Payment tokenization: How it improves e-commerce security

In the world of e-commerce, data security is a non-negotiable dealbreaker. Customers want to know their payment information is safe before they hit the “Buy Now” button. With high-profile data breaches becoming all too common, businesses can’t afford to leave anything to chance. That’s where payment tokenization steps in, protecting sensitive card information and making life a lot harder for cybercriminals.

So, what exactly is payment tokenization, and why is it one of the most effective defences against data theft? Let’s break down how this security technology works and how it helps build the trust that keeps customers coming back.

What is payment tokenization?

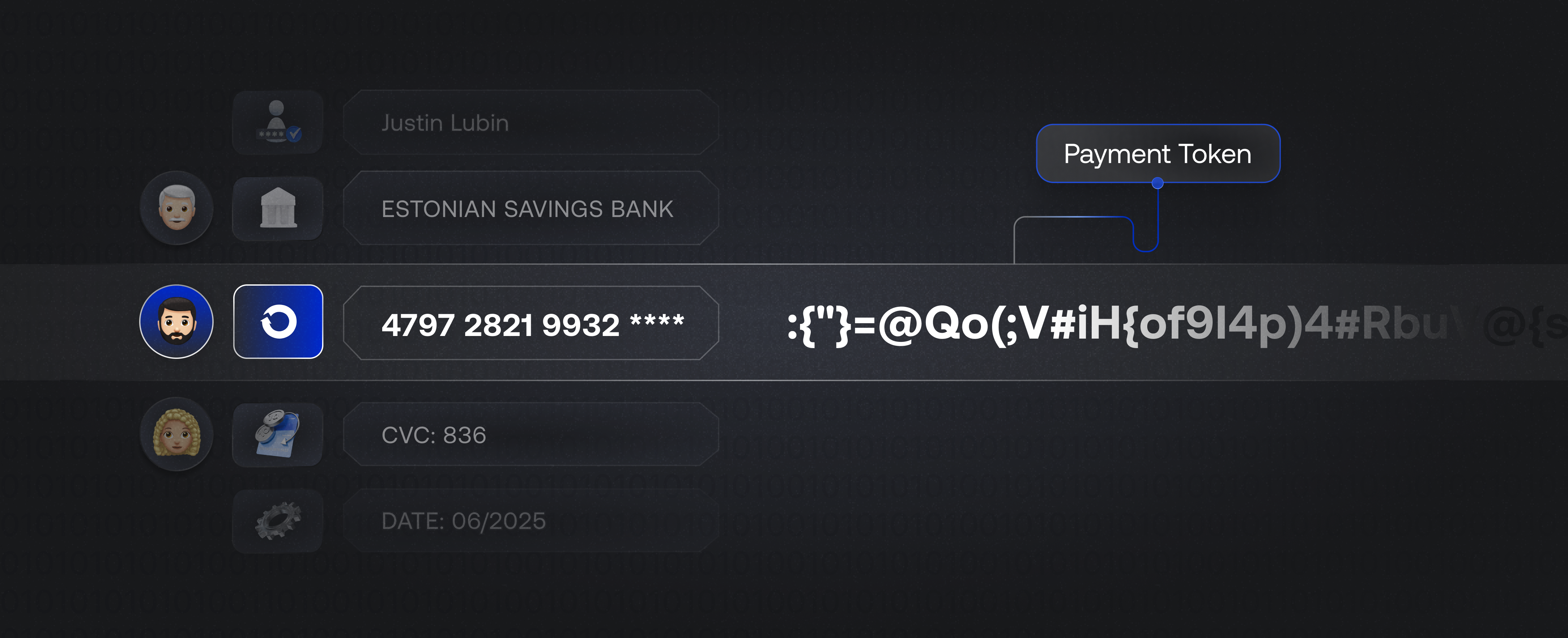

Imagine your credit card number being replaced by a random string of numbers and letters – completely meaningless to anyone who intercepts it. That’s what payment tokenization does. It swaps out sensitive card data with a unique identifier, or token, that can’t be reverse-engineered.

For example, when a shopper enters their card information on an e-commerce site, the data is instantly converted into a token. This token is then used to process the payment, while the original card details remain securely stored in a protected environment managed by a tokenization service provider. Even if a cybercriminal manages to access the token, it’s useless outside that context.

How does payment tokenization work?

The tokenization process is relatively straightforward but incredibly effective:

- Checkout: A shopper enters their payment information at an e-commerce site’s checkout page.

- Token creation: The card data is encrypted and sent to a tokenization provider, which generates a unique token.

- Token in action: This token is sent back to the merchant and used instead of the real card number to authorise the payment.

- Secure payment processing: The token is passed through the payment network to complete the transaction. The sensitive data remains stored securely with the tokenization provider.

Because the real card information never passes through or gets stored in the merchant’s systems, hackers have little to gain from breaching the site.

Why every business needs payment tokenization

Tokenization isn’t just a security upgrade – it’s a necessity in today’s digital world. Here are some standout benefits:

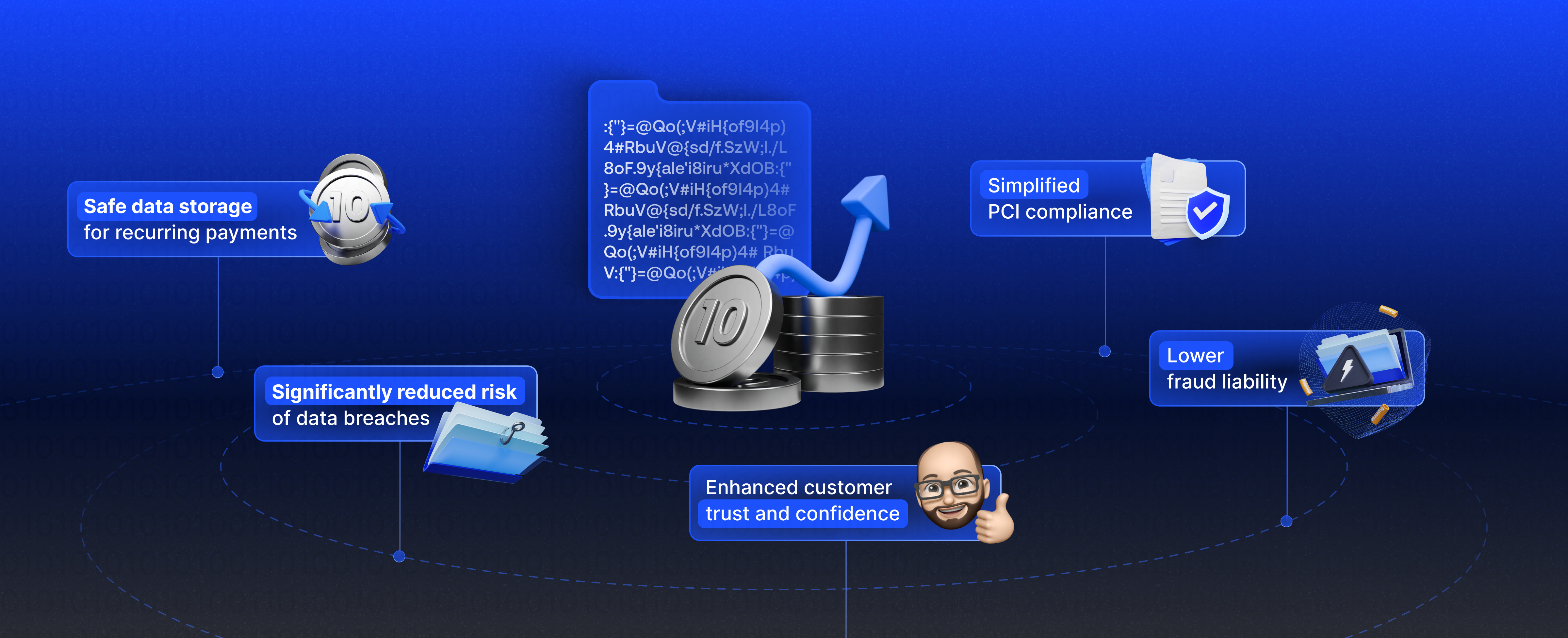

1. Significantly reduced risk of data breaches

Data breaches are an e-commerce merchant’s worst nightmare. Tokenization dramatically reduces this risk. By replacing card numbers with tokens, hackers can’t do anything with the intercepted information. It’s like stealing a car key that doesn’t match any vehicle.

2. Simplified PCI compliance

Dealing with sensitive card data requires strict regulations, particularly the Payment Card Industry Data Security Standard (PCI DSS). Tokenization lightens the compliance burden by minimising the sensitive information a merchant needs to secure. With tokenization in place, staying compliant becomes much less complicated – and less costly.

3. Enhanced customer trust and confidence

Shoppers are becoming increasingly aware of data security risks. A well-secured payment process can set a merchant apart, and tokenization is a major confidence booster. When customers know their information is safe, they’re more likely to complete purchases and come back for more.

4. Safe data storage for recurring payments

E-commerce businesses based on subscription models benefit enormously from tokenization. Tokens make recurring billing simple and secure. Instead of asking for payment details over and over, merchants can use stored tokens, creating a frictionless and safe experience for their subscribers.

5. Lower fraud liability

Storing real payment data comes with financial risk. Tokenization can shift or reduce liability in case of fraud, protecting merchants from hefty financial consequences. It’s like an insurance policy for your business that also makes it harder for cybercriminals to cash in on stolen data.

Learn how to choose a secure payment provider for your e-commerce business.

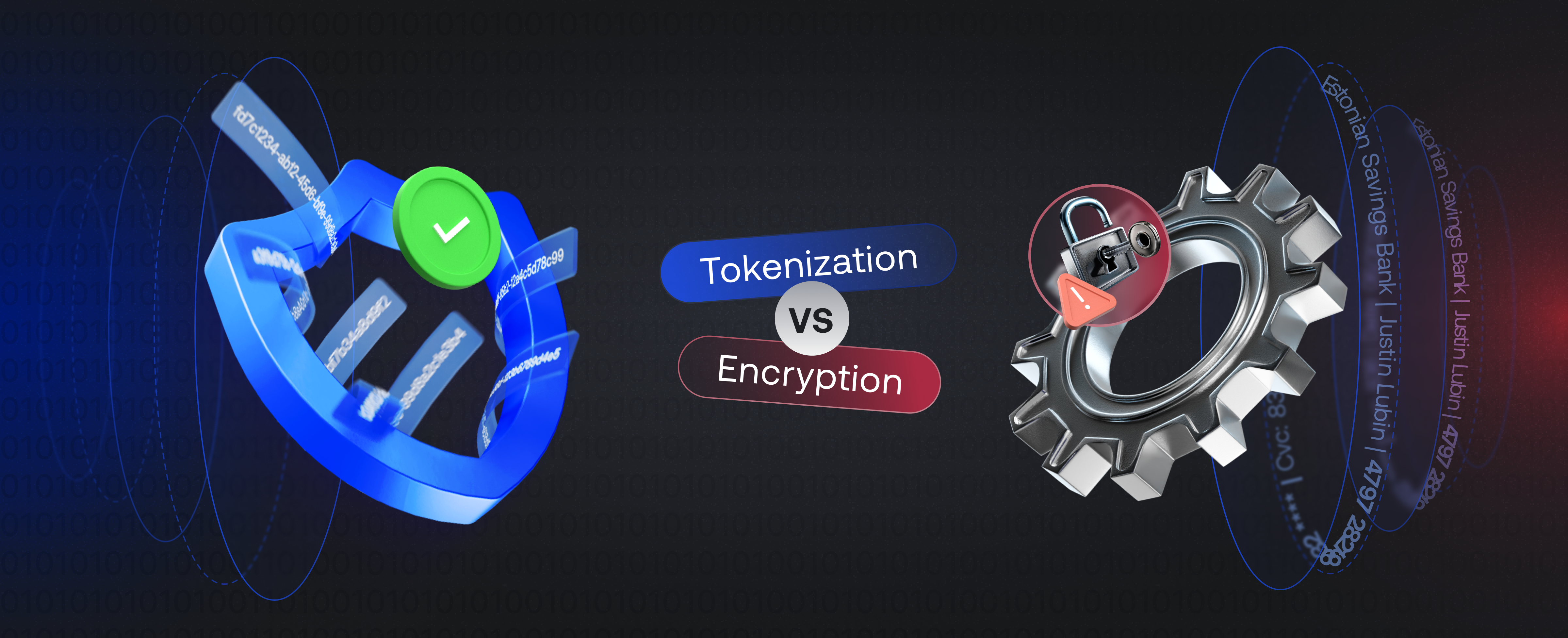

Tokenization vs. Encryption

While tokenization and encryption are critical security measures, they differ in how they protect data. Encryption scrambles sensitive data into a code that can be decrypted with a key. Hackers can access the original information if they get both the encrypted data and the key.

Tokenization, however, doesn’t have a decryption key. The token can’t be transformed back into the original data without access to the secure tokenization system. In a nutshell, tokenization makes it practically impossible for thieves to gain anything valuable from a data breach, making it a better fit for payment security.

Implementing tokenization in your e-commerce business

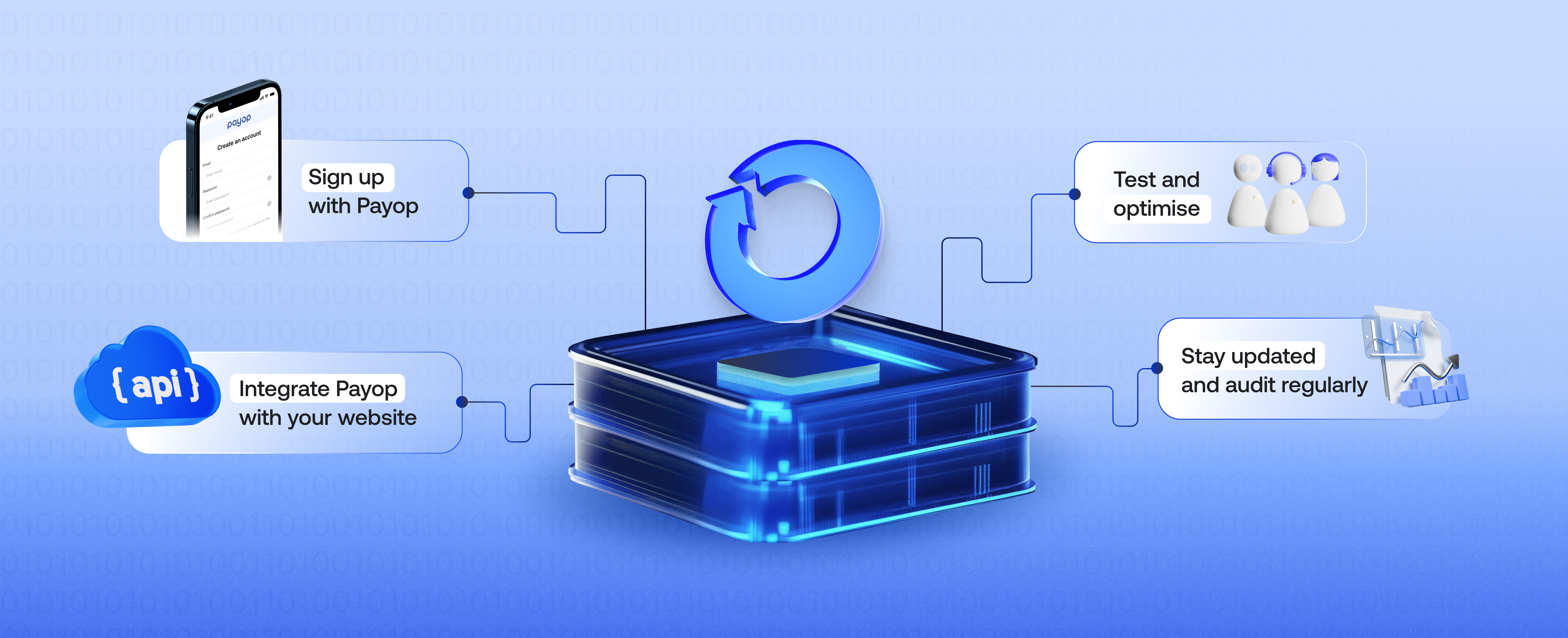

Ready to level up your e-commerce security with tokenization? Payop makes it easy for merchants to get started, offering an easy approach to protecting customer data and enhancing their checkout experience. Here’s how to implement tokenization using Payop:

- Sign up with Payop: Create an account on the Payop platform. During the onboarding process, you’ll gain access to a range of payment and security features, including tokenization. Payop’s team will guide you through the setup, ensuring everything is tailored to your business needs.

- Integrate Payop with your website: Payop has flexible integration through easy-to-use API, technical integrators and plugins. Whatever you choose, Payop’s developer resources make integration a breeze.

- Test and optimise: Before going live, use Payop’s testing tools to ensure everything is working smoothly. Payop’s support team is there to help fine-tune the setup if needed.

- Stay updated and audit regularly: Even with tokenization in place, keeping up with the latest security practices is essential. Schedule periodic audits to make sure your website is well protected.

On our side, Payop offers regular updates and security features to keep your system robust. Protect your customers and your business with Payop, and embrace a safer, smarter approach to online payments. For more information sales@Payop.com.