Can open finance deliver what open banking promised?

Gaming without cards: A look at Pay by Bank for in-game purchases

Are e-wallets enough? Building a diverse payment mix in emerging markets

Secure by design: How open banking mitigates data breach impact

How to build a local payment strategy for global growth

Secure by design: How open banking mitigates data breach impact

Security is a top concern for any business handling online payments, and for good reason. Digital threats, such as data breaches and payment fraud, are growing more sophisticated, and the consequences can be costly.

That’s where open banking stands out. While often recognised for improving speed and user experience, open banking is also secure by design. With regulated access, strong authentication, and user-controlled data sharing, it provides a safer way to handle financial information, helping businesses reduce both the risk and impact of security breaches.

Why open banking is built for security

Open banking isn’t just a new way to pay, it’s a complete rethink of how financial data is shared.

Instead of old-school methods like screen scraping (where users hand over their bank login details to third-party apps), open banking uses secure, standardised APIs. That means data is transferred through encrypted connections, with banks acting as trusted access points. Users give explicit permission for what can be shared and for how long, and they never hand over their login info.

It also means third-party providers don’t store sensitive credentials or access full account data. Everything is scoped, time-limited, and permission-based.

How open banking minimises data breach impact

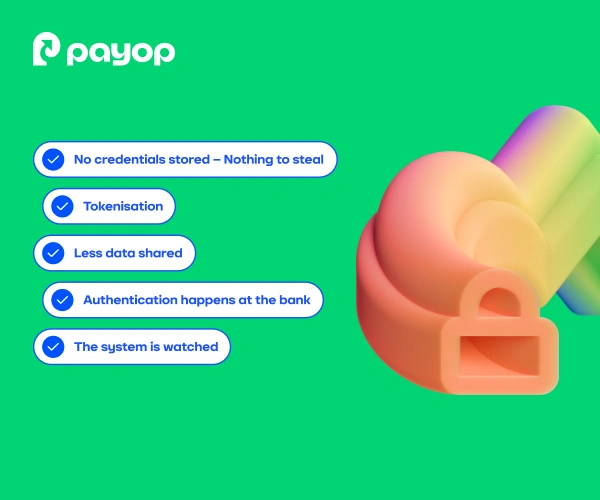

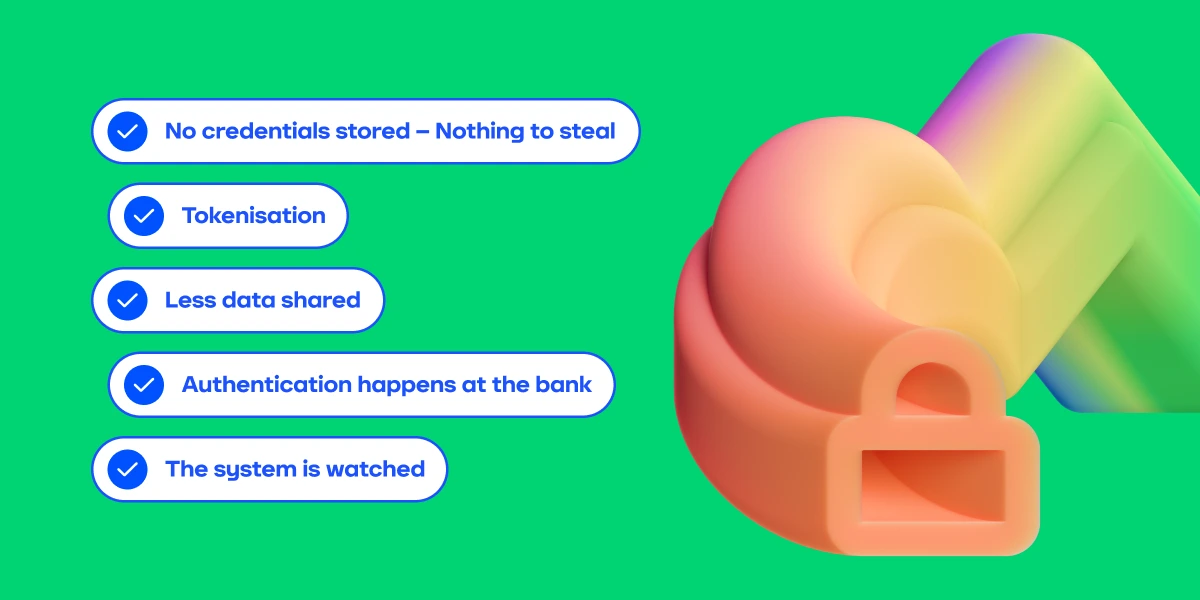

So, what happens if a provider using open banking is breached? Compared to traditional systems, the damage is usually far more contained. Here’s why:

1. No credentials stored – Nothing to steal

Open banking doesn’t rely on stored passwords or login details. Users authenticate directly with their bank. So if a provider is hacked, there’s no access to your banking credentials, because they were never stored in the first place.

2. Tokenisation

Instead of giving third parties the keys to your entire account, open banking works with secure tokens – information substitutes. These are short-lived, limited in scope, and easily revoked. If one is compromised, it can’t be used to perform unauthorised actions, as it doesn’t carry any data.

3. Less data shared

With open banking, users only share what’s necessary. Need to see the account balance? That’s all you get. Need to make a payment? Only that payment is authorised. This minimal data sharing helps reduce exposure in case of a breach.

4. Authentication happens at the bank

Users confirm payments directly through their bank, never on third-party sites. This means no rerouting sensitive info through external platforms. Everything is confirmed securely through the payer’s bank interface, ensuring bank-level protection at every step.

5. The system is watched

In regulated environments, every licensed provider is regularly audited. They must follow strict technical and security requirements. This tight supervision keeps the entire ecosystem cleaner and safer.

Why it matters for your business

For businesses, especially those in fintech, e-commerce, marketplaces, or subscriptions, open banking isn’t just about staying ahead of trends. It’s about delivering the best user experience and protecting your customers.

When you use open banking:

- You’re less exposed to fraud and leaks

- You build more trust with security-conscious customers

- You lower your compliance and legal risks

Data breaches can lead to massive losses, and open banking is a solution that gives you a competitive edge here.

Secure payments with Payop’s Pay by Bank

At Payop, we’ve built our Pay by Bank solution on the core strengths of open banking: no cards, no stored credentials, and direct, bank-level authentication. Each payment is confirmed by the customer within their own banking app, keeping sensitive data out of reach and reducing the risk of fraud.

For merchants, this means fewer chargebacks, lower compliance burden, and peace of mind knowing transactions are protected from the start.

Security isn’t added on, it’s built in.