Marketplace payments: 9 things to look for when choosing a provider

- #1: Integration capabilities

- #2: Marketplace payment methods and currencies#2: Marketplace payment methods and currencies

- #3: Security and compliance

- #4: Payout flexibility

- #5: Pricing structure

- #6: Customer support and reliability

- #7: Scalability

- #8: User experience

- Payop – a reliable partner for marketplaces

In the busy world of online marketplaces, a smooth flow of transactions is what keeps these digital ecosystems thriving. Whether you own a platform for goods, services or experiences, choosing the right marketplace payment provider is critical. It affects not only your operational efficiency but also your user experience, security, and growth potential. This article discusses the key factors to consider when choosing a payment provider for your marketplace.

#1: Integration capabilities

The first consideration is how well a payment provider can integrate with your marketplace platform. Look for providers offering robust APIs and developer tools that easily blend with your existing systems. The API must be able to handle the unique workflows of your marketplace, such as split payments and refunds.

Some providers also offer plug-and-play solutions for popular marketplace platforms like WooCommerce. This can be an ideal option that doesn’t require any technical groundwork and will also save you a lot of time on integration. Generally, a provider that supports a wide range of integrations can significantly reduce operational friction.

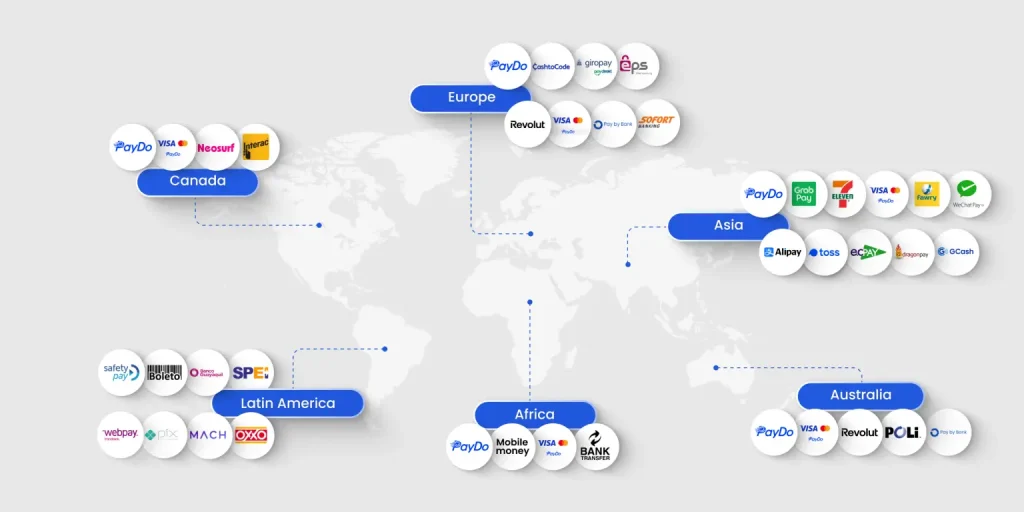

#2: Marketplace payment methods and currencies

Catering to a diverse user base requires support for various payment methods and currencies. A suitable provider should accommodate credit/debit cards, digital wallets, bank transfers, and even newer options like cryptocurrencies.

If your marketplace business aims for a global audience you will need a provider that supports cross-boarder transactions and offers not only popular international methods, but also local options like Alipay in China or OXXO in Mexico. This can significantly impact user adoption and, in some cases, will allow you to reach a category of users who cannot access traditional banking services.

#3: Security and compliance

Security is paramount in marketplace payment processing. Any misstep can lead to financial losses, legal consequences, and a damaged reputation. Look for providers that prioritise security and compliance:

- PCI DSS Compliance: The provider must adhere to the Payment Card Industry Data Security Standard (PCI DSS) to safeguard cardholder data.

- Fraud detection: Advanced fraud detection tools can help prevent unauthorised transactions and chargebacks.

- Regulatory adherence: The provider should comply with global regulations, including GDPR in Europe and AML/KYC regulations.

#4: Payout flexibility

Sellers are the foundation of any marketplace. Therefore, how and when funds are distributed to them is a critical operational aspect. Payment providers offer different payout schedules and methods, which can impact seller satisfaction. There are three important aspects to consider:

- Payout frequency: Check if the provider supports daily, weekly, or on-demand payouts.

- Payout methods: Ensure a variety of payout options, including bank transfers and digital wallets, to cater to different seller preferences.

- Escrow and holding periods: Some providers offer escrow services to hold funds until certain conditions are met, adding an extra layer of security.

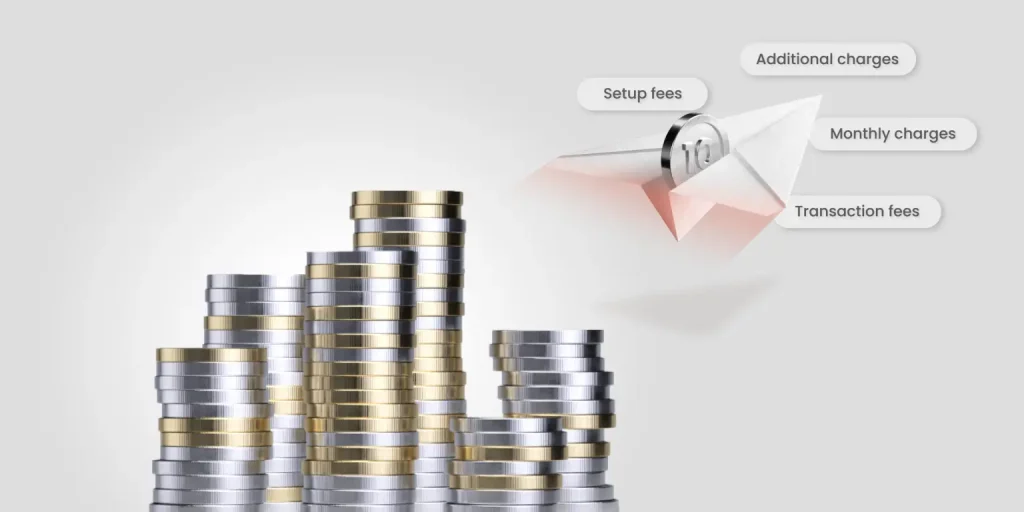

#5: Pricing structure

Understanding the cost structure of a payment provider is crucial. Transparent pricing helps in budgeting and financial planning. Costs can typically include transaction fees, setup fees, and monthly service charges:

- Transaction fees: Some providers offer discounts for high transaction volumes, which can be beneficial as your marketplace grows.

- Setup fees: Also known as onboarding fees, are paid once to cover all registration and integration processes.

- Monthly charges: recurring fees that payment providers charge to businesses for maintaining and accessing their payment processing services.

- Additional charges: Be aware of any extra costs for currency conversion, chargebacks, or cross-border transactions. Some providers don’t transparently communicate these costs.

#6: Customer support and reliability

Effective customer support can save your marketplace from potential disruptions. Evaluate the provider’s support infrastructure, including availability and response times. Immediate access to support can be the difference between a minor hiccup and a major disaster.

The second fundamental factor is the reliability of a payment system. A payment provider must offer a high level of system reliability to ensure that transactions are processed smoothly without interruptions. Downtime can have severe repercussions for a marketplace, leading to lost sales, frustrated users, and damaging the platform’s reputation. Therefore, selecting a provider with a proven track record of uptime and system stability is crucial.

#7: Scalability

Your marketplace is likely to grow, and your payment provider should be able to support this process. Scalability features ensure the provider can handle increasing transaction volumes and new business requirements without sacrificing performance. This includes:

- Transaction volume handling: The provider’s ability to process a high number of transactions per second.

- Global expansion support: Means the provider’s compliance with international standards and the support of the wide variety of currencies and payment methods that will facilitate your marketplace’s expansion into new markets.

- Feature upgrades: Involve the provider’s ability to listen to your business’s needs and make changes that optimise its performance.

Read our Guide to payment processing: What it is and how it works.

#8: User experience

A smooth marketplace payment experience is critical for user satisfaction. Opt for an intuitive checkout that guarantees a fast payment process and doesn’t require unnecessary information and actions from customers. Support for multiple languages, optimisation for various devices, a wide choice of payment methods, a minimum number of steps and clear design are the aspects that will allow you to boost customer experience and, consequently your conversion.

Payop – a reliable partner for marketplaces

After years of working with marketplace payments, Payop knows and understands your needs. We offer a comprehensive suite of payment solutions designed to enhance user experience, optimise operations, and support growth. With a focus on flexibility, security, and global reach, Payop provides the tools and services needed to ensure that transactions are processed smoothly and efficiently:

- Easy integration: We offer three integration options – our reliable API, plugins and technical integrators – allowing you to simultaneously connect all payment solutions to your platform.

- Wide range of payment options: Payop supports over 500 local and international payment methods and 100 currencies in 170 countries.

- Robust security and compliance: Adherence to PCI DSS level 1 and global AML and KYC regulations, advanced monitoring and fraud prevention tools, encryption, tokenization – you name it, we provide it all.

- No hidden charges: You pay only for successful transactions and currency conversions – no setup or monthly fees.

- Individual customer support: You get a personal account manager who provides ongoing support for your business and is always available to answer your questions.

- Scalability and flexibility: Payop offers payment methods with high conversion rates and uptime, as well as a proven record of handling high transaction volumes. We also regularly update platform features to keep pace with evolving marketplace needs.

- User-friendly checkout: We provide an intuitive and adaptable checkout to ensure a smooth buyer experience and reduce cart abandonment.

By combining these features, Payop ensures a secure, efficient, and scalable payment solution that can adapt to the unique needs of any marketplace. To learn more and get individual offer, contact our team at sales@Payop.com.