FAQ

Popular questions

You can edit recipient details by clicking the three dots next to the recipient you want to update and selecting Edit.

If the chosen recipient is in the Rejected section, they’ll be automatically resent to the relevant team for verification and moved to the In review section until our team approves or rejects them.

If you change the Accepted recipient, they’ll also be set to In review once you add new details and submit the update. Until our team approves the recipient and sets the Accepted status, these payment details won’t be available for funds withdrawal.

On the checkout page the payers can check the details of the requested order (its ID and amount), choose the preferred language of this page (among 12 available), and select the most convenient payment method to process a transaction.

All the methods are grouped according to their types (eWallet, Bank Transfer, Cards International, etc.), and to complete the payment the user should: find the needed group → select the method → fill in the required data.

There is also a possibility to use the search bar to find a specific method.

Some methods are only available for certain countries, so the IP and Geolocation for payment must be changed accordingly.

For example, Italian payment methods will be available on the payment page if a user has Italian as the default browser language, Italian IP, and geolocation.

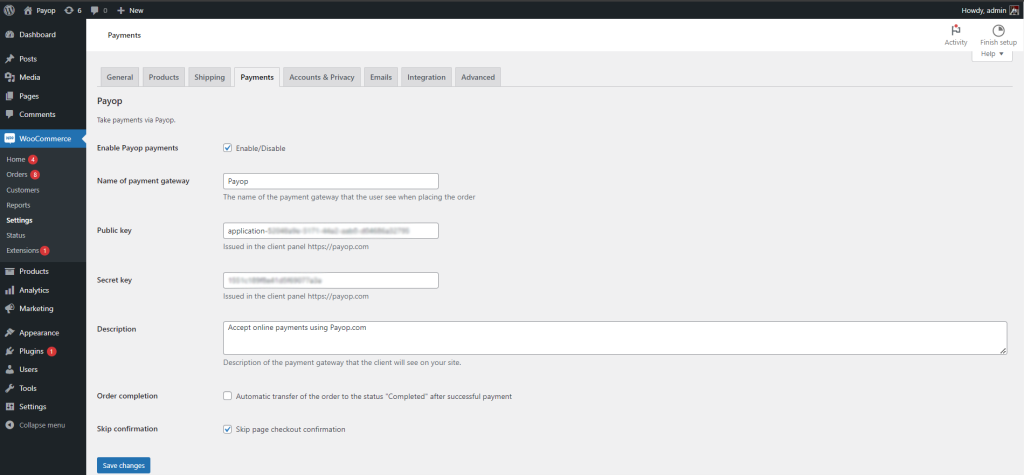

Configuring the Payop Plugin in WooCommerce:

1.Ensure the Payop plugin is activated on your WordPress website. If it’s not already active, follow these steps:

– Open your WordPress admin panel.

– Navigate to the “Plugins” section.

– Look for the Payop plugin and click “Activate” if it’s listed but inactive.

2.Access WooCommerce Settings. In your WordPress admin panel, go to the WooCommerce settings to configure the Payop payment gateway:

– Click on “WooCommerce” in the left-hand menu.

– Click on the “Settings” button.

3.Navigate to the “Payments” tab. Within the WooCommerce settings, select the “Payments” tab. This is where you can manage all payment-related configurations for your online store.

4.Locate the Payop Payment Option and Configure:

– Scroll down to find the option related to Payop among the available payment methods. You should see “Payop” or the name you specified in the “Name of payment gateway” field when setting up the plugin.

– Click on the Payop option to access the plugin’s settings. This is where you will configure the details required for Payop payments to function correctly.

– Fill in the required Public key and Secret key fields.

– Name of payment gateway. In this field, you can specify the name customers will see at the checkout when choosing the Payop option to pay for an order.

– Description. In this field, you can briefly describe the payment gateway, which will be visible to customers on your website. It helps customers understand that they can use Payop for online payments.

– Automatic transfer of the order to the status “Completed” after successful payment. Enabling this option will automatically change the order status to “Completed” once a successful payment is made via Payop.

– Skip page checkout confirmation. If enabled, this option allows you to skip the confirmation page during the checkout process, streamlining the payment process for customers.

– Payment form language. This setting enables you to select the language for the payment form displayed on your website. Choose the language that best suits your customers.

– Save Your Settings. After entering the necessary information, make sure to save your settings within the Payop plugin. You will typically find a “Save” or “Update” button at the bottom or top of the plugin settings page. Click on it to save your configurations.

By following these steps, you have successfully configured the Payop plugin within WooCommerce on your WordPress website. This will allow your online store to accept online payments using Payop as a payment gateway.

Please check the video instruction by following the link.

If you want to add a payment method that is not available for your application now, please contact our Support team via email at support@payop.com or our Ticketing system. They will clarify your request with the relevant department. If enabling the requested method for the project is possible, our team will make the necessary adjustments.

In case a certain method is not relevant for your customers, you may deactivate it in your merchant account:

– go to the Payment Methods section;

– find the needed method using the Search field;

– disable it using On/Off toggle.

1.Go to the Request settlement page.

2.Select the Bank Transfer method.

3.On the Recipient tab, click the Add New button. You will then be redirected to the recipient creation form.

4.On the Recipient information tab, you must specify the following information: Recipient bank country, Recipient currency, Recipient IBAN or Account number, Bank name, Bank address, and Type of account.

5.Then click the Next button.

6.On the Recipient address tab, you need to specify the following information: Country of business incorporation, Province/District/Country of business incorporation, City of business incorporation, Address of business incorporation, and ZIP code. If the Pooled account type is selected at the Recipient information stage, it is necessary to specify the Recipient company name.

7.Then click the Next button.

8.On the Documents tab, you must provide one of the following documents confirming that the specified details belong to your company: Bank statement or Bank Confirmation Letter.

9.Then click the Next button.

10.You can view and edit all information previously specified on the Confirmation tab. You can also provide additional information for Payment reference if necessary.

11.To send the recipient’s details for verification, click the Send for verification button. You will then receive an email confirming that your application is under review.

Please note that you cannot specify a country that Payop does not co-operate with. You can see the list of prohibited countries, regions, and SWIFT codes by clicking the Prohibited jurisdictions button.

Type of account:

– Own account – a direct and exclusive bank account established under the name and governance of your entity.

– Pooled account – a shared account managed by a third party that holds multiple entities’ funds, with separate accounting records defining each entity’s balance sheet.

- Go to the Request settlement page;

- Choose a payment method from the list of available ones: PayDo, Volet, Payoneer, or other;

- On the Recipient tab, click the Add New button. You will then be redirected to the recipient creation form, which may differ depending on the selected payment method;

- On the Recipient information tab, you must specify the following information: Template name and Recipient’s details;

- Then click the Next button;

- On the Documents tab, you must provide documents confirming that the specified recipient details belong to your company. The type of document depends on the selected payment method;

- You can view and edit all information previously specified on the Confirmation tab;

- To send the recipient’s details for verification, click the Send for verification button. You will then receive an email confirming that your application is under review.

The recipient’s details depend on the selected payment method:

- For PayDo: The PayDo user ID or email to which your PayDo business account is registered, and proof of account ownership. To get the proof:

- Sign in to your PayDo account;

- Navigate to the “Account details” tab;

- Click on the “All available Account details” section;

- Choose any desired account;

- Click on “Download PDF”.

- For Payoneer: Confirmation of your Payoneer receiving account that shows the account holder’s name and address.

- For Volet: A screenshot from your Volet profile that shows the business account name and the registered email.

Please note that the Recipient company name is filled in automatically.

You may easily perform the currency exchange in your merchant account.

To do that, follow these steps:

1. Go to the Exchange section.

2. Select the currencies you would like to exchange from the drop-down list and fill in the amount.

3. Push the Convert button to complete the exchange.

Before confirming the transaction, you can review the exchange rate and the amount you will receive.

Once the procedure is complete, you will receive a notification about the successful operation.

There is also an autoexchange operation which is applied when there are insufficient funds to complete your withdrawal. For instance, you have 900 EUR and 200 USD on your merchant balance, and you have requested a withdrawal of 1000 EUR. In that case, the system will charge 900 EUR from your EUR balance and automatically make an exchange for the remaining amount (100 EUR) from your USD balance to complete the request.

You can find this exchange operation in the “Currency exchange history” section of the “Exchange” tab.