenization to protect sensitive data.

- Fraud prevention tools to monitor and flag suspicious transactions.

- Secure authentication like 3D Secure, which adds an extra layer of protection during checkout.

PSPs must also comply with any local laws and regulations in the regions where you do or plan to do business.

3. Compare fees

The cost of processing payments can eat significantly into your profits. Different providers come with different pricing models. Some charge only for transactions, while others have all sorts of hidden charges for onboarding and new methods integration. The standard fees are:

- Transaction commission – the percentage of each payment processed.

- Monthly fees – payment for account maintenance.

- Refund and chargeback fees.

Make sure the PSP’s pricing aligns with your sales volumes and business model.

Processing with Payop, you don’t have any hidden fees and pay only for successful transactions.

4. Secure multiple payment options

Customers expect flexibility at checkout. Providing them with various payment methods can help reduce cart abandonment by 13%. Ensure PSP supports:

- Credit and debit cards

- Digital wallets

- Bank transfers

- Alternative methods

- Cryptocurrency

A good PSP will also enable you to accept payments from anywhere in the world, making it easier to expand your business internationally. So, check that the PSP supports local payment methods for customers in different regions.

With Payop, you can access over 500 local and international payment methods, allowing you to reach different customer groups worldwide.

5. Easy integration

A PSP should integrate smoothly with your system, whether you’re using some platforms, like WooCommerce, or a custom-built site. Easy integration ensures a hassle-free setup and minimises technical challenges.

Payop offers three integration options:

- Our reliable API lets you connect all methods simultaneously and within one contract.

- Plugins for WooCommerce and OpenCart.

- Integration partners like Praxis and Payment IQ (PIQ).

6. Support for international payments

If you’re selling globally, choose a PSP that supports multi-currency payments and provides competitive exchange rates. International payments may come with extra fees, so be sure to select a provider that minimises these costs. The ability to process payments in a customer’s local currency will enhance the shopping experience and build trust.

7. Strong customer service

Even the best PSP can experience technical issues, disputes, or fraud incidents. When these occur, reliable customer support can make all the difference. Choose a PSP that offers:

- Dedicated account manager support.

- A comprehensive help centre or knowledge base for troubleshooting common issues.

- Fast and efficient dispute resolution services.

A responsive support team can help resolve issues quickly, minimising potential revenue loss from downtime or disputes.

8. Future-proof your business

As e-commerce trends shift, your payment processing needs will change. Opt for a PSP that can grow with your business. Ensure the provider can handle increased transaction volumes and support new emerging methods.

Consider PSPs at the forefront of innovation, developing their solutions and implementing modern security features.

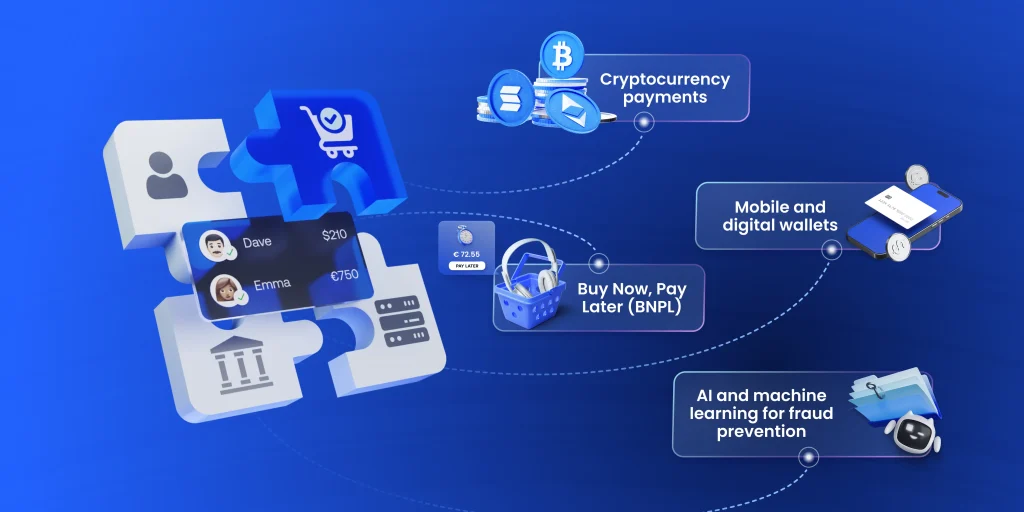

Payment trend in the e-commerce industry

The world of e-commerce payments is evolving fast, and staying on top of these trends will help you offer a better customer experience:

- Mobile and digital wallets: Customers are increasingly using digital wallets for faster, more secure payments on their smartphones.

- Buy Now, Pay Later (BNPL) services are gaining popularity, especially among younger consumers. Offering them can reduce cart abandonment and increase average order value.

- Cryptocurrency payments: Offering to pay with cryptocurrencies like Bitcoin and Ethereum allows you to cater to tech-savvy customers.

- AI and machine learning for fraud prevention: Payment processors are leveraging artificial intelligence to detect and prevent fraud in real time. As fraud tactics become more sophisticated, investing in a processor with advanced AI capabilities can protect your business from financial loss.

Learn about payment trends in the emerging markets.

Conclusion

Choosing the right payment provider can make or break your e-commerce business. With Payop, you get a payment partner that covers all the essentials – advanced security, support for multiple payment methods, and easy integration with your platform.

Whether you’re expanding to new markets or scaling up, Payop offers multi-currency support, competitive fees, and dedicated customer service to keep your business running smoothly.

Contact us at sales@payop.com to get started.