Pay by Bank vs. e-wallets: What should merchants promote at checkout?

How Gen Z shops: Insights on online payments

Why cash-based digital vouchers still matter in 2025

Can open finance deliver what open banking promised?

Gaming without cards: A look at Pay by Bank for in-game purchases

Recover lost sales with a smart payment strategy: What a PSP can do for your conversion

Cart abandonment is one of the most common challenges for online businesses. Studies show that up to 70% of online shopping carts are abandoned, often due to friction at checkout. While pricing, shipping costs, and website experience play a crucial role, it would be a mistake to focus solely on these factors and ignore payment issues. One of the most effective ways to recover and prevent lost sales is through a good payment strategy.

A modern payment service provider (PSP) can help businesses optimise payments, reduce friction, and increase conversions by offering the right tools, insights, and payment options.

Why payment strategy matters

The checkout process is often the final step that determines whether a visitor becomes a customer. Even minor obstacles can lead to cart abandonment. Research shows that a quarter of customers leave a cart because they don’t trust the website with their credit card information, making security a top concern. Another 22% abandon their purchase due to a long or complicated checkout process, while 13% do so simply because the available payment options don’t meet their needs.

These numbers highlight that security concerns, friction, and limited choices are major barriers to conversion. An innovative payment strategy addresses all of these factors, ensuring that:

- Customers feel confident their data is safe

- Checkout is fast, seamless and intuitive

- The right payment methods mix is available for every market and customer segment

By tackling these key pain points, you can significantly reduce abandonment and recover sales before they are lost. And here’s how.

1. Offer payment methods your customers actually want

Customers are more likely to abandon a cart if their preferred payment method isn’t available. A PSP can help you:

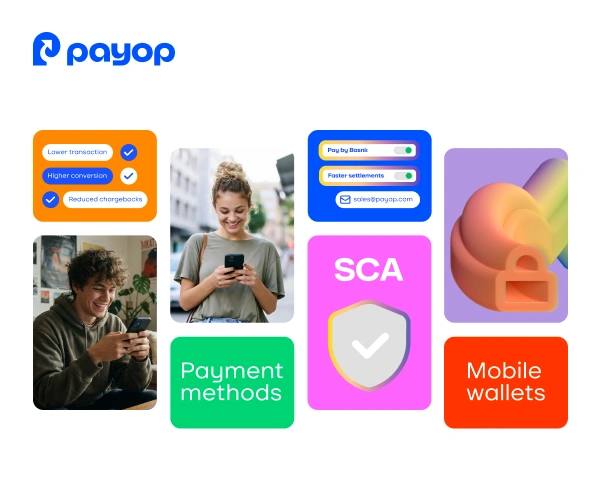

- Support local and international payment methods depending on the market

- Enable a variety of payment options: digital wallets, bank transfers, cash-based methods and Pay by Bank solutions

- Monitor which methods perform best for different customer segments

For example, in some regions, mobile wallets dominate, while in others, cash is still the main choice. Offering the right options expands the customer base and reduces friction at checkout.

2. Build customer trust with advanced security

Security is one of the main reasons shoppers abandon carts. A modern PSP helps merchants win customer trust by implementing advanced security measures that protect both businesses and buyers.

With a PSP, your business can:

- Ensure encrypted payment processing, meaning sensitive card and banking data is never exposed

- Gain access to fraud detection and prevention tools, automatically flagging suspicious activity before it affects you

- Stay compliant with global standards, such as PCI DSS and PSD2, further reassuring customers that their payments are safe

By leveraging these security features, you can reduce cart abandonment caused by trust concerns and create a reliable, professional checkout experience that encourages customers to complete their purchase.

3. Simplify the checkout experience

Complex or lengthy checkout processes increase abandonment. PSPs can help by:

- Offering one-click or fast checkout solutions

- Providing intuitive checkout forms without unnecessary fields and steps

- Supporting tokenisation, so returning customers can pay quickly and securely without re-entering details

- Providing personalisation features that automatically adjust the checkout page to each customer based on their location, history and payment preferences

A smoother, faster payment experience keeps customers engaged and more likely to complete their purchase.

4. Leverage payment insights for smarter decisions

Modern PSPs provide valuable analytics that help merchants understand payment behaviour. These insights can include:

- Decline rates by payment method, region, or customer type

- Patterns in cart abandonment linked to specific payment steps

- Conversion trends that indicate which options drive the most sales

By analysing these insights, businesses can adapt their payment strategy proactively, rather than reacting after the sale is lost.

5. Support multiple currencies and automatic conversions

International shoppers often abandon carts when prices are displayed only in a foreign currency. They may hesitate to complete a purchase if they need to calculate exchange rates manually or worry about unexpected costs. A modern PSP allows merchants to offer multiple currencies and automatic conversions, providing a localised shopping experience that feels familiar and trustworthy.

6. Enable mobile-optimised payments

Mobile commerce continues to grow rapidly, with a lot of online shopping now happening on smartphones and tablets. A checkout flow that isn’t optimised for different devices can frustrate users, leading to abandoned carts.

A PSP provides mobile-optimised payment solutions that adjust seamlessly to different screen sizes, ensuring a smooth, intuitive experience. This includes support for mobile wallets, one-click payments, and responsive design, all of which streamline the process for shoppers on the go.

Final thoughts

With a smart payment strategy, merchants can reduce cart abandonment, streamline checkout, and build customer trust. Payop provides all the tools needed to achieve this, offering multiple payment methods, advanced security, mobile-optimised flows, and actionable insights. We help businesses boost checkout conversion and recover more sales.