Payment trends in Asia in 2025

Why gaming platforms need localised payment methods

How payment flexibility drives customer loyalty in e-commerce

Cross-border payments: Key challenges and solutions for 2025

Interview with Finance Team Lead Olena Polishchuk

Tips for improving the payment success rate for online businesses

The rise of instant bank transfers: The payment revolution you can’t ignore

One of the biggest game-changers in the payment industry is instant bank transfers. These real-time transactions are revolutionising the payments industry, offering speed, security, and convenience that traditional methods simply can’t match. If you’re a merchant, it’s time to take notice – because this shift isn’t just a trend, it’s the future.

What are instant bank transfers?

Instant bank transfers, also known as real-time payments (RTP), let money move directly from one bank account to another in seconds. Unlike traditional bank transfers, which can take hours or even days, these transactions happen immediately, even on weekends and holidays.

Such speed is possible thanks to networks like SEPA Instant (Europe), Faster Payments (UK), and RTP (US), as well as open banking solutions that simplify the process.

Learn about the adoption of instant payments in Europe.

How do instant bank transfers work?

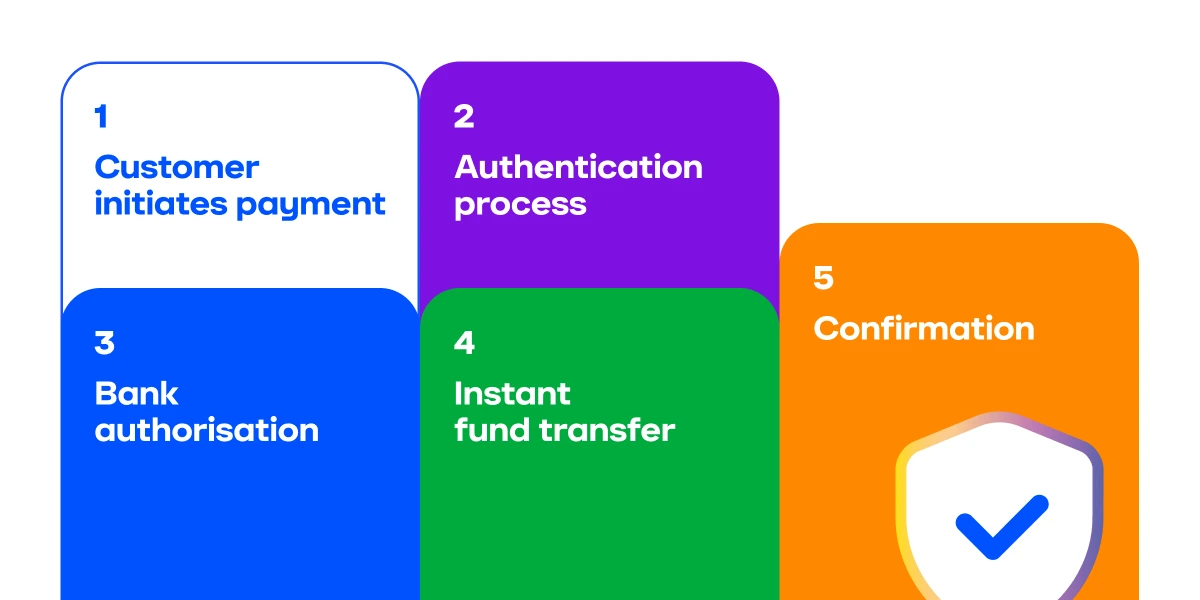

Here’s a step-by-step process:

- Customer initiates payment: At checkout, the customer selects instant bank transfer as their payment method.

- Authentication process: The customer is redirected to their bank’s secure portal or uses an open banking API to authenticate the transaction.

- Bank authorisation: The customer’s bank verifies the details and confirms the payment in real time.

- Instant fund transfer: The funds immediately move from the customer’s bank account to the merchant’s.

- Confirmation: Both the customer and the merchant receive instant confirmation, ensuring transparency and eliminating delays.

Why are instant bank transfers trending?

So, why are more businesses and customers choosing instant bank transfers? Is it just about speed or something more? Here are the key reasons:

Speed & convenience

No more waiting for funds to clear! Instant transfers allow businesses to get paid immediately, improving cash flow and reducing the need for short-term credit.

Lower costs

Credit card transactions come with hefty fees. Instant bank transfers cut out the middleman, making them a cheaper alternative for merchants.

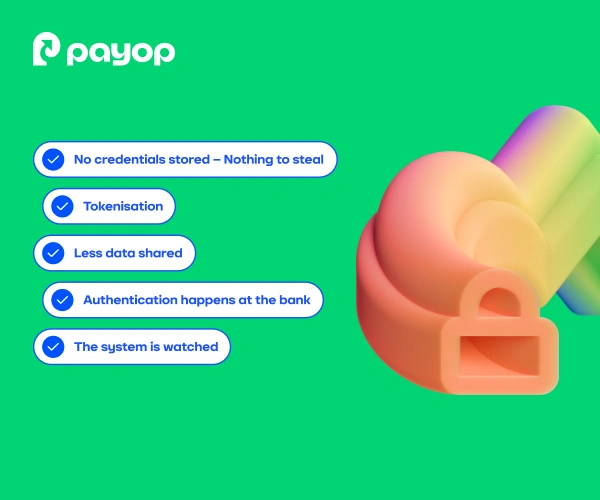

Better security

Say goodbye to chargebacks! Since instant transfers require strong customer authentication (SCA), fraud risks are significantly lower compared to card payments.

Growing consumer demand

More and more people prefer fast, hassle-free payments. Open banking is fueling this trend by making instant bank transfers a seamless option at checkout.

24/7 availability

Unlike traditional methods, instant transfers don’t depend on banking hours and work around the clock—including nights, weekends, and holidays. That means you won’t have to wait until Monday morning for payments to clear!

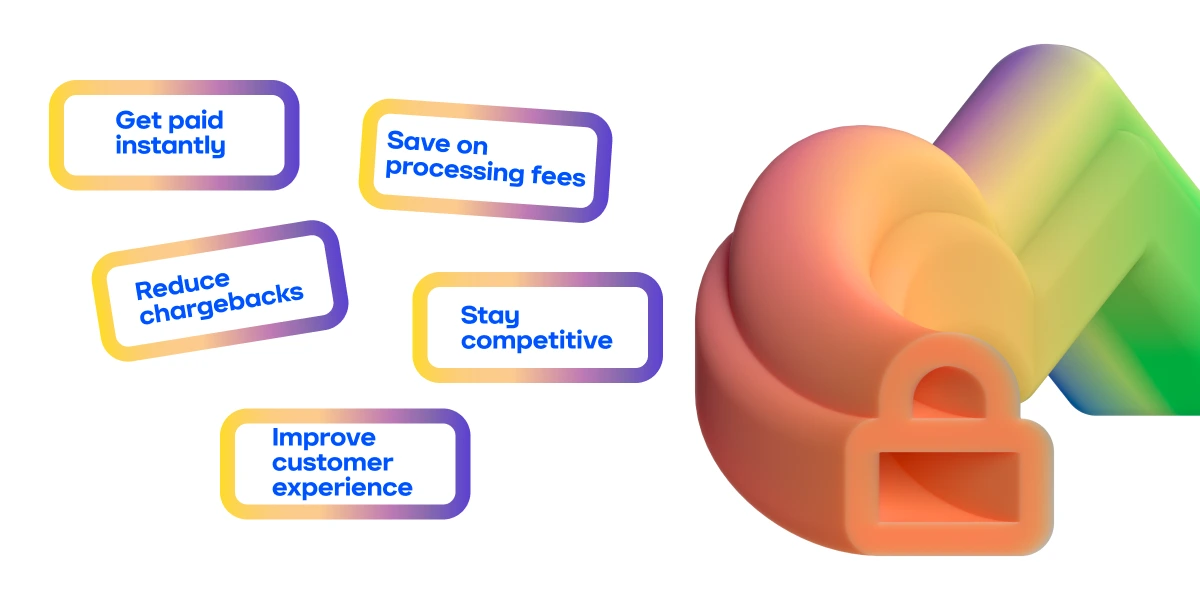

Advantages for your business

If you’re a business owner, here’s why you should start offering instant bank transfers:

- Get paid instantly: No delays, no waiting – instant access to your money.

- Save on processing fees: Cut costs by bypassing expensive card networks.

- Reduce chargebacks: Since payments are authorised directly by the customer’s bank, disputes and chargebacks are nearly non-existent.

- Improve customer experience: Offering more payment choices makes checkout smoother and more convenient for your customers.

- Stay competitive: Early adopters of instant payments gain an edge over businesses still relying on slower methods.

The role of open banking

Open banking is playing a massive role in making instant bank transfers mainstream. By allowing third-party providers (TPPs) to initiate bank payments directly, open banking makes transactions seamless, eliminating the need for cards.

Payop is already using this technology in our Pay by Bank solution to offer real-time payments directly from bank accounts. No need for cards, high security, and round-the-clock processing.

How to start accepting instant bank transfers

Ready to embrace instant bank transfers? Here’s how to make it happen:

- Partner with a payment service provider (PSP) – Partner with Payop. We support instant transfers and open banking.

- Integrate seamlessly – Make instant transfers easy to find at checkout.

- Educate your customers – Highlight the benefits of instant payments to encourage adoption.

- Monitor transactions – Use real-time data to optimise your payment process.

Conclusion

Instant bank transfers aren’t just the future – they’re happening right now. Businesses that embrace them will enjoy faster cash flow, lower costs, and better security while providing customers with a seamless payment experience.

Payop’s Pay by Bank solution makes it even easier for you to use instant transfers. It ensures you receive payments 24/7, including on weekends and bank holidays. With no chargebacks, lower fees, and real-time settlement, Payop helps you stay ahead in an increasingly competitive market.

Now is the time to integrate Pay by Bank and unlock the benefits of instant payments!