A guide to payment processing: what it is and how it works

Automated payments and how your business can benefit from them

Pay by Bank payments explained: Step-by-step guide

10 Questions to ask before choosing a payment service provider

Why do some markets still prefer cash, and how can your business adapt?

How global payment habits are shifting and what it means for businesses

What is a chargeback?

Each year, the e-commerce industry loses billions of dollars to chargebacks. However, their impact goes way beyond lost revenue. The true danger is high chargeback rates. They can cause card network penalties, harm your reputation, and even affect your ability to accept online payments.

In this article, we explain what chargebacks are, what triggers them, and how to protect your business.

What does a chargeback mean?

Chargebacks happen when a customer contacts their bank rather than the merchant to reverse a payment. In this case, the bank withdraws the disputed amount from the merchant’s account, temporarily refunds it to the customer and investigates the matter.

There are two possible outcomes. In the first case, the merchant wins the dispute, and the funds are returned to his account. In the second case, the customer’s claim is proven legitimate, and the refund becomes permanent. The merchant loses the funds, pays the chargeback fee, and the dispute is counted toward their chargeback ratio.

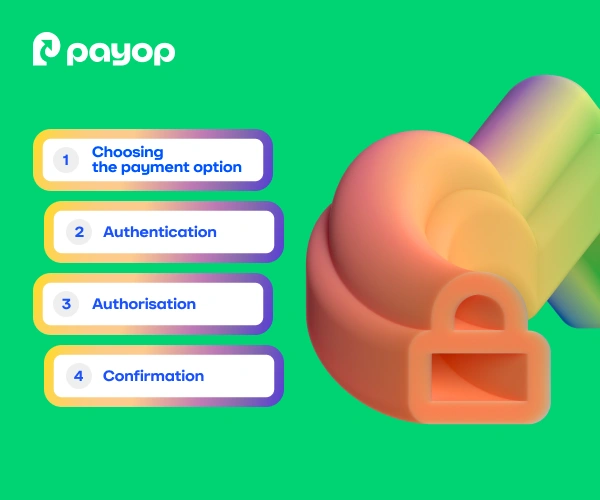

The chargeback process, step by step

From the customer’s perspective, a chargeback may look simple. In reality, it consists of many steps, involves several parties, and can take weeks.

Let’s break down this process:

- The customer requested a chargeback

A chargeback begins when a customer contacts their bank to dispute a transaction and formally request their money back.

- The issuing bank initiates the dispute

The payer’s bank reviews the claim and sends the chargeback request to the merchant’s bank via the card network. At this stage, the customer’s bank may issue a temporary refund to the cardholder while the investigation is still ongoing. The acquiring bank then withdraws the disputed amount and chargeback fees from the merchant’s account.

- The merchant is notified

The notification includes chargeback information, such as transaction details, reason code, disputed amount and fees, response deadline, and instructions for submitting evidence. After this, the merchant has two options: accept the chargeback or challenge it.

- Evidence gathering

If the merchant decides to challenge the dispute, collecting as much evidence as possible is very important. It may include purchase and payment records, delivery confirmation, the customer-signed return policy, and any customer correspondence.

- The bank reviews the evidence

The issuing bank reviews the customer’s claim and the merchant’s evidence. Based on this and the card network rules, the bank makes a decision.

- The bank makes a decision

If the merchant wins the dispute, the funds are credited back to their account. If the bank approves the chargeback, the refund becomes permanent, and the business loses the disputed amount, along with the chargeback fee. In addition, every chargeback increases the merchant’s chargeback ratio.

- Arbitration, if required

When a business or customer disagrees with a decision, they may escalate the dispute. But because arbitration is costly and slow, it’s rare.

Refund vs chargeback: what’s the difference?

Both refunds and chargebacks mean returning money to a customer. The difference lies in two aspects:

- Who controls the process?

A refund is initiated by the merchant and processed by the payment provider when a customer requests their money back directly from the website. A chargeback is initiated by the customer through their bank. It triggers a formal dispute and may result in additional fees and a negative impact on the merchant’s chargeback ratio.

- How long does it take?

Refunds usually settle within a few days.

Chargebacks can take weeks or months and require evidence, formal responses, and follow-ups. As a result, disputes lead to higher costs, more administrative work, and greater long-term risk than standard refunds.

Common reasons for chargebacks

Cardholders can request a chargeback for three main reasons:

Credit card fraud

In these cases, the transaction was never authorised by the cardholder. Fraudsters may get card details through phishing, malware, data breaches, or lost physical cards. When the customer notices strange unauthorised transactions, they contact their bank. The bank then investigates the case. If the fraud is confirmed, the bank will return the money to the customer.

Friendly fraud

In so-called friendly fraud cases, the payer authorised the transaction but later disputes it.

Typical scenarios include:

- The customer is unhappy with the product, or simply changed their mind and now regrets the purchase.

- The buyer wants a refund while keeping the product or service, hoping to get something for free. This is especially common with digital goods.

Friendly fraud can also happen by accident. For example:

- A family member used the card without the cardholder’s knowledge.

- The customer forgot about a subscription renewal or missed the cancellation deadline.

- The payer misunderstood the return policy.

Merchant mistakes

Sometimes, disputes happen because of transaction errors or merchant mistakes.

Examples include:

- Late or missing deliveries

- Unclear billing

- Duplicate charges

- Incorrect amount charged

- Misleading product descriptions

- Damaged goods

- Unclear return policies

How to avoid chargebacks?

Chargebacks are costly, but their impact goes beyond lost revenue and extra fees. Repeated disputes raise your chargeback rate. If it goes over 1%, you may face penalties, higher processing costs, or mandatory monitoring. In the long run, your business can lose its merchant account and the ability to accept card payments.

You can’t avoid chargebacks entirely, but the right setup can reduce the risk. Here’s what you can do to protect your business:

- Provide tracking numbers, delivery updates, and proof of delivery to keep the process transparent for customers.

- Use clear billing descriptors so payers can easily recognise the charges.

- Send reminder emails and make it easy to cancel subscriptions and free trials.

- Keep the checkout fast and intuitive to minimise confusion and accidental purchases.

- Clearly describe all product or service details.

- Make refund policies easy to find and understand.

- Offer accessible customer support to resolve issues before they escalate into disputes.

- Keep detailed transaction records for evidence.

- Regularly monitor payment systems to catch technical errors.

To minimise the risk of unauthorised transactions:

- Use advanced fraud prevention tools.

- Apply strong customer authentication (SCA).

- Track transactions and use risk scoring to detect suspicious activity.

How can a payment service provider change the game?

Payment disputes are stressful, time-consuming, expensive, and harmful to your reputation. But working with a payment service provider such as Payop makes a difference.

We help merchants manage chargebacks by clarifying dispute reasons, supporting evidence preparation, and reducing avoidable losses. Even better, with our Pay by Bank solution, many disputes can be prevented altogether. It practically eliminates chargeback risk as customers approve payments directly in their banking apps. There’s just no room for unauthorised transactions and friendly fraud left.

If you want a reliable and secure payment partner, contact us at sales@payop.com to learn more.