Payment trends in Asia in 2025

Why gaming platforms need localised payment methods

How payment flexibility drives customer loyalty in e-commerce

Cross-border payments: Key challenges and solutions for 2025

Interview with Finance Team Lead Olena Polishchuk

Tips for improving the payment success rate for online businesses

Cross-border payments: Key challenges and solutions for 2025

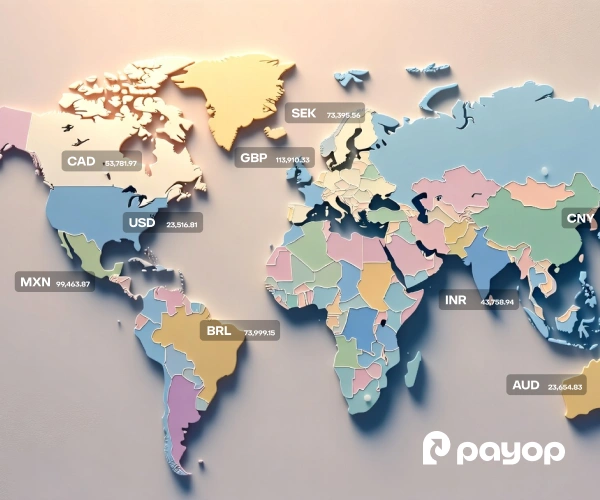

Cross-border payments are the backbone of global trade, enabling businesses to reach international markets and individuals to send money across borders. However, even with the rise of digital payments and fintech solutions, challenges persist. Businesses and financial institutions face hurdles like high fees, slow transaction speeds, and increasing fraud risks.

The good news is that emerging technologies and solutions are helping to tackle these problems head-on. Let’s explore the key challenges and innovative solutions shaping the future of cross-border payments.

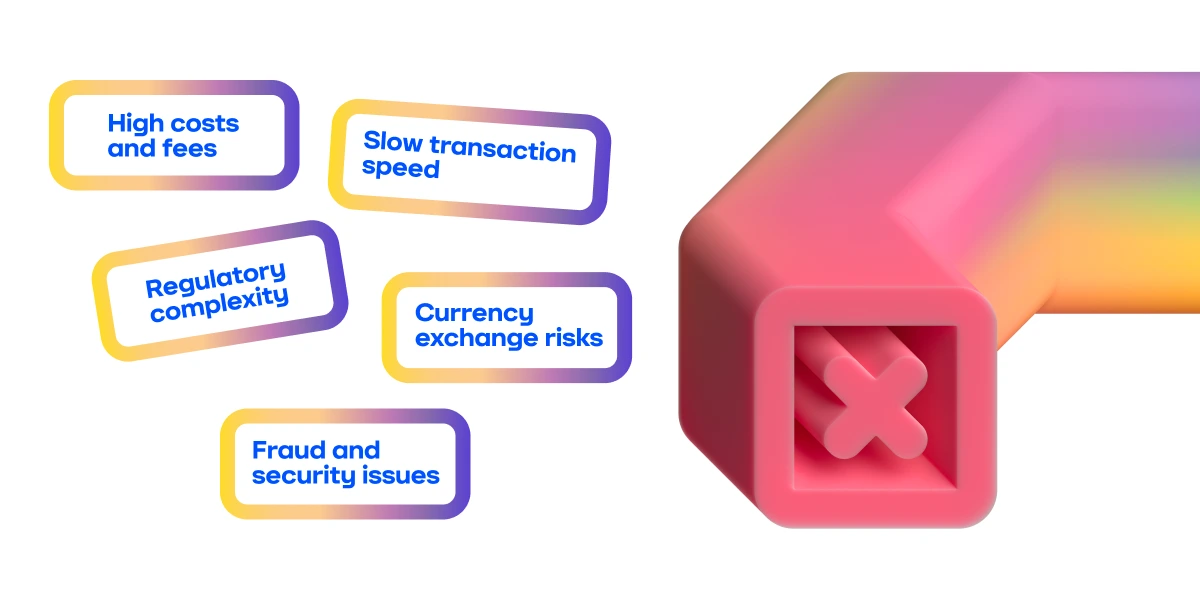

Key challenges in cross-border payments

1. High costs and fees

One of the biggest obstacles to sending money across borders remains the cost. Traditional banks and money transfer services often charge significant fees, which can amount to 7% or more of the total transaction.

These fees result from the involvement of multiple intermediaries, each adding its own charges. The high costs make international payments less appealing for businesses and individuals and can seriously impact margins.

2. Slow transaction speed

Anyone who’s waited days for an international payment to clear knows how frustrating the process can be. International transactions often take longer than domestic ones, with settlement times ranging from a few hours to several days.

These delays happen because payments must pass through various banking networks and regulatory checks, which can cause a bottleneck. In today’s fast-paced world, waiting for payment to clear is not just inconvenient – it can hurt cash flow and delay business operations.

3. Regulatory complexity

The regulatory landscape for cross-border payments is a maze. Different countries have their own rules for financial transactions, and keeping up with these regulations can be a full-time job.

Anti-money laundering (AML) and know-your-customer (KYC) requirements make cross-border payments even more complicated. Businesses and financial institutions must comply with each jurisdiction’s rules, creating an often burdensome process.

Learn about payment regulations in Europe and Asia.

4. Currency exchange risks

Currency exchange is a natural part of cross-border payments, but it can also be a headache. Exchange rates fluctuate constantly, meaning the cost of a payment can change unexpectedly. If a company is not careful, a sudden drop in the exchange rate can lead to losses. Managing these risks can take up valuable time and resources, especially for businesses that regularly handle international payments.

5. Fraud and security issues

With multiple intermediaries involved, cross-border payments are an attractive target for fraudsters. Fraudulent activities, such as money laundering and account takeovers, can cause significant financial loss. The complexity and lack of transparency in cross-border payments make tracking and preventing fraud difficult. This leaves both businesses and consumers vulnerable.

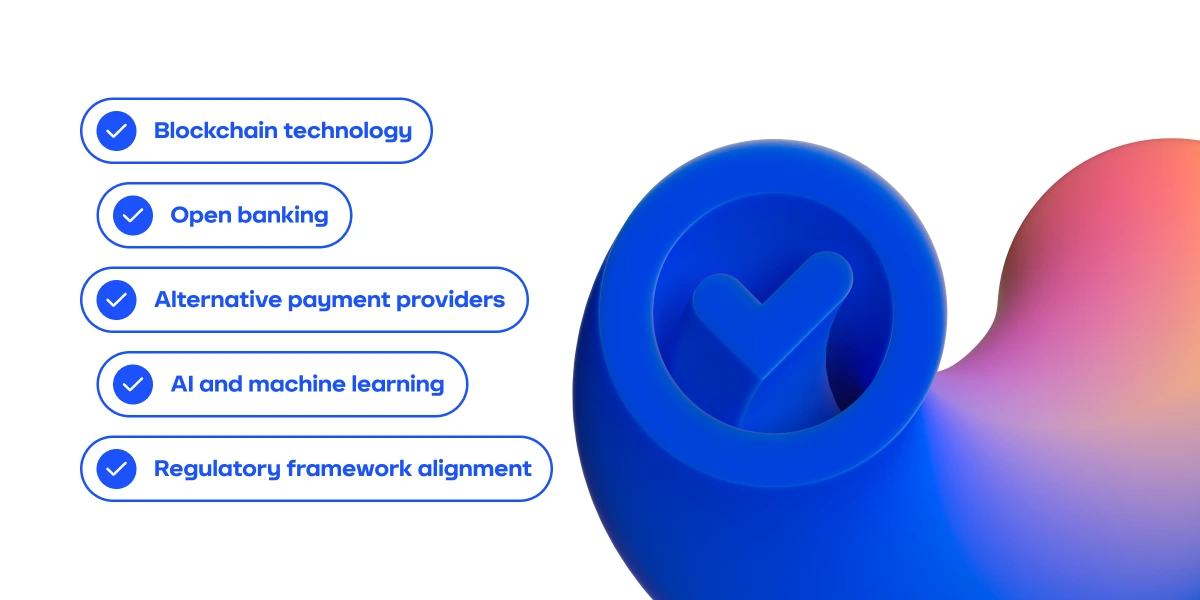

Solutions for cross-border payment challenges

It all may sound pessimistic, but positive developments are on the horizon. In this section, we’ll explore some of the most promising solutions transforming the cross-border payments landscape. These solutions are helping businesses and consumers overcome barriers such as high costs, slow speeds, and complex regulations.

1. Blockchain technology

Blockchain can drastically reduce the cost and time required to complete international transactions by eliminating intermediaries. With blockchain, payments can happen directly between parties without needing multiple banks or clearinghouses. Additionally, blockchain enhances transparency and security, making it much harder for fraudsters to manipulate the system.

Central Bank Digital Currencies (CBDCs) are also integrating with blockchain, further simplifying cross-border payments by reducing reliance on traditional banking systems.

2. Open banking

Open banking allows third-party providers to access bank data through APIs securely. This enables businesses to bypass traditional banks, reducing costs and speeding up transactions.

Open banking also makes it easier to create customised payment solutions, offering flexibility and greater control over cross-border payments. As adoption expands globally, open banking will make real-time, low-cost international payments more common.

Payop uses open banking technology in its Pay by Bank solution. It allows businesses to accept payments directly from customers’ bank accounts, bypassing intermediaries and ensuring faster, more secure transactions. This means businesses can receive payments during unbanked hours, weekends, and holidays, giving them greater flexibility and improving cash flow management.

3. Alternative payment providers

Alternative providers like Payop are disrupting the traditional payment system by offering more affordable, fast, and secure international transactions. These platforms help businesses avoid the high fees associated with traditional banks.

They also offer competitive exchange rates, saving companies money on currency conversions. These services especially benefit small and medium-sized enterprises (SMEs) that need efficient, cost-effective international payment solutions.

4. Artificial intelligence (AI) and machine learning

AI and machine learning are improving both security and efficiency in cross-border payments. AI-powered systems can detect fraud in real time, helping to minimise risks.

Additionally, machine learning is being used to optimise currency exchange, predicting the best times for businesses to exchange currencies and minimising the risk of loss due to exchange rate fluctuations.

5. Harmonisation of the regulatory framework

Regulatory complexity remains a significant obstacle for cross-border payments. However, initiatives like the EU’s Single Euro Payments Area (SEPA) simplify payments within Europe, and similar efforts are underway globally. Standardising rules across borders will reduce compliance costs, making cross-border payments easier and more affordable for businesses.

Conclusion

The cross-border payment landscape is evolving rapidly. While challenges persist, solutions such as blockchain, open banking, and AI are set to transform the industry. Businesses that embrace these innovations can streamline processes, cut costs, and improve customer experience.

Payop is at the forefront of this change, offering services like Pay by Bank to provide faster, more secure transactions. As technology advances, Payop will continue to help businesses navigate the future of cross-border payments, making them more efficient and cost-effective.

Contact our team at sales@payop.com to learn more.