How to accept international payments: Guide for your business

Top payment options for video gaming in 2025

Payment service provider vs. payment gateway: Which do you need?

Pay by Bank vs. Credit cards: Which is better for business?

Your guide for Payop’s WooCommerce plugin integration

Unlocking growth in Africa: Local payment trends and methods

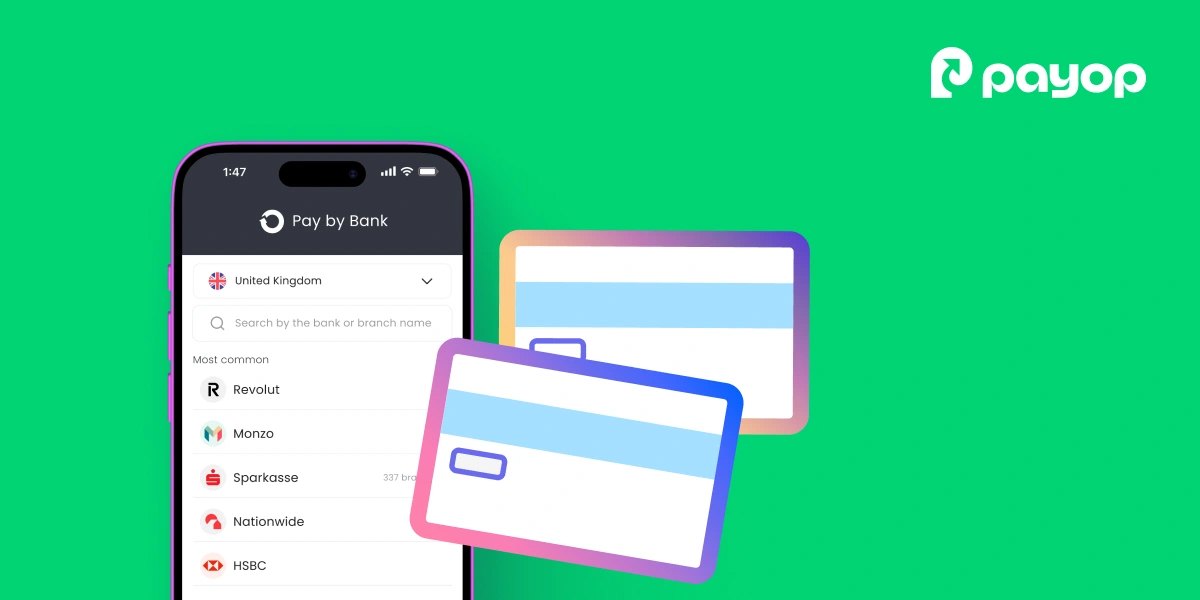

Pay by Bank vs. Credit cards: Which is better for business?

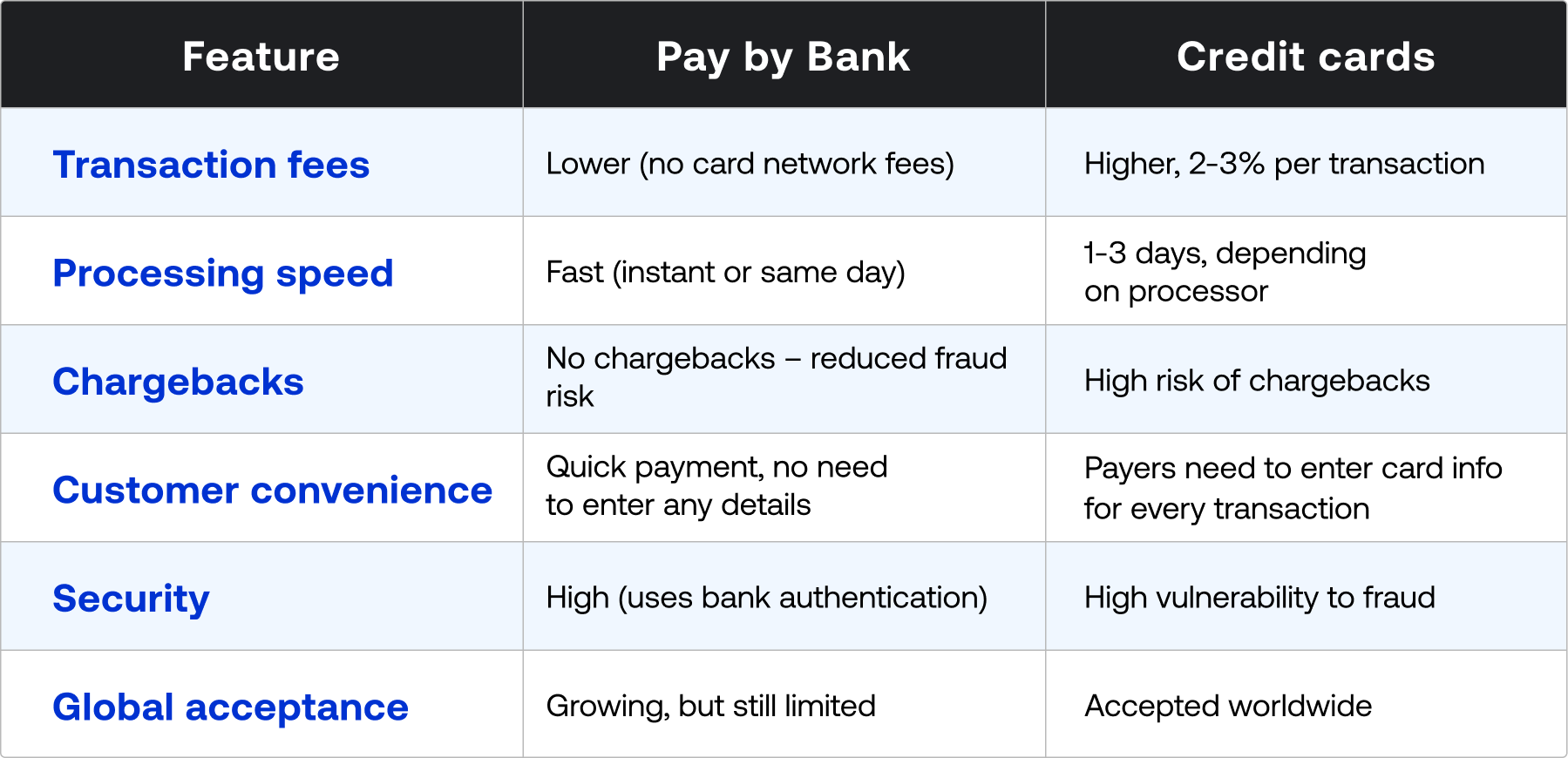

Businesses today have more payment options than ever, but choosing the right one can be challenging. Among the most debated choices are Pay by Bank (also known as account-to-account or A2A payments) and credit card payments. Both offer unique benefits, but which one is better for your business?

Let’s compare Pay by Bank and credit card payments across key factors, so you can make an informed decision.

What is Pay by Bank?

Pay by Bank enables customers to make direct payments from their bank accounts without using cards. These transactions leverage open banking technology, bypassing card networks and reducing processing costs.

Key features:

- No card networks involved

- Uses bank authentication for security

- Funds settle directly between bank accounts

What are credit card payments?

Credit card payments rely on card networks like Visa and Mastercard. Customers pay using their credit cards, and businesses receive the funds after processing fees and potential chargebacks are deducted.

Key features:

- Requires card network infrastructure

- Supports chargebacks and refunds

- Allows customers to borrow funds

Pay by Bank advantages for business

As businesses seek cost-effective and secure payment solutions, Pay by Bank offers several key benefits that can improve cash flow and reduce risks.

- Lower costs – Businesses can save on processing fees since Pay by Bank bypasses expensive card networks.

- Reduced fraud & chargebacks – With no chargebacks and strict bank authentication, fraud risks are lower compared to credit cards.

- Faster settlement – Funds can be received almost instantly, improving business cash flow.

- Seamless payments anytime – Unlike traditional banking hours, Pay by Bank transactions via Payop’s Pay by Bank solution allow businesses to receive payments even during unbanked hours, weekends, and holidays.

Altogether, it leads to higher customer satisfaction, cart abandonment reduction and more sales.

Why do some businesses still prefer credit cards?

Despite the advantages of Pay by Bank, credit cards remain a preferred payment method for many businesses due to the following reasons:

- Widespread consumer adoption – Customers are used to credit cards and may hesitate to adopt new payment methods. This is especially true for the older payers.

- Supports recurring payments – Many subscription-based businesses rely on credit cards for automated billing.

- Higher consumer spending – Credit limits encourage customers to spend more, which can increase revenue for some businesses.

Which is better for your business

The payment method you choose depends on your business model, customer preferences, and cost considerations. Here’s a quick checklist to help you decide:

Choose Pay by Bank if you:

- Want to reduce transaction costs

- Need instant payment settlements

- Want to minimise chargeback risks

- Operate in industries with strict fraud prevention needs ( forex, iGaming, e-commerce)

Choose credit cards if you:

- Serve a customer base that relies heavily on cards

- Need recurring billing options

- Sell high-priced goods where customers may prefer credit-based payments

Learn how payment flexibility drives customer loyalty in e-commerce.

Final thoughts

Selecting the right payment method for your business can be a tricky task. At Payop, we try to achieve just that.

If you’re looking for a cost-effective, secure, and instant payment method, Payop’s Pay by Bank solution offers a strong alternative to credit cards. It ensures faster transactions, lower fees, and increased protection against chargebacks – making it an excellent choice for modern businesses.

Want to integrate Pay by Bank into your payment system? Get started with Payop today!