Instant payments in Europe: Guide for your business

In recent years, the landscape of financial transactions in Europe has undergone significant changes, driven by the rise of instant payment systems. For businesses, this evolution offers many opportunities and challenges, fundamentally transforming how they manage cash flow, conduct transactions, and engage with customers. So, does your business need instant payments in Europe?

What are instant payments?

Instant payments refer to electronic transactions processed and settled in real time, or near real time, 24/7. This system allows for the immediate transfer of funds between accounts, providing a level of convenience and efficiency previously unavailable.

The core technology of instant payments involves secure, real-time data transmission between banks and financial institutions, ensuring that funds are available to the recipient almost immediately after initiation.

Key features of instant payments in Europe include:

- Speed: Transactions are completed within seconds, significantly reducing the waiting period associated with traditional bank transfers.

- Availability: Instant payment services operate 24/7, including weekends and holidays, unlike traditional banking hours.

- Security: Advanced encryption and authentication measures protect the transaction data, minimising the risk of fraud.

- Transparency: Both the sender and recipient receive immediate confirmation of the transaction, providing clarity and reducing the chances of errors.

The adoption of instant payments in Europe

Europe has been at the forefront of implementing instant payment systems, driven by a combination of regulatory support, technological innovation, and market demand. The SEPA Instant Credit Transfer (SCT Inst) scheme, launched by the European Payments Council (EPC) in 2017, has been a cornerstone of this development. This scheme facilitates the transfer of up to 100,000 euros per transaction across participating banks in the SEPA region within seconds, available 24/7, all year round.

In February 2024, the European Parliament passed new legislation for the Single Euro Payments Area (SEPA) to make instant payments in euros available to all people and businesses holding a bank account in the EU as well as in Iceland, Norway and Liechtenstein. Its main points include:

- Instant credit transfers should be executed at any time, processed within 10 seconds, and the payer should receive an immediate receipt.

- If the payment is from a non-euro account, the amount should be converted to euros instantly.

- Payment service providers must implement robust and up-to-date fraud detection tools and prevent transfers to incorrect recipients.

- PSPs are also required to introduce additional measures against money laundering and terrorist financing.

- The cost of instant payments should not exceed that of traditional euro transactions.

- Non-euro EU countries will also implement these rules after a longer transition period.

Benefits of instant payments for businesses

The speed is the first advantage that comes to mind when you think about instant payments in Europe. But let’s break down in more detail what other benefits businesses get:

- Improved cash flow management: Instant payments enable businesses to receive funds almost immediately after a transaction, significantly enhancing liquidity. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that rely on steady cash flow to maintain operations and meet financial obligations.

- Enhanced customer experience: With instant payments, businesses can offer customers faster and more convenient payment options, resulting in higher customer satisfaction. This is especially advantageous in sectors such as e-commerce, where speedy transaction processing can be a crucial differentiator.

- Cost efficiency: By reducing the reliance on traditional payment methods that may involve higher fees and longer processing times, businesses can lower transaction costs. Instant payments also help minimise the need for intermediaries, which can further reduce expenses.

- Increased security: Instant payment systems are generally supported by robust security protocols, reducing the risk of fraud and ensuring the safe transfer of funds. This is crucial for maintaining customer trust and protecting sensitive financial information.

Challenges of implementing instant payments

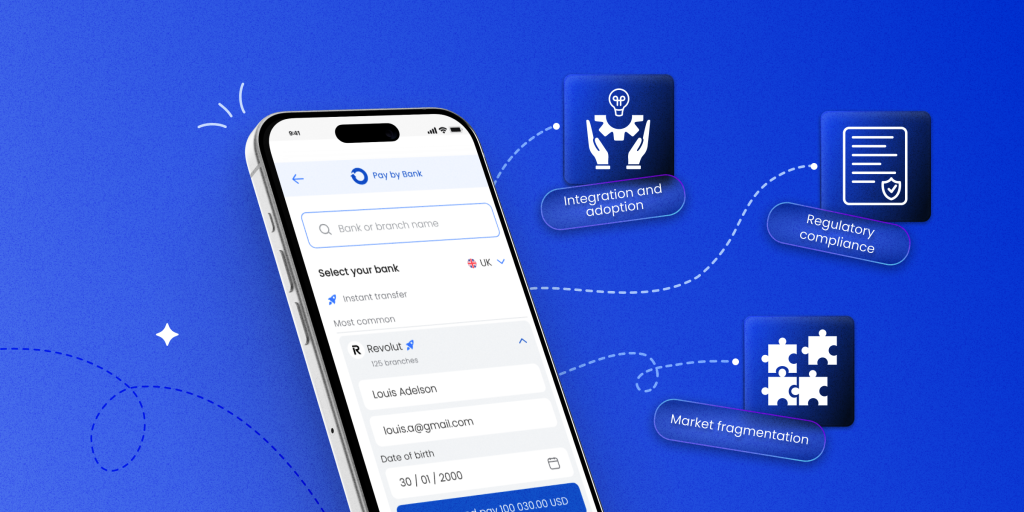

Despite the significant benefits of instant payments in Europe, this technology, like any other innovation, has its challenges:

- Integration and adoption: While the benefits of instant payments are clear, integrating these systems into existing financial infrastructure can be challenging, particularly for businesses with outdated systems. Ensuring smooth integration requires investment in technology.

- Regulatory compliance: Navigating the regulatory landscape is another critical aspect for businesses adopting instant payments. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, among others, is essential to avoid legal and financial repercussions.

- Market fragmentation: The adoption of instant payments varies across European countries, leading to a fragmented market. Businesses operating across borders may face challenges in ensuring consistent payment experiences for customers in different regions.

How to start accepting instant payments in Europe

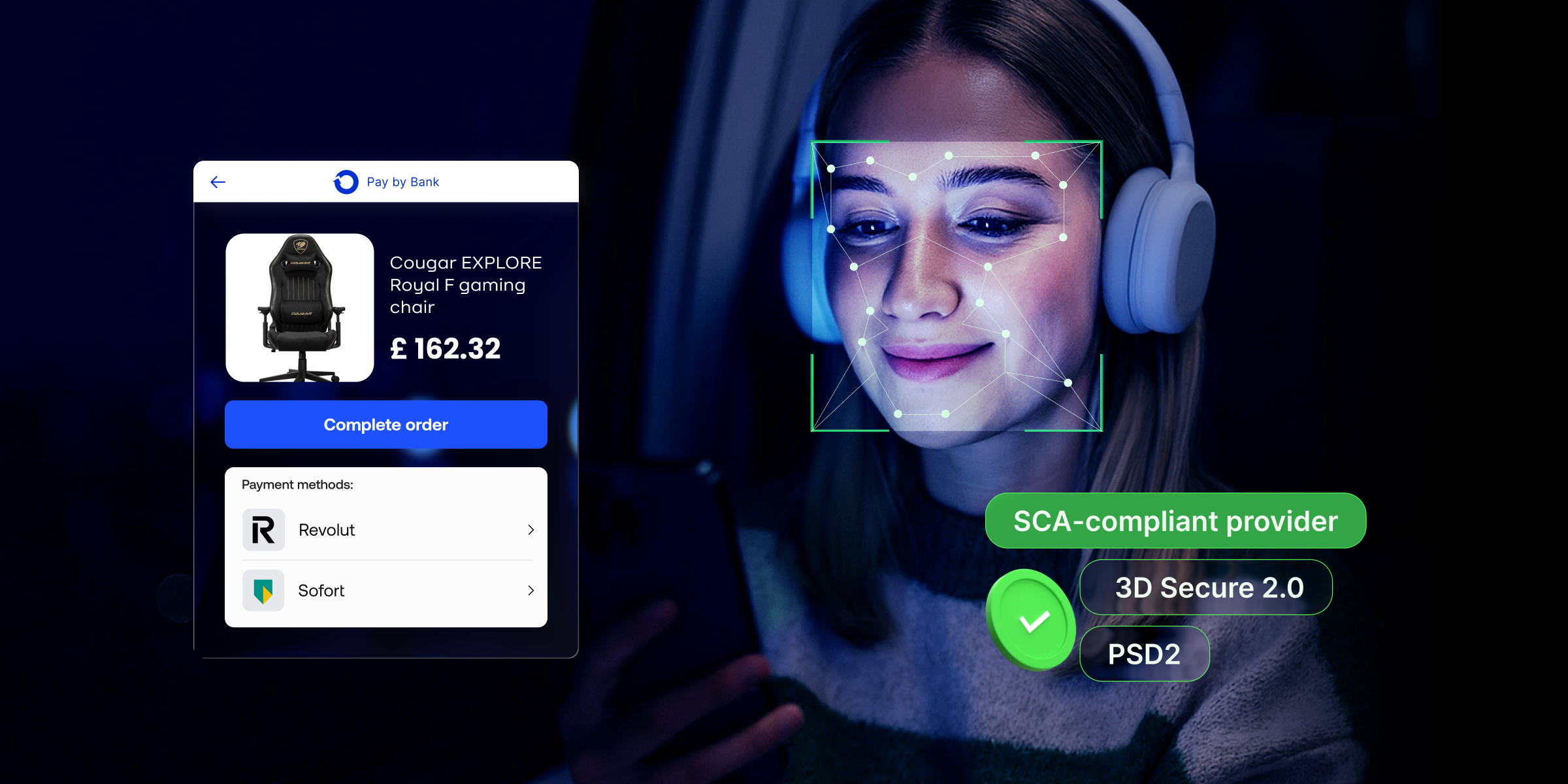

At Payop, we can help your business overcome the mentioned challenges and start using instant payments with our Pay by Bank solution. Available in 11 European countries, this payment method allows your customers to authorise purchases directly from their bank accounts.

What’s important is that your business doesn’t even need an EU bank account to use instant payments. Payop can accept money into its account and send you instant confirmations. Our Pay-by-Bank solution allows for real-time, secure transactions, ensuring that you and your customers can enjoy the benefits of instant payments without any complexities.

Contact our team at sales@Payop.com to learn more and get individual consultation.