Top payment options for video gaming in 2025

Payment service provider vs. payment gateway: Which do you need?

Pay by Bank vs. Credit cards: Which is better for business?

Your guide for Payop’s WooCommerce plugin integration

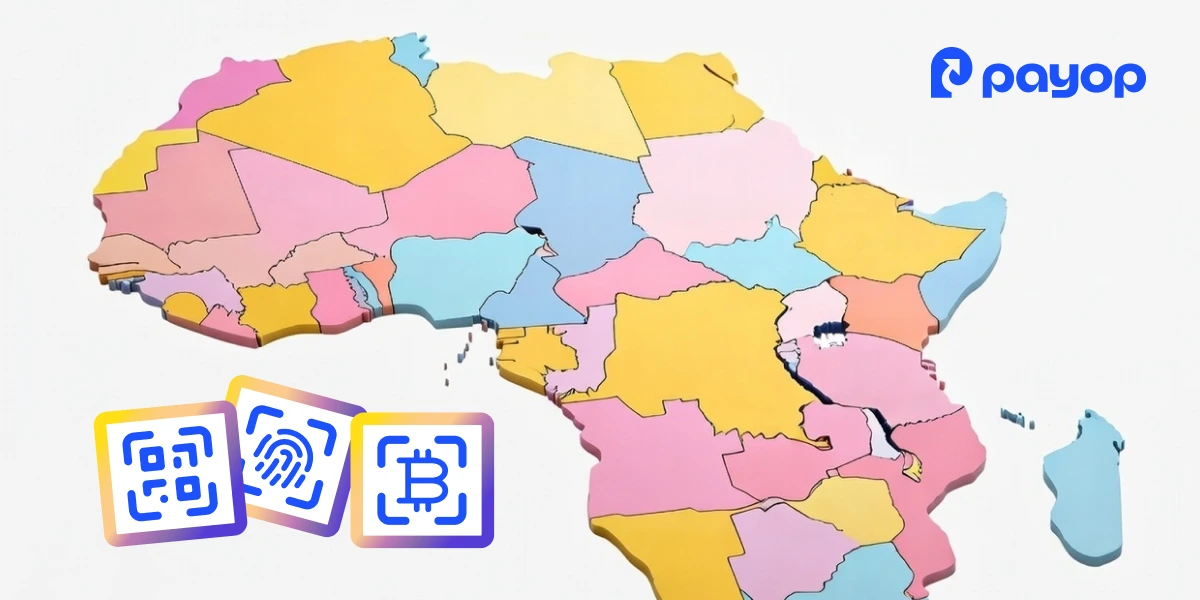

Unlocking growth in Africa: Local payment trends and methods

How payment UX can make or break your e-commerce store

Unlocking growth in Africa: Local payment trends and methods

Africa is quickly becoming one of the most exciting regions for business growth. With a population of over 1.4 billion across 54 countries, the opportunities are vast. However, success in Africa requires understanding its unique payment landscape, which is shaped by its diverse cultures, economies, and technological advancements.

As businesses seek to tap into this growing market, understanding local payment trends and methods is crucial. In this article, we’ll take a deep dive into how payment trends are shaping the future of commerce in Africa.

The growth of digital payments in Africa

Over the last decade, Africa has seen a remarkable shift towards digital payments, driven by the rise in internet access, mobile phone usage, and fintech innovations. While cash still plays a significant role in many parts of the continent, mobile and digital payment methods are rapidly gaining ground. Mobile money has been particularly influential, transforming how people send money, pay for goods, and access financial services.

Key drivers of digital payment growth in Africa

- Mobile phone penetration: With over 495 million mobile internet users in Africa, smartphones are becoming the go-to tool for digital payments. Mobile money platforms like M-Pesa in Kenya have made financial inclusion a reality for millions who previously had little or no access to banking services.

- Fintech innovation: Local fintech companies are stepping in to fill the gaps left by traditional banking, offering services like peer-to-peer transfers and mobile wallets. These are making payments easier, cheaper, and more accessible for millions of Africans.

- Government initiatives: African governments are embracing digital payments with open arms, offering regulatory frameworks and investments that encourage cashless transactions. Countries like Nigeria and South Africa are leading the charge in creating an environment conducive to the growth of electronic payments.

Popular payment methods in Africa

While mobile money has emerged as the leader, several other payment methods are thriving in Africa’s diverse markets. Let’s take a closer look at the payment methods businesses can leverage to succeed in this rapidly growing region.

Mobile money

Mobile money is the payment method of choice for many Africans. It allows users to send and receive money via their mobile phones, without the need for a bank account. Services like M-Pesa in Kenya, MTN Mobile Money in West and Central Africa, and Orange Money have transformed how people make payments.

- How it works: Users load money into their mobile wallets through local agents, who serve as intermediaries. These funds can be used for payments, transfers, or even withdrawn as cash.

- Why it works: Mobile money is accessible to anyone with a mobile phone – no bank required. It’s also fast and affordable, making it a perfect solution for small businesses and the unbanked population.

Bank transfers

Bank transfers are still an important payment method, especially in more urbanized areas. Mobile banking apps are making it easier for consumers to transfer funds instantly, pay bills, and even send money internationally.

- Why It Works: Bank transfers are trusted, especially for large transactions. With the growing adoption of banking apps, they’re becoming faster and more user-friendly.

Card payments

Though not as widely adopted as mobile payments, card payments are becoming more common, particularly in larger cities. Credit and debit cards are often used for online purchases and point-of-sale transactions.

- Pros: Card payments are quick, easy, and widely accepted, especially for international transactions. They offer a secure way to make purchases, and cardholders can enjoy loyalty programs and rewards.

- Cons: Card payment systems are less accessible for people in rural areas or those without credit histories, and there can be higher fees compared to mobile money or cash payments.

Cash on delivery

Despite the digital revolution, cash on delivery (COD) remains a vital payment method, especially in e-commerce. Many African consumers still prefer to pay in cash when their goods are delivered, whether due to a lack of trust in digital payments or simply not having access to other payment options.

- Pros: COD builds trust with customers who are wary of online fraud. It’s also simple for both the buyer and seller, with no need for complex payment infrastructure.

- Cons: COD can delay the delivery process, and businesses face the risk of returns or non-payment. Additionally, it doesn’t support the kind of instant transaction flow that digital payments can provide.

QR code payments

QR code payments are quickly becoming a favourite, particularly in cities and among tech-savvy customers. Merchants display QR codes that customers can scan with their smartphones to make instant payments using mobile money or card networks.

- Why It Works: QR codes are incredibly easy to implement and provide a seamless experience for both consumers and merchants. They offer a quick, low-cost solution that businesses of all sizes can take advantage of.

Cryptocurrency

While still emerging, cryptocurrency is making waves in Africa, especially in countries like Nigeria, South Africa, and Kenya. Cryptocurrencies, such as Bitcoin and Ethereum, offer an alternative to traditional currencies and have become a way to bypass issues like inflation and currency devaluation.

- Pros: Cryptocurrencies offer decentralisation, security, and fast international transactions, making them an attractive option for cross-border payments. For businesses, they provide a way to work around traditional banking systems and reduce transaction fees.

- Cons: Despite growing interest, cryptocurrencies still face issues like volatility, regulatory uncertainty, and a lack of widespread understanding among the general population.

Key trends shaping Africa’s payment landscape

- Financial inclusion: With many Africans still unbanked, mobile money platforms are leading the charge in financial inclusion. Payment service providers are focusing on reaching rural areas and underserved communities, bringing financial services to those who need them most.

- Cross-border payments: As trade within Africa increases, businesses need efficient cross-border payment solutions. Platforms like Flutterwave and Paystack are helping businesses process payments across borders with ease.

- Payment security: With the rise of digital payments comes the need for robust security. Payment providers are increasingly focusing on enhancing fraud prevention measures through technology like biometric authentication, encryption and tokenization.

- E-commerce growth: The rise of online shopping is driving demand for better digital payment systems. As e-commerce expands across the continent, businesses need to offer quick, secure, and convenient payment methods to meet customer expectations.

Growth opportunities for businesses in Africa

To succeed in Africa, businesses need payment solutions that cater to local preferences. Payop offers seamless integration with popular African payment methods, ensuring your business can meet the diverse needs of consumers across the continent.

With our platform, you can easily process transactions, enhance customer experience, and support cross-border payments.

Contact our team at sales@payop.com to learn more.