Cross-border payments: Key challenges and solutions for 2025

Interview with Finance Team Lead Olena Polishchuk

Tips for improving the payment success rate for online businesses

Understanding chargeback fraud: How to protect your business

Interview with Finance Team Lead Olena Polishchuk

In this interview, Olena Polishchuk, Payop’s Finance Team Lead, shares how the company is staying ahead in the fast-changing payments world. She discusses how Payop tackles complex regulations and meets the growing demand for global payment solutions. Olena also offers insights into emerging trends and what the future holds for the payments landscape.

Question: Can you share your experience in the financial sector, and how it has shaped your approach as Payop’s Finance Team Lead?

Olena Polishchuk: My journey in finance began with analytics and evolved through roles in reporting, budgeting, cost management, auditing, and project implementation. Over the years, I’ve built effective teams with a focus on strategic thinking. Today, one of our key tasks at Payop is developing a financial strategy that aligns with our broader company goals – expanding our markets and customer base through innovation, customer satisfaction, compliance, and profitability.

Q: With evolving financial regulations, how does the finance team ensure Payop remains compliant?

O.P.: This is a great question, especially given our work as a global financial provider offering over 500 payment methods. The answer may seem simple: we comply with international standards and stay actively engaged with the latest developments. To do this, we stay in the relevant professional information space, constantly study our markets and monitor changes in local and international regulations, and operate in full compliance.

It’s also important that we collaborate closely with risk colleagues, lawyers, compliance, and both internal and external auditors to share experience and maintain best practices.

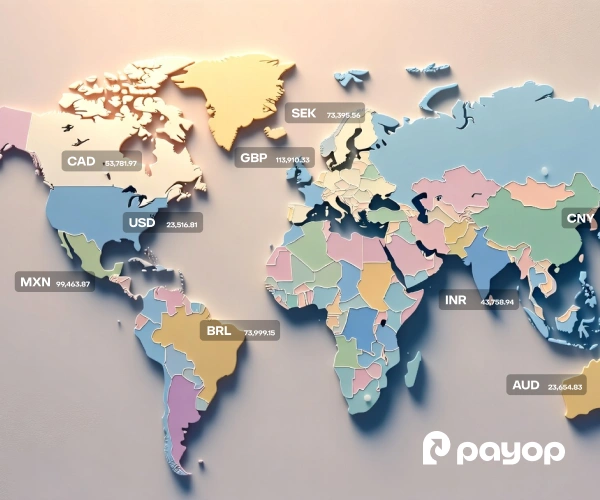

Q: E-commerce and a lot of other industries are going global. How is Payop reacting to the increasing demand for international online payments?

O.P.: Payop is addressing the increasing demand for international online payments by introducing local payment methods that meet customer needs and comply with local laws. We’re continuously developing and integrating solutions to enhance our payment infrastructure, ensuring convenient and secure transactions. These methods are tailored to the unique characteristics of different markets, enabling us to support merchants as they expand globally and tap into the growing e-commerce market.

Q: Are there any hidden fees in Payop?

O.P.: At Payop we are transparent about our fees. While some fees might not be immediately obvious, we make sure merchants are fully informed. For example, currency conversion fees apply if a transaction involves a currency exchange, and there can be fees for chargebacks or dispute resolutions.

We encourage merchants to read the terms and conditions for a detailed understanding of our fee structures, and our team is always available to provide clarity on specific costs.

Q: Does Payop provide financial reporting tools that help merchants analyze their overall financial performance?

O.P.: Yes, Payop provides access to various reports and transaction details through the Merchant Cabinet. Merchants can view their account balances and transaction histories, and we also offer customised reports upon request through their account manager. The reports available in the Merchant Cabinet cover up to 99.99% of the requests we receive from merchants.

Q: How do you see payment trends evolving in the next 3-5 years, and how will this impact merchants?

O.P.: I believe the trend toward convenience will continue driving the adoption of digital wallets and mobile payments over the next 3-5 years. These options are user-friendly and easy to adapt to. As are the contactless payments, that will continue to grow, especially with the changes brought on by the pandemic.

Plus, with the rise in acceptance of cryptocurrencies as legal tender more merchants will likely integrate these payment options. And with the popularity of subscription-based services that we can see now, managing recurring payments will become increasingly important.

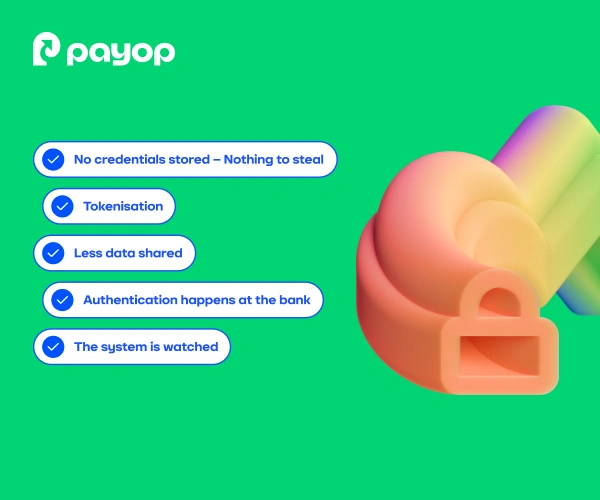

On the security front, financial institutions will need to respond to the he increasing number of digital transactions by implement even stronger fraud detection and cybersecurity measures to protect consumer data and build trust.

As e-commerce expands globally, cross-border payments will become even more important. The demand for multi-currency transactions and efficient international solutions will shape the future of payments.

At Payop, we’re excited to offer merchants the modern tools they need to manage their finances and provide convenience to their customers. We look forward to working with new merchants to seize these opportunities in the ever-evolving world of financial technology.