Why your business should accept PagoEfectivo in Peru

How is Pay by Bank revolutionising e-commerce payments?

Payment landscape in Mexico: a complete guide

The future of mobile payments: Trends and innovations to watch

Simple guide to payment regulations in Africa

Africa’s digital payments landscape is growing at full speed. From mobile money to fintech innovations, the continent is embracing digital finance like never before. But with that growth comes complexity. Every country has its own set of rules, making Africa one of the most diverse regions in the world in terms of payment regulations.

If you’re a business expanding into Africa – or already operating across multiple countries – you’ll need a clear understanding of how these regulations work. Let’s break it down.

Diverse African regulatory environment

Unlike the EU’s unified PSD2 or some regional frameworks in Latin America, Africa is made up of dozens of separate regulatory environments. Each country’s central bank or financial authority sets its own rules on payments, e-money, and fintech.

Here are some of the main regulators:

- Nigeria – Central Bank of Nigeria (CBN)

- South Africa – South African Reserve Bank (SARB) and Financial Sector Conduct Authority (FSCA)

- Kenya – Central Bank of Kenya (CBK)

- Ghana – Bank of Ghana (BoG)

- Francophone West Africa – BCEAO (Central Bank of West African States)

- Egypt – Central Bank of Egypt (CBE)

These institutions control who can offer financial services, what licenses are needed, how customer data is handled, and how anti-money laundering rules are enforced.

Mobile money and e-money regulations

Mobile money is a massive part of Africa’s financial story. It’s what brought financial access to millions, and regulators have built specific frameworks around it, usually classifying it under Electronic Money Issuers (EMIs).

Kenya – Central Bank of Kenya (CBK)

- Regulated under the E-Money Guidelines (2013)

- Mobile money providers must be licensed as Electronic Money Issuers (EMIs)

- Customer funds must be safeguarded in segregated trust accounts

- Monthly reporting and real-time transaction monitoring are mandatory

- CBK has made interoperability between providers a legal requirement

Nigeria – Central Bank of Nigeria (CBN)

- Introduced a Payment Service Bank (PSB) framework to expand access in rural areas

- PSBs can provide wallets, transfers, and savings accounts, but cannot offer credit or forex

- Must keep 75% of customer funds in treasury instruments

- Minimum capital requirement: ₦5 billion (approx. $10 million)

- Nigeria also uses a tiered KYC system:

- Tier 1: name and phone number (low limits)

- Tier 2 & 3: government ID and address verification (higher limits)

UEMOA countries – BCEAO regulation

- Instruction No. 008-05-2015 governs e-money issuance

- Only licensed EMIs and banks can offer mobile money services

- All user funds must be stored in protected bank accounts

- Daily transaction limits and balance caps apply (e.g., XOF 200,000 per day)

- Providers must submit detailed financial and fraud reports to BCEAO

Learn about local payment methods and trends in Africa.

Fintech licenses and the rise of open banking

As the fintech sector grows, African regulators are adapting with new licensing regimes to cover digital services like wallets, gateways, and processors. Open banking is also starting to appear on the radar.

Nigeria – Tiered Licensing from CBN

- CBN categorises fintech licenses into:

- Switching and Processing

- Mobile Money Operators

- Payment Solution Services (gateways, aggregators)

- Super Agents

- Each category has defined functions and capital requirements, ranging from ₦100 million to ₦2 billion

- CBN has also launched regulatory sandboxes to support innovation under supervision

South Africa – Regulated Innovation

- There is no single “fintech license,” but companies must comply with:

- National Payment System Act (NPSA)

- Financial Sector Regulation Act (FSRA)

- Payment providers often operate through partnerships with licensed banks

- The Intergovernmental Fintech Working Group (IFWG) promotes policy alignment and is exploring open banking policy frameworks

Egypt – A Clear Fintech Law

- Passed Law No. 5 of 2022 (Fintech Law)

- Requires fintechs to register with the Central Bank of Egypt (CBE)

- Imposes rules on cybersecurity, data handling, capital adequacy, and consumer protection

- Offers a regulatory sandbox to test new products under controlled conditions

Cross-boarder payments: Moving toward regional solutions

Transfers between African countries are often slow and expensive, particularly when using different currencies. In response to this problem, regional initiatives are emerging to simplify and localise cross-border payments.

PAPSS – Pan-African Payment and Settlement System

- Backed by the African Export–Import Bank (Afreximbank) and the African Union

- Enables real-time cross-border payments in local currencies

- Connects African central and commercial banks to eliminate reliance on foreign clearing systems

- Already operational in the West African Monetary Zone (WAMZ)

AfCFTA – African Continental Free Trade Area

- The largest free trade area in the world by number of countries

- Aims to standardiыe financial rules and mutually recognise licenses

- Encourages collaboration on KYC norms, data protection, and fintech regulation

- Still in early implementation, but presents long-term harmonisation potential

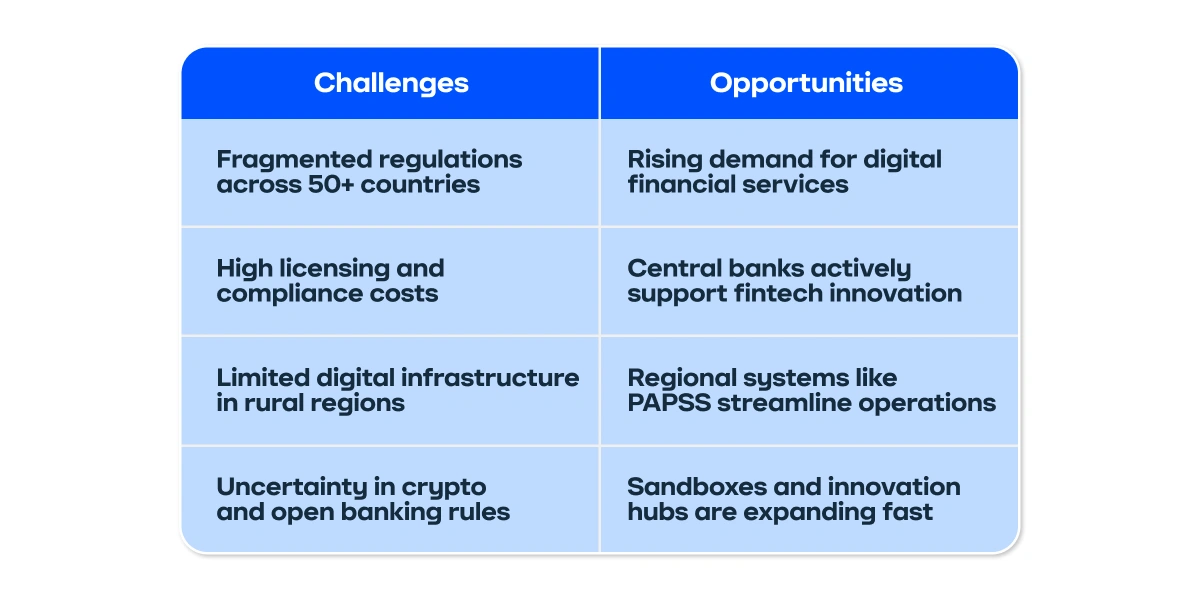

Challenges and opportunities in Africa

While Africa’s payment ecosystem holds immense potential, navigating it isn’t without its difficulties. Regulatory fragmentation, infrastructure gaps, and compliance costs pose real challenges for businesses. At the same time, the continent offers unmatched opportunities for innovation, financial inclusion, and cross-border growth. Here’s a look at what companies need to consider:

Final thoughts

Africa’s regulatory landscape may be fragmented, but it’s also full of promise. As fintechs and mobile payment services continue to shape the future of finance, regulators are catching up with clearer, more supportive frameworks.

For businesses to succeed in the region, they need to:

- Understand each country’s requirements

- Build strong compliance systems

- Partner with local experts or providers that can ensure regulatory alignment

By doing so, companies can tap into one of the world’s most dynamic and fast-growing digital economies responsibly and sustainably.