Bank holidays 2026 in Europe

The rise of QR code payments worldwide

Payment preferences in Southeast Asia: From cash to digital wallets

How to adapt your payment strategy for entering new markets

Payment tokenization vs. encryption: Do you need both?

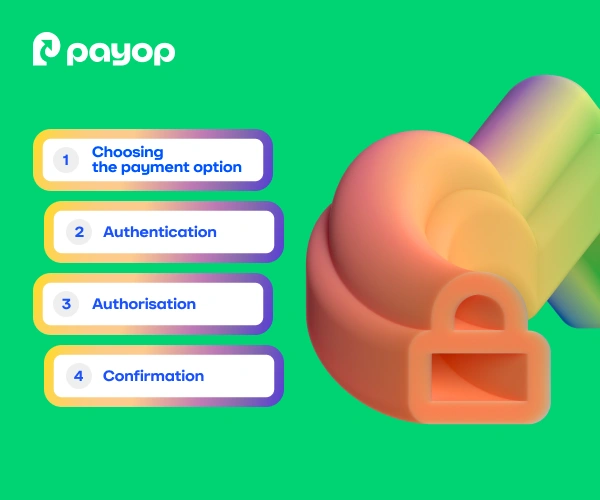

Every time a customer pays online, they share some sensitive financial data. Whether it’s entering a card number, connecting a bank account, or using a digital wallet, they expect one thing from your business: security.

And they are right to worry. Total damage from online fraud is projected to reach $362bn between 2023 and 2028. This number shows that payment data protection is not just a compliance checkbox, but an essential condition for customer trust.

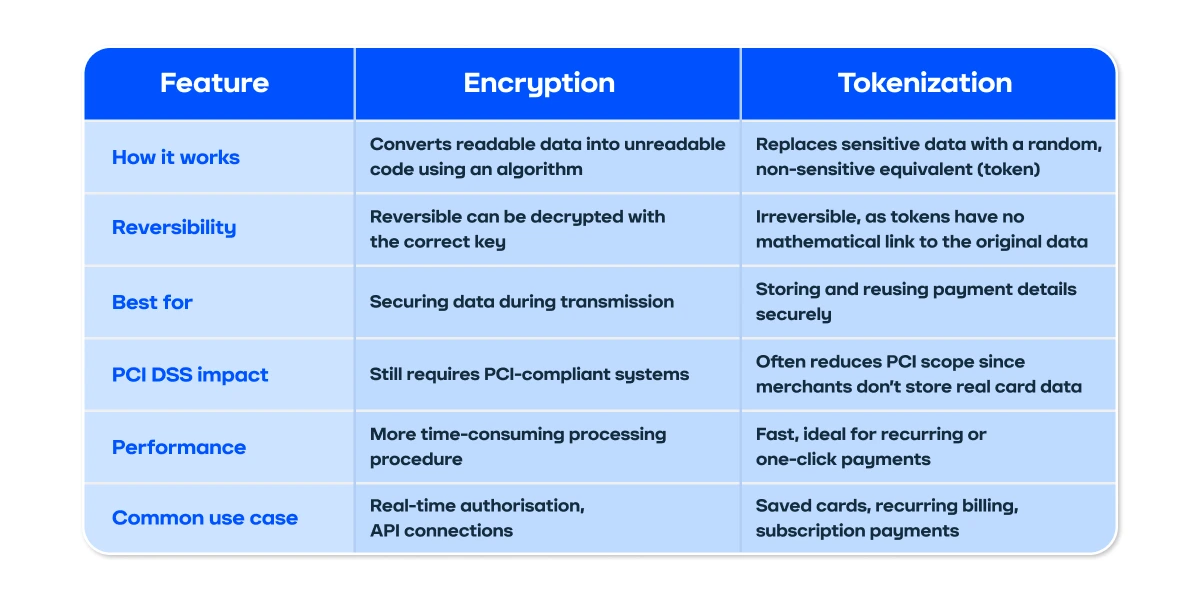

Two technologies that play a major role in preventing fraud are tokenization and encryption. They’re often mentioned together, but they do very different jobs. Understanding how each works and where they’re used helps your business strengthen security and streamline payment operations.

What is encryption?

Encryption is the process of converting readable information, like a card number or CVV, into an unreadable string of characters using a mathematical algorithm. The data can only be “unscrambled” by someone who has the correct decryption key.

Think of it like sending a locked parcel. The sender locks it, and only the recipient with the correct key can open it. Even if someone intercepts it, all they will see is nonsense.

In payments, encryption protects data in transit as it moves from your checkout page to the payment processor and through the banking network.

Example:When a shopper enters their card details, encryption turns on before that data leaves their browser. It remains encrypted until it reaches the payment gateway for verification.

What is tokenization?

While encryption scrambles data, tokenization replaces it. The process takes sensitive information, like a card number, and swaps it with a random, non-sensitive “token” – a unique identifier that’s useless outside the payment system.

The real data is stored securely in a token vault – an isolated environment managed by a trusted provider. Whenever that customer makes another purchase, your system uses the token instead of the real card number. The actual sensitive details never reappear in the payment flow.

Example:

Imagine a returning customer making a second purchase on your website. Instead of asking for their card number again, your system sends a stored token – something like “e23f9c4a83b9” – to the payment gateway. The gateway knows how to match that token to the actual card data, but you never see or store it yourself.

Tokenization vs. encryption: Key differences

Both methods protect sensitive payment data, but they do so in very different ways and on different levels:

Learn how to protect your business from chargeback fraud.

Why tokenization is becoming a standard

In recent years, tokenization has become the go-to approach for payment security, and for good reason.

Here’s why more businesses are adopting it:

- Reduced compliance burden

Since you don’t handle real card data, your PCI DSS (Payment Card Industry Data Security Standard) requirements can be significantly reduced. That means fewer audits, lower costs, and less risk. - Lower breach risk

Even if hackers break into your system, the data they find – the tokens – are meaningless. They can’t be reversed or used elsewhere. - Frictionless experience for customers

Tokenization makes repeat payments and one-click checkouts safe. Customers can save their payment details securely without worrying about breaches. - Supports modern payment models

Tokenization enables smooth recurring and stored payment flows while keeping data secure. It’s a perfect match for subscription-based businesses and marketplaces.

Tokenisation basically enables convenience without security risks.

Learn how fraud prevention measures can affect payment speed.

How encryption complements tokenization

So, answering the initial question: you don’t choose between encryption and tokenization. You need both to keep payments safe at all times.

Here’s how the two protect different parts of the same journey:

- Encryption secures the data while it’s moving from the customer to your payment service provider.

- Tokenization secures it after it reaches the destination and needs to be stored or reused.

Together, they form a complete protection loop – encryption secures the journey, while tokenisation secures the destination.

This layered approach is what makes modern payments so resilient, even as cyberthreats become more sophisticated.

Keep your payments safe with Payop

At Payop, security is built into every step of the payment flow.

We combine advanced encryption, secure tokenisation, and real-time fraud monitoring to keep your payments safe from start to finish.

Our systems ensure that:

- Sensitive data never touches your servers.

- All payment transmissions are encrypted using industry-grade protocols.

- Returning customers can pay effortlessly through tokenised payment flows.

- You get full support in managing chargebacks and disputes through our dedicated anti-fraud tools.

That means fewer risks, smoother operations, and a checkout experience your customers can trust.