How to adapt your payment strategy for entering new markets

The future of payments: How AI is transforming the industry

Pay by Bank vs. e-wallets: What should merchants promote at checkout?

How Gen Z shops: Insights on online payments

Why cash-based digital vouchers still matter in 2025

Pay by Bank vs. e-wallets: What should merchants promote at checkout?

The checkout page is where your customer makes the final decision – to complete the purchase or abandon the cart. Around 70% of online shopping carts are abandoned, and one of the top reasons is a lack of preferred payment methods. That’s why deciding which payment options to highlight at checkout is more than a technical choice; it’s a strategic business decision.

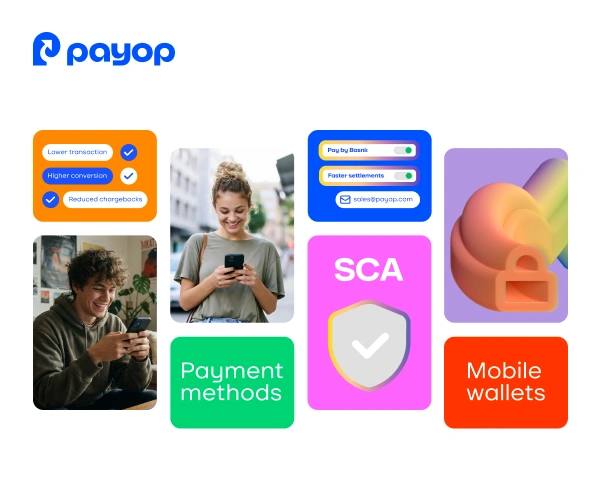

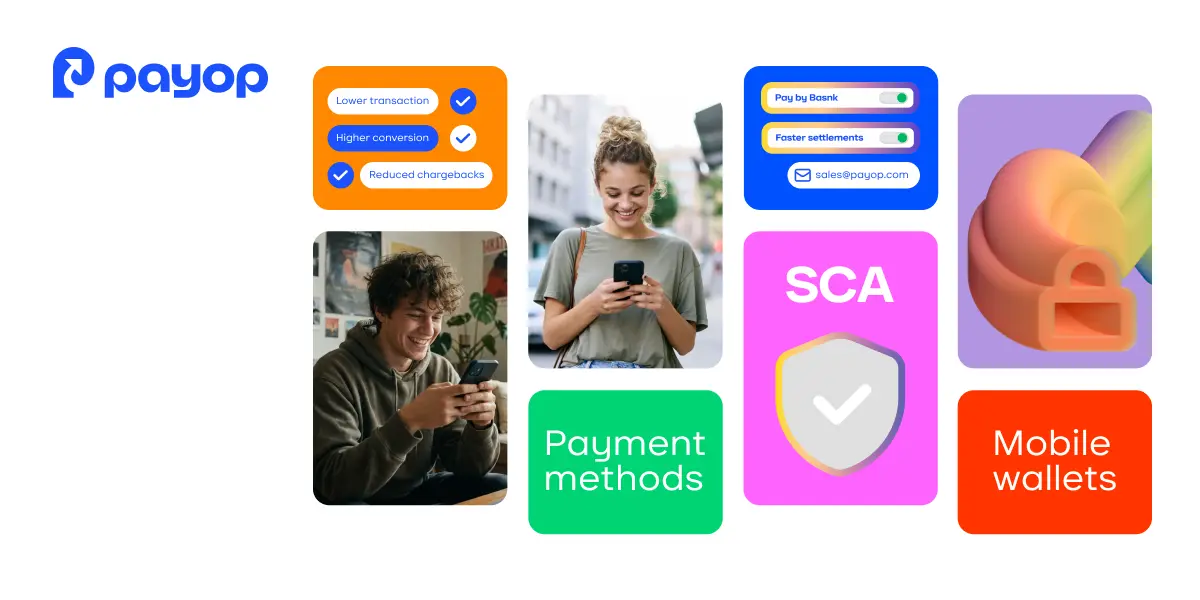

Two of the most popular alternatives today are Pay by Bank and digital wallets. Both methods offer advantages, but their effectiveness varies depending on the market and audience. So, which one should you be promoting more actively at checkout?

What is Pay by Bank?

Pay by Bank leverages open banking infrastructure, allowing customers to pay directly from their bank account. Instead of entering card details, the customer is redirected to their mobile banking app, approves the transaction with biometrics or PIN, and the funds move instantly.

Business advantages:

- Lower transaction costs: No card networks or intermediaries mean fewer fees. For high-volume merchants, savings can be significant.

- Faster settlements: Payments often clear in seconds, even outside banking hours in some regions. This improves cash flow and business operations.

- Reduced fraud and chargebacks: Transactions are authenticated directly by banks with strong customer authentication (SCA). This practically eliminates chargebacks and minimises fraud.

- Trust factor: Customers feel more secure approving payments in their banking app rather than entering card details on a website.

Adoption trends:

- In the UK, Pay by Bank is becoming a mainstream alternative thanks to PSD2 and open banking.

- Several European countries, including Germany, Spain, and the Netherlands, are seeing rapid adoption.

- Asia-Pacific is another growth hotspot, with countries like India and Singapore rolling out account-to-account real-time payments that work similarly to Pay by Bank.

What are e-wallets?

Digital or e-wallets such as Apple Pay, Google Pay, Alipay, or GrabPay store users’ payment details and enable fast online transactions. Wallets are often linked to cards, but some also hold stored balances or connect directly to bank accounts.

Business advantages:

- Customer familiarity: Wallets are already widely adopted. For example, Apple Pay is used by more than 500 million people worldwide.

- Frictionless checkout: One-click or biometric confirmation leads to faster conversions.

- Omnichannel reach: Wallets can be used in-app, online, or at physical POS.

- Extras: Many wallets integrate loyalty programs, coupons, or instalment options, boosting customer retention.

Adoption trends:

- In China, wallets like Alipay and WeChat Pay dominate digital commerce, accounting for over 90% of mobile payments.

- In Europe and North America, Apple Pay and Google Pay are the leaders, particularly among younger, mobile-first consumers.

- Emerging markets also see wallet growth as they bridge gaps for underbanked populations.

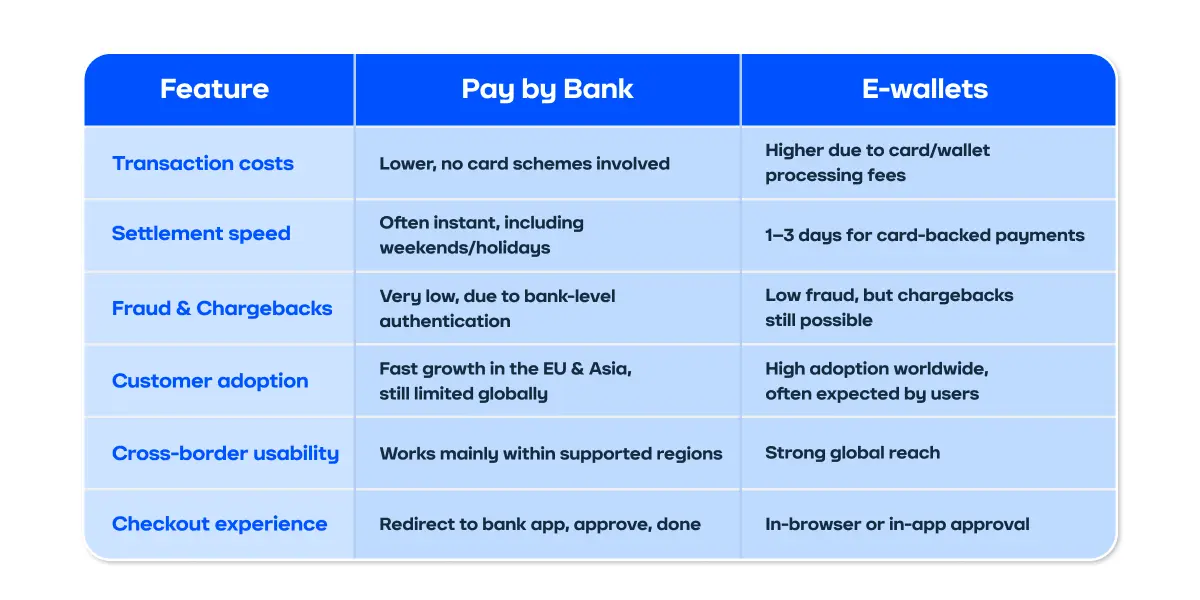

Pay by Bank vs. E-Wallets

Both Pay by Bank and e-wallets offer strong advantages, but they work differently. Here’s a side-by-side look at how they compare across key factors that matter to merchants.

Which option should merchants promote at checkout?

The correct answer depends on your target market and audience profile.

When to promote Pay by Bank:

- If you operate in regions with strong open banking adoption (UK, EU).

- If cost savings are a crucial aspect for you.

- If instant payments can help you process orders and run operations more efficiently.

- If you want to reduce chargebacks.

- If customer trust and security are top priorities.

When to promote digital wallets:

- If your customers are mobile-first or Gen Z, who expect wallets as default.

- If you sell globally and need methods that work across markets.

- If you want to reduce cart abandonment by offering “one-tap” payments.

Best practice: Offer both, but prioritise strategically

The smartest approach is not to choose one over the other, but to adapt your checkout layout:

- Highlight Pay by Bank in regions where open banking is well established, but keep wallets available for those who prefer them.

- Place wallets more prominently for mobile-driven audiences.

- Run A/B testing to track which method increases conversion for specific customer segments.

- Use smart routing: Payop allow you to automatically present the most relevant option based on location or device.

Final thoughts

At checkout, payment choice directly influences conversions. Pay by Bank delivers cost efficiency, speed, and security, making it ideal for high-volume and region-specific markets. Digital wallets bring convenience, global reach, and customer familiarity, especially in mobile commerce.

Instead of seeing them as competitors, merchants should treat Pay by Bank and wallets as complementary tools. The key is knowing your audience, testing what works best, and making payment as seamless as possible.

With Payop, you don’t have to choose. We support Pay by Bank across multiple countries as well as hundreds of digital wallets, helping merchants boost conversions while controlling costs. Reach out to us at sales@payop.com to learn more.