How your business can accept cryptocurrency payments

As cryptocurrencies like Bitcoin and stablecoins gain popularity, businesses across industries are eyeing them as a way to broaden customer reach, lower transaction costs, and stay ahead of the competition. Here’s everything you need to know to make cryptocurrency payments work for your business.

What are cryptocurrency payments?

Put simply, cryptocurrency payments allow your customers to pay with digital currency like Bitcoin, Ethereum, or stablecoins*. Instead of involving banks, these transactions happen on secure, decentralised networks known as blockchains.

Unlike traditional transactions, crypto payments are fast, direct, and usually cost much less – a win-win for businesses and customers.

*Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, like the US dollar or other fiat currencies.

Why should businesses consider cryptocurrency payments?

Crypto isn’t just for tech enthusiasts anymore. Here’s why more and more businesses are saying yes to digital currency:

- Low fees: Traditional payment processors can charge around 2-4%. By contrast, many crypto transactions are cheaper, especially for international purchases.

- Fast and global: Crypto payments are processed in minutes, not days, and international transactions have no extra fees or exchange rates.

- Attracting new customers: Many millennials and Gen Z shoppers are already comfortable with crypto. Accepting it can make your business a magnet for these digital-savvy customers.

- Increased privacy and security: Crypto allows customers to pay without exposing sensitive information, offering them peace of mind and minimising fraud risk for you.

Which cryptocurrencies are popular for payments?

While there are thousands of cryptocurrencies, a few are popular for business transactions:

- Bitcoin (BTC): As the first and most recognised cryptocurrency, Bitcoin is widely accepted. However, transaction speed and fees can fluctuate.

- Ethereum (ETH): Known for its advanced technology, Ethereum is versatile but sometimes costly during high demand.

- Stablecoins (USDT, USDC): Pegged to traditional currencies like the US dollar, stablecoins provide price stability – perfect for businesses wary of crypto’s price swings.

- Litecoin (LTC) & Bitcoin Cash (BCH): Both offer faster transactions and lower fees than Bitcoin, making them solid choices for quick, affordable payments.

How to start accepting cryptocurrency payments

Launching crypto payments isn’t as complex as it sounds! Here’s how to get started:

- Pick a payment processor that supports crypto payments. With Payop, you can easily accept cryptocurrencies and use over 500 other payment methods.

- Get a digital wallet to store cryptocurrency. Choose between software wallets for easy access, hardware wallets for top security, or a custodial wallet from your payment processor.

- Add crypto to your payment methods. Let your customers know cryptocurrency payments are welcome. Display the option clearly on your website and checkout page.

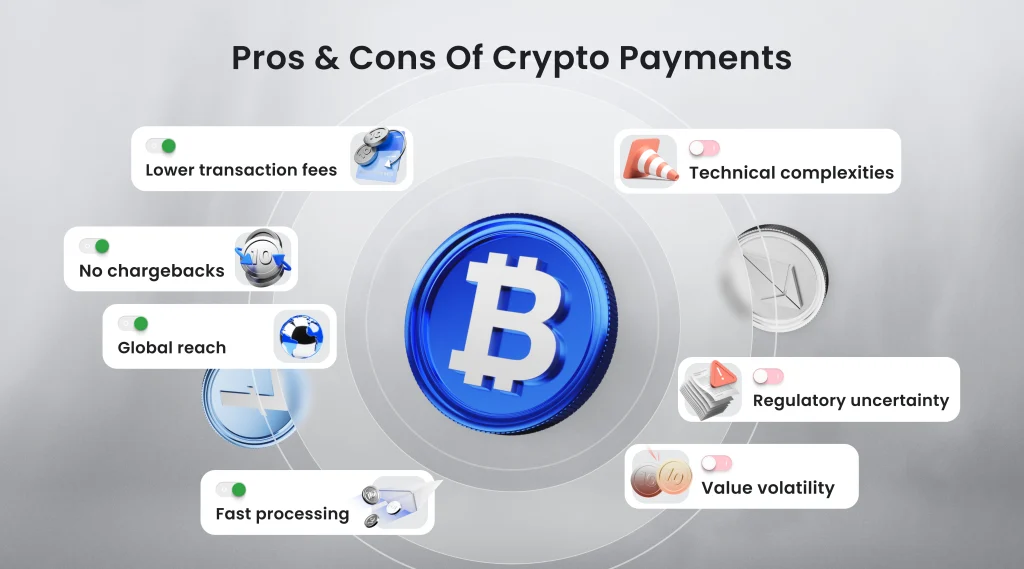

The pros and cons of accepting cryptocurrencies

While crypto offers exciting possibilities, it’s important to weigh both the upsides and downsides.

Now, let’s briefly address two main concerns regarding crypto payments.

One of the biggest issues with cryptocurrency is price volatility. However, stablecoins like USDT, pegged to fiat currencies, offer stability and predictability and are ideal for everyday transactions.

The second challenge is regulatory compliance. Some countries don’t have comprehensive regulations. Some countries do and treat cryptocurrencies as assets, meaning they may be subject to capital gains taxes. So, check local tax laws and consult a financial expert to ensure your crypto transactions are reported accurately.

Conclusion

Adding cryptocurrency to your payment options is a smart move to stay ahead of competitors, attract global customers and optimise transaction costs. With Payop’s crypto payments, your business can easily integrate digital currencies with minimal hassle and maximum security.

By partnering with Payop, you’re not just offering crypto – you’re enhancing customer convenience and future-proofing your business. Start today by contacting us at sales@Payop.com!