Are e-wallets enough? Building a diverse payment mix in emerging markets

Secure by design: How open banking mitigates data breach impact

How to build a local payment strategy for global growth

Latin America’s digital wallet boom: What’s driving adoption in 2025

A merchant’s guide to transaction monitoring

Understanding real-time payments across the world: from Brazil’s Pix to India’s UPI

In Brazil, more people now use Pix than credit cards. In India, UPI processes over 10 billion transactions each month – more than Visa and Mastercard combined. Around the world, real-time payments are not just gaining ground. They’re becoming the default way to pay.

Real-time payment (RTP) systems are reshaping financial ecosystems and raising the bar for speed, transparency, and efficiency. In this article, we explore how they work, where they thrive, and how they can benefit your business.

What are real-time payments?

Real-time payments are digital transactions that are completed – initiated, cleared, and settled – in seconds. They’re available 24/7, including weekends and holidays, offering instant confirmation to both the sender and the receiver.

Key advantages include:

- Instant settlement and access to funds

- Improved user experience and trust

- Reduced reliance on cash and traditional cards

- Lower fees and operational costs for businesses

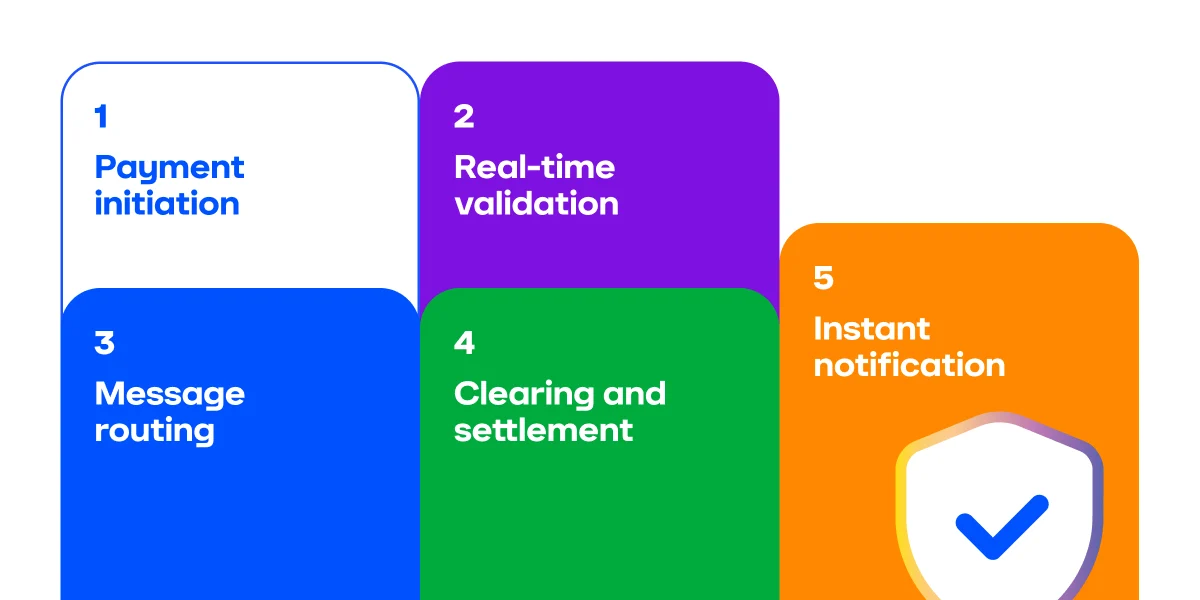

How real-time payments work

Real-time payments may seem simple: you send money, and it arrives instantly. But behind the scenes, a lot happens in just a few seconds. Here’s how the process typically works:

1. Payment initiation

The user starts the transaction through a bank app, payment service, or digital wallet by entering a phone number, scanning a QR code, or selecting a merchant.

2. Real-time validation

The system checks if:

- The sender has sufficient funds

- The receiver’s account is active

- The request is legitimate (using fraud filters, biometrics, or two-factor authentication)

This happens almost instantly, thanks to fast and secure APIs.

3. Message routing

The payment request is routed through a central infrastructure, usually run by a central bank, clearing house, or a regulated third party (e.g., NPCI in India and Banco Central do Brasil for Pix).

4. Clearing and settlement

Unlike traditional batch payments, RTP systems:

- Clear the payment by verifying both sides and updating balances

- Settle it in real time by moving funds between bank accounts

In many systems, settlement happens through a central account ledger, often backed by the central bank.

5. Instant notification

Both parties are notified immediately, confirming that the money has been transferred and received successfully.

In their work, RTP systems rely on the following technologies:

- Open APIs, which enable fast communication between banks and apps

- ISO 20022 – a global standard for data-rich transactions

- Alias mapping services, which allow payments by phone or ID instead of bank account numbers

- Real-time fraud detection that uses machine learning or rule-based systems to block suspicious activity instantly

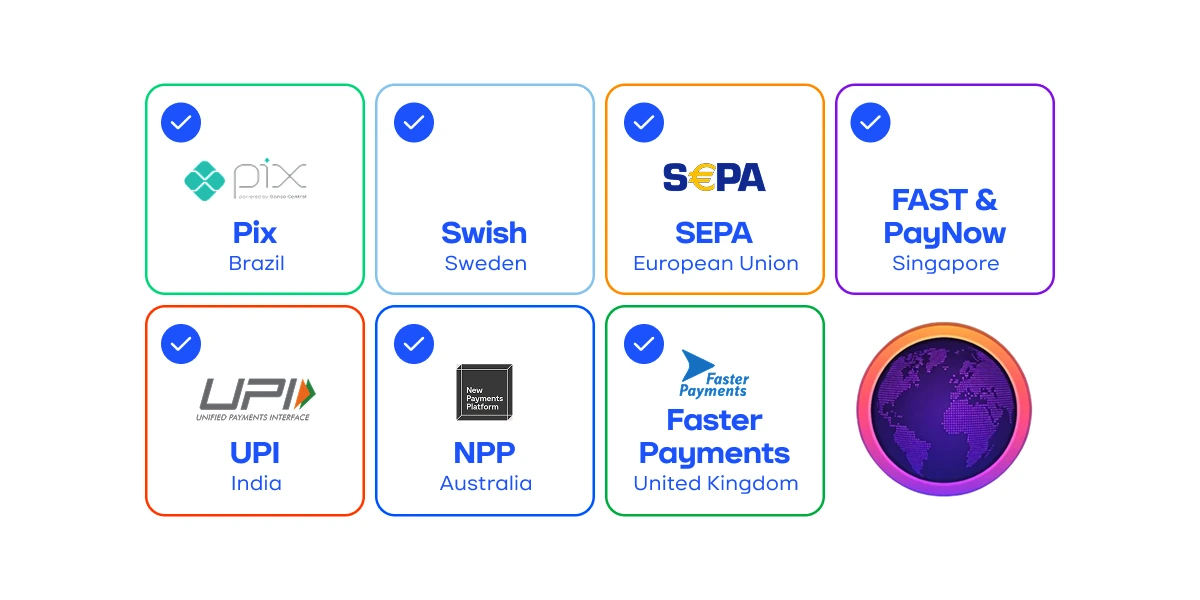

Key real-time payment systems

Pix – Brazil

Launched in 2020 by the Central Bank of Brazil, Pix quickly became the dominant payment method in the country. As of 2025, over 150 million users make billions of Pix transactions monthly, covering everything from P2P transfers to utility payments and business transactions. It supports payments via QR codes, phone numbers, and national IDs, and is free for individuals.

SEPA Instant Credit Transfer (SCT Inst) – European Union

SEPA Instant allows to make euro-denominated payments within 10 seconds across participating European countries. Over 29 countries are part of this scheme, with increasing merchant and fintech adoption, especially as the EU mandates wider use of instant payments by 2025.

Faster Payments – United Kingdom

The UK’s Faster Payments Service (FPS), launched in 2008, was one of the earliest RTP systems. It enables near-instant domestic transfers between banks and has been widely adopted for personal and business use, with support from banks, fintechs, and payment service providers.

Find out about payment regulations, trends and popular methods in the UK.

Swish – Sweden

Launched in 2012 by Swedish banks and the central bank, Swish allows instant transfers between users and businesses using just a phone number. It’s widely adopted in Sweden for peer-to-peer transfers, retail payments, donations, and even invoices. Around 80% of Swedes use Swish, making it a national standard for real-time mobile payments.

UPI (Unified Payments Interface) – India

UPI, launched in 2016 by the National Payments Corporation of India (NPCI), allows users to link multiple bank accounts and make real-time payments through a single mobile app. UPI supports both small-value and high-value payments, with over 10 billion monthly transactions recorded in 2024. It’s also being adopted for cross-border use in countries like Singapore and the UAE.

New Payments Platform (NPP) – Australia

Australia’s NPP supports instant transfers and data-rich transactions. Services like Osko leverage NPP to facilitate consumer and business payments, and real-time payroll, invoicing, and e-commerce integrations are growing rapidly.

Singapore – FAST & PayNow

Singapore’s FAST (Fast and Secure Transfers) supports real-time bank transfers, while PayNow allows users to send funds using just a phone number or national ID. Singapore has also pioneered international RTP interoperability with India and Malaysia.

Why RTPs matter for merchants

For businesses, real-time payments offer more than speed. They bring efficiency, cost savings, and a better customer experience.

Here’s what merchants gain:

- Immediate access to funds – no more waiting days for settlement

- Faster order processing thanks to instant confirmation

- Lower payment costs by avoiding card networks and their fees

- Fewer chargebacks and reduced fraud risk

- Happier customers who can pay the way they prefer

In markets like Brazil and India, offering RTP methods like Pix or UPI is no longer optional – it’s expected.

Accepting real-time payments with Payop

Getting started with real-time payments doesn’t have to be complicated. With Payop, merchants can tap into local RTP systems across multiple countries through a single integration.

Here’s what Payop offers:

- Access to Pix, SEPA Instant, and other regional methods

- Faster processing, improving your cash flow

- Lower fees compared to cards and wire transfers

- An all-in-one dashboard to track payments, payouts, and customer activity

- Dedicated support manager who actually helps rather than hides behind standard guidelines

Whether you sell digital goods, run a gaming platform, or operate an online marketplace, Payop helps you accept the payment methods your customers already trust, wherever they are.